Euro Risks Losses on Dovish ECB repricing says Commerzbank

- Written by: Gary Howes

Image © Adobe Images

The European Central Bank (ECB) forms the near-term risk for the outperforming Euro and one investment bank research team warns of downside risks if policymakers in Frankfurt strike a 'dovish' tone next week.

The ECB is all but set to raise interest rates by 25 basis points as it battles inflation rates that are above its 2.0% with market pricing showing another such hike will be delivered in September.

But analysis from Commerzbank warns this expectation might not be met.

"From the market’s point of view the likelihood of a further rate hike in September stands at 70%, so there is potential for disappointments particularly on the EUR side," says You-Na Park-Heger, FX Analyst at Commerzbank.

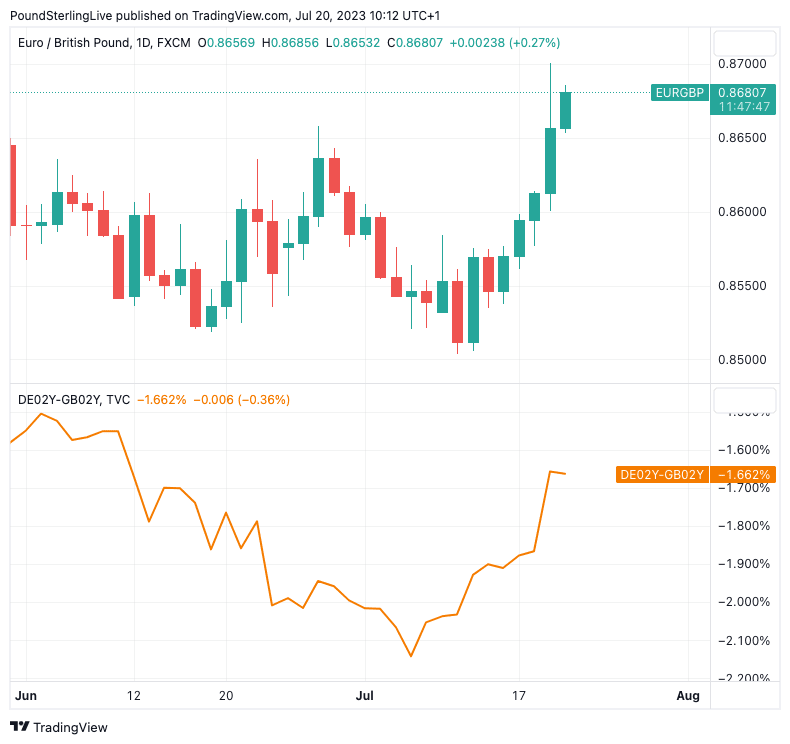

Above: The Euro has risen against the Pound (top) as the yield of UK bonds fell in relation to those of Germany (lower panel showing German two-year bond yield minus UK two-year yield). This line would move down - all else equal - if German bond yields fell in response to a dovish ECB).

The call comes amidst a tearing rebound in the Euro to Pound exchange rate that has seen the pair rise from 0.8505 to 0.8660 in the space of a week amidst ongoing support for the Eurozone's single currency at a time of broader Sterling weakness.

The Euro is the third-best performing major currency of 2023 courtesy of an improved economic outlook linked to falling gas prices and a steady rise in interest rates at the ECB.

Currencies tend to follow market expectations for future rate hikes, appreciating as these expectations rise and retreating when expectations reverse. One only needs to look at the falling Pound this week for confirmation that a paring of central bank rate hike expectations can weigh heavy on a currency.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The question for the Euro is whether it faces a similar retracement, particularly given increasing evidence of deflationary global dynamics, which was clearly underscored this week by the UK's June inflation undershoot.

ECB Governing Council members are taking the global temperature and this week appeared to prime market expectations for the possibility that July's could be the final ECB rate hike of the cycle.

One of the more 'hawkish' members of the ECB board - Klass Knot - said this week it looks as though Eurozone core inflation has plateaued and he is optimistic inflation will fall back to the 2.0% target in 2024.

"For July I think it is a necessity, for anything beyond July it would at most be a possibility but by no means a certainty," Knot told Bloomberg TV. "From July onward I think we have to carefully watch what the data tells us on the distribution of risks surrounding the baseline."

Bundesbank President Joachim Nagel said that a rate hike at the September meeting was now entirely down to the incoming data, signalling the ECB was no longer on a pre-set path to deliver higher rates.

"Not so long ago he had still signalled that he saw the need for further action even after the July meeting," points out Park-Heger. "Now he sounds cautiously optimistic also as far as inflation is concerned. Comments like these illustrate that a September step can be called into question."

Boris Kovacevic, FX & Macro Strategist at Convera, says pre-committing to any rate decision one or two months beforehand cannot be justified. "This is why European policymakers have recently softened their tone and have broadly described the rate decision in September as being open and dependent on the incoming data," says Nagel said he was hopeful core inflation will follow headline inflation - albeit at a lagged rate - and that the headline rate of inflation will return to the 2% target."

