GBP/EUR Rate: Near-Term Rebound Seen

- Written by: Gary Howes

- Quotes:

- Pound to Euro exchange rate: 1.1006

- Euro to Pound Sterling exchange rate: 0.9085

Pound Sterling could be correct higher against the Euro in the short-term ahead of a decline towards 1.08 in the medium-term says the foreign exchange strategy team at one of Europe’s key financial services providers.

The findings suggests some welcome relief for those hoping for a stronger Pound over coming days and weeks.

However, the key message from Rabobank is that any relief should ultimately prove limited, so don’t sit around too long by making the mistake in assuming Sterling is commencing a longer-term recovery.

For the Pound, it’s all about the economy argues Rabobank's senior FX strategist, Jane Foley in a forecast briefing seen by Pound Sterling Live.

And when it comes to the economy, the UK is in the midst of a "soggy summer," says Foley.

Economic Disappointment

The weak post-brexit Pound Sterling has caused rising inflation, which is reducing real earnings and impacting on consumer spending while a hoped-for counter-weight of increasing export growth has failed to materialise.

In Foley’s eyes this awards the UK economy an unfortunate “double minus” grade and the analyst expects a “soggy summer” for the currency.

"For some months wage inflation has remained moderate in the face of a pick in consumer prices, leaving shoppers out of pocket," says Foley, who adds that this has been rendered palatable by the same weak Pound's expected boost to export competitiveness.

"Optimism has prevailed in some quarters that the weaker Pound would bolster exporters’ order books and support investment," says Foley of the UK's predicament.

"This logic assumed that the performance of these sectors could counter some of the weakness in the consumer sector and so head off a sharp deceleration in UK growth," she goes onto say.

But the data doesn't add up: a drop in the Royal Institute of Survey's House Price balance, a rise in the trade deficit despite the weak Pound and weaker manufacturing data, all released on Thursday 10th, suggests the economy is on a 'sticky wicket' this summer.

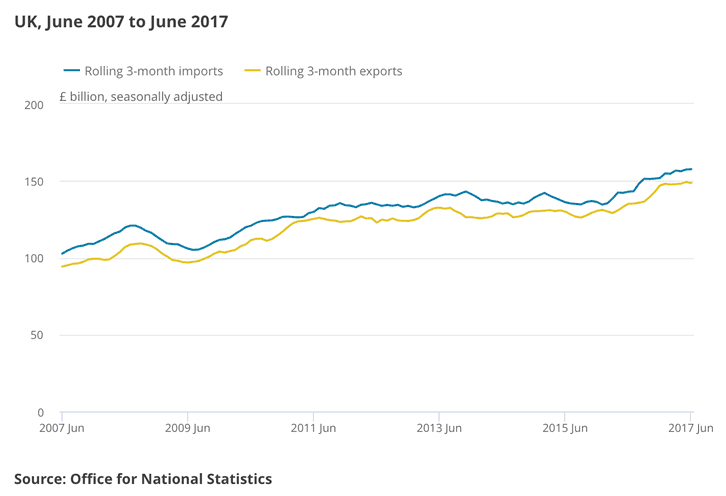

ONS data this month confirms UK trade does not appear to be offering any positive uplift to UK economic activity as of yet owing to the dominant position of imports in the trade balance.

A rise in imports by 1.5% has seen a widening of the deficit to -12.772bn in June.

“It is disappointing that GBP weakness has not done more to support the UK’s export sector particularly given the relative strength of world growth currently," says Foley.

Consistent with the poor export data was lacklustre manufacturing and industrial production data, which showed no-change (0.0%) in Manufacturing and an, on the surface of it, positive 0.5% rise in Industrial Production.

However, on closer inspection the data was only positive due to a delay in oil outages, according to Foley's analysis:

“This was due to the usual June maintenance on some oil rigs being postponed. Although use of the re-developed Schiehallion oil field and the new Kraken oil field will support production data going forward, the key manufacturing sub-sector failed to show any growth in June vs. May and this has consolidated a trend."

Foley notes that the production index has fallen by -0.4% in the last quarter.

"In the 3 months to June 2017, the UK Index of Production decreased by 0.4% compared with the 3 months to March 2017, due mainly to a fall of 0.6% in manufacturing."

A fall in transport equipment manufacture appears to be in a large part responsible for the decline:

According to the ONS, the largest contribution to the fall in UK manufacturing in the 3 months to June 2017 came from transport equipment, which fell by 2.2%, along with smaller downward contributions from a range of other industries.

This fall also appears to be reflected by a -2.2% fall in new car registrations.

The decline in car-buying, and a corresponding fall in mortgage applications are thought to be as a result of the fall in real earnings, due to higher inflation.

A fall in investment has been noted by the Bank of England and this is expected to curtail future growth by limiting spare capacity, so even if growth picks up it will be hemmed in by lack of previous investment.

Is the fall in value of Sterling impacting your international payments? Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

Central Banks Going in Different Directions = a Bullish Euro

For Sterling the downside pressure from the declining economic numbers had been broadly offset by increased expectations that the Bank of England will increase interest rates after they voted 5-3 to at their June meeting.

However, Foley notes that whilst this may have provided "some support" it is not likely to lead to an outperformance of the Euro.

Indeed, at the August meeting the Bank voted 6-2 for rates to remain on hold, which suggests perhaps the idea of a Sterling-supportive interest rate rise has faded further in the minds of Bank policy-makers.

Meanwhile, the European Central Bank is widely-anticipated to announce a shift in policy that continues to provide the Euro with support.

“The fact that the market is anticipated a tapering in the ECB’s QE plan next year has diluted the impact of a more hawkish BoE on EUR/GBP,” says Foley.

Pound / Euro Forecasts: Beware a Sterling Correction Ahead of Deeper Decline

Putting all the above together, Rabobank confirm a bullish forecast for the EUR/GBP exchange rate in the medium-term but do caution that the Euro’s recent rise might be too rapid.

“Going forward, we continue to favour the EUR vs. GBP. However, in light of the rapid pace of appreciation in the EUR in recent months we would expect to see some consolidation in the EUR crosses before additional gains are made,” says Foley.

The possibility of a dip back down to 0.89 in the short-term is therefore heightened.

But once ECB QE tapering kicks in they expect a continuation of the uptrend to 0.92.

A EUR/GBP exchange rate at 0.89 gives a Pound to Euro exchange rate at 1.1236.

EUR/GBP at 0.92 gives a rate of 1.0870.

So this forecast is certainly not as dire as some of the calls we have been hearing of late, for example a fall to parity seen at Morgan Stanley, but it does confirm a consensus view that the bottom in GBP/EUR is not yet in.

The Euro Looks Overbought

Others agree with the Rabobank position that a short-term recovery in the Pound to Euro exchange rate is possible.

While the Euro remains a favourite amongst traders and the analyst community alike, there certainly is a sense that a pullback might be due.

The rally higher in EUR/GBP has been strong and some would advocate that now is not the time to bet on further strength.

“The EUR has been supported since the start of the week. However, with speculative oriented investors’ selling interest in the single currency rising and as there is limited scope of policy differentials diverging further to the benefit of majors such as EUR/USD, we advise against buying at these levels,” says Manuel Oliveri at Credit Agricole.

Micaella Feldstein at Natixis also identifies the Euro as being ripe for a correction saying the EUR/GBP exchange rate, "can rally further but we see profit takings against 0.9089/98."

We also note that latest data from the US Commodity Futures Trading Commission suggest traders are now getting wary of adding to the substantial pro-Euro bets that already exist in the market.

As such, the Euro could be due a bout of weakness but it's tricky to say just when this might happen.