Pound to Euro Forecast for the Week Ahead: Drawn to 1.19

- Written by: Gary Howes

Image © Adobe Images

Our Pound to Euro Week Ahead Forecast looks for 1.19 to act as gravity but for weakness to be limited below here.

Pound Sterling fell 0.22% last week as it recorded a first weekly decline since early September, potentially bringing an end to the recent run of gains that brought with them regular fresh 2024 highs.

The selloff was linked to comments from Bank of England Governor Andrew Bailey that the Bank could be more "activist" in its approach to lowering rates. The read-through from markets showed that this was a signal the Bank was preparing to speed up the pace at its cuts rates.

The selloff in Sterling was significant, and GBP/EUR fell to a low of 1.1858.

Yet, by Friday, the exchange rate had recovered, and the weekly loss of 0.22% is no game-changer from a technical perspective. The weekly chart is still constructive and upward momentum remains intact:

Above: The weekly chart is still constructive, but a tactical pause in the uptrend is set to playout.

Sure, the unadulterated uptrend of the previous couple of weeks has been blunted, but all technical indicators still point higher.

Tactically, however, we wouldn't expect for a break to fresh highs in the coming week, so 1.20 should be confirmed as the hard ceiling.

The exchange rate didn't close under 1.19 last week despite the Bailey selloff, suggesting we have a relatively neat range between 1.19 and 1.20 to consider. We place great odds on the lion's share of this week's price action occurring in this range.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

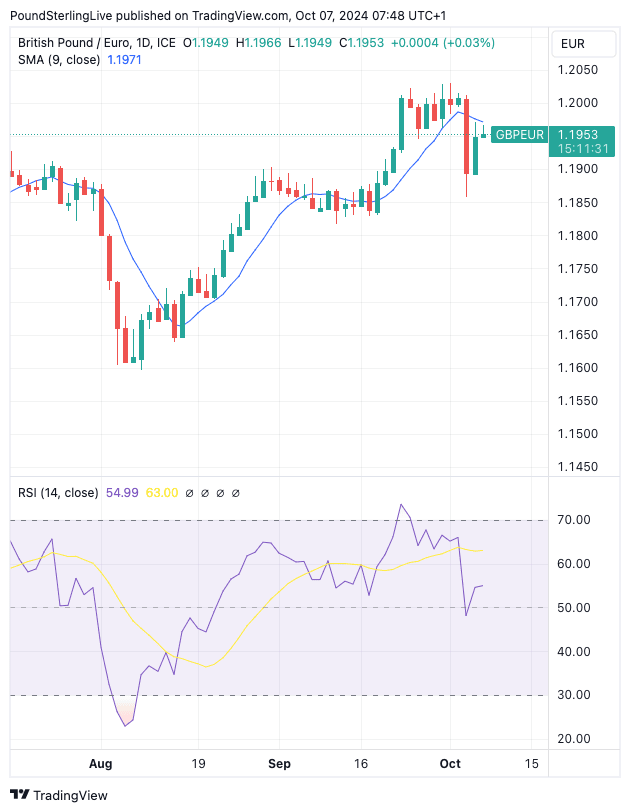

The pair is still below the 9-day moving average, which is a short-term day-to-day technical level that offers some clues to upcoming price action.

A failure to break above the 9 DMA (currently at 1.1970) would keep the pair favouring the lower end of the range and why we think 1.19 will exert a gravitational pull in the coming hours and days.

Above: The daily chart shows momentum has stalled somewhat and this is not the week we expect fresh peaks to be registered

The week ahead is a quiet one for both the UK and Eurozone, with no tier-one market moving events in the calendar. But bear in mind that next week will be important as the European Central Bank (ECB) has a decision to make on interest rates.

October was supposed to see the ECB keep rates unchanged, but weak inflation and economic activity data have prompted markets to bet another rate cut is possible, which has weighed on euro exchange rates and will keep it flighty ahead of next week's decision.

🎯 GBP/EUR year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. 📩 Request your copy.

For this week, global investor sentiment will be in the driving seat, and we will look for further GBP/EUR upside if stock markets climb higher.

With this in mind, Thursday's U.S. inflation report is the highlight of the week, as it will determine how market sentiment evolves.

A below-expectation reading would firm hopes that the Federal Reserve will cut interest rates two more times in 2024, which can bolster GBP against the EUR and USD.

The market is looking for a reading of 2.3% year-on-year and 0.1% month-on-month. Anything above this could act to pushback against rate cut expectations and could see GBP struggle.

The Dollar firmed and the Pound fell last Friday after it was reported the U.S. economy added 254k non-farm jobs in September, smashing expectations for a 147K reading.

The report was strong across the board, with August's report seeing a significant upgrade from 142k to 159k. The unemployment rate fell from 4.2% to 4.1%.

Yet, the stock market was relatively sanguine about the outcome and GBP/EUR didn't take a hit, with GBP/USD bearing the brunt of the move.

This is probably because the paring back of Fed rate cut bets also prompted a paring of Bank of England rate cut bets, which is broadly supportive of 2024's best-performing G10 currency.