Commerzbank's FX strategists say should the market reach a conclusion that a September rate hike is out, "EUR might temporarily come under depreciation pressure."

Strategists at Barclays said in their most recent weekly strategy note they see diminishing value in chasing the Euro higher from current levels.

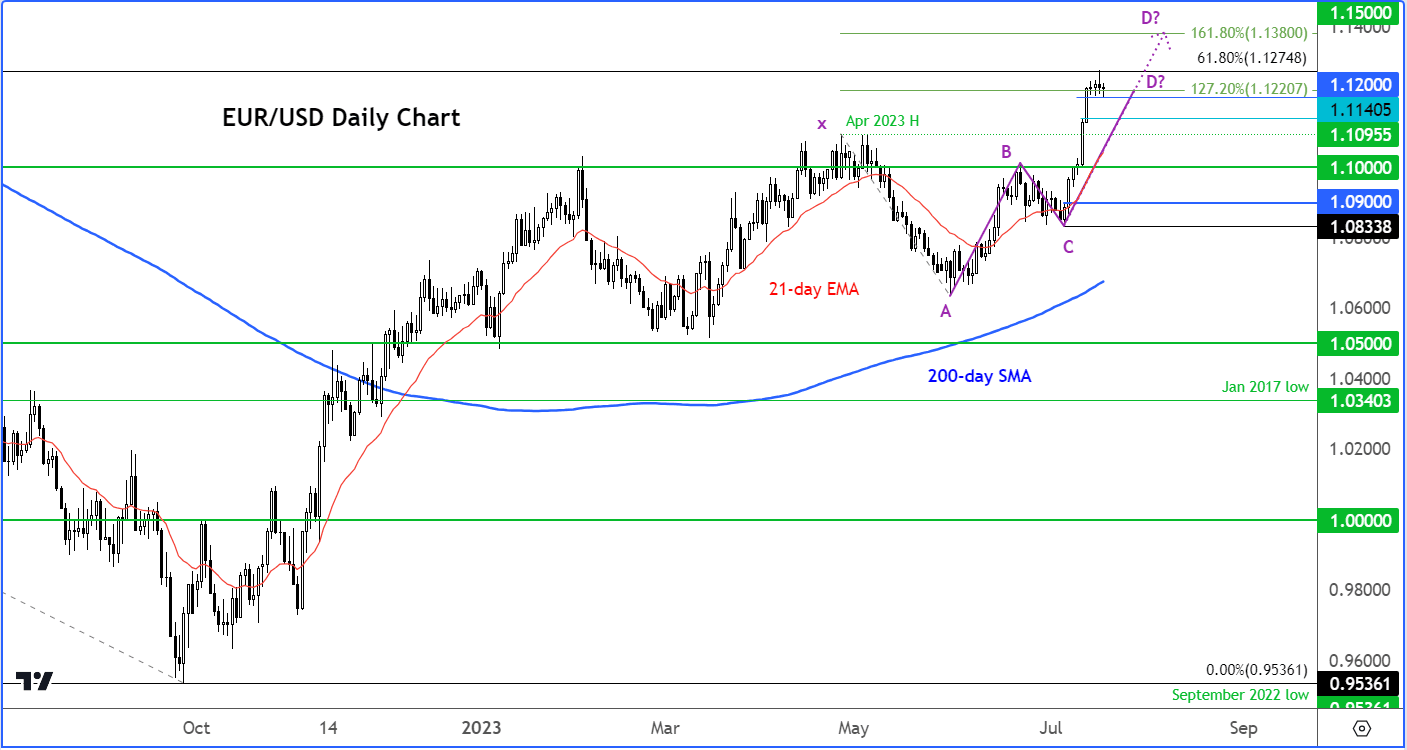

Above: EURUSD could see near-term weakness ahead of another crack higher according to City Index.

The call comes in the wake of the Euro to Dollar exchange rate (EURUSD) breaking out of its six-month 1.08-1.10 range last week and achieving a high at 1.1275 on July 18.

"We are wary of chasing this move further at this stage," says Barclays' FX strategy team in a regular weekly update.

It is noted that from a technical perspective Euro-Dollar "is among the most stretched pairs at the moment".

Economists at the bank reckon a rebound in Eurozone inflation is still required for a more sustained move higher in the EUR via the rotation away from U.S. assets into Europe.

Analysts at ING Bank meanwhile reveal their short-term financial fair value model has EURUSD overvaluation at an extended 3.0% on the back of the pair's recent rally.

But UBS strategists say this week they maintain a constructive stance on the Euro-Dollar even though they opt to maintain their target for September at 1.12, which suggests limited upside from here over the remainder of the summer.

A move to 1.14 is forecast by December, 1.16 for March and 1.18 for mid-year 2024.

"We see no need to change forecasts after the pairing's strong move this week," says Thomas Flury, Strategist at UBS.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes