Pound Sterling Hurtles Lower against Euro and Dollar Following "Watershed" Inflation Reading

- Written by: Gary Howes

Image © Adobe Stock

Good news for households and businesses as UK inflation came in well below expectation in June, but for the British Pound the slowdown in price rises could spell weakness.

Pound Sterling fell sharply after UK inflation read at 7.9% year-on-year, down from 8.7% previously, while the all-important core CPI read at 6.9%, down from 7.1%.

CPI was forecast to have risen 8.2% y/y with core inflation expected to have remained at 7.1% y/y.

CPI inflation rose just 0.1% month-on-month in June said the ONS, which was far less than the 0.4% the market was looking for and sharply down on May's 0.7% increase. Core rose 0.2% m/m in June, half the 0.4% expected and down on the 0.8% reported the month prior.

The undershoot prompted markets to lower expectations for future Bank of England interest rate hikes, which in turn weighed on UK bond yields and the Pound. Early responses from economists we follow suggest the Bank of England will raise interest rates by a further 25 basis points in August whereas the market consensus was for a 50bp hike ahead of the release.

"A watershed moment," says Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics. "June’s CPI report gives the MPC the green light to increase Bank Rate by 25bp next month, rather than by the hefty 50bp increment priced-in by markets as the most likely outcome."

The market will likely lower this expectation in accordance with the data, which should reflect in lower UK bond yields and a softer Pound. At the time of writing the Pound to Euro exchange rate has extended its decline by a further half per cent in the wake of the data and is now back at 1.1550.

The Pound to Dollar exchange rate fell half a per cent and is at 1.2962.

Above: GBPUSD (top) and GBPEUR at daily intervals showing the reaction to the UK inflation release.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

"The pound fell sharply after UK CPI inflation fell more than predicted which will raise speculation the next BoE interest rate rise in two weeks’ time may be smaller than the 50bp increase at the last policy meeting. GBP/USD and GBP/EUR dropped below 1.30 and 1.16, respectively," says Hann-Ju Ho, an economist at Lloyds Bank.

The UK currency has rallied through 2023 as UK inflation has proven more resilient than expected and prompted the Bank of England to take a more assertive stance on monetary policy by hiking interest rates and dropping its cautious guidance.

The rule of thumb is that an undershoot in inflation will result in a weaker Pound, and this is what is playing out.

However, the fall in inflation will certainly bolster the UK economic outlook as households and businesses see the end of the price squeeze on the horizon.

The Bank of England won't be required to hike interest rates as aggressively as previously expected, which can bring down mortgage payment rates

So while the near-term outlook for the Pound has turned lower as a result of falling rate hike expectations, the longer-term outlook will have likely improved alongside the economic outlook.

The ONS said the fall in inflation reflects falls in transport prices, particularly for motor fuels.

There were also notable downward effects from food and non-alcoholic beverages, furniture and household goods, and restaurants and hotels. There were no large offsetting upward effects.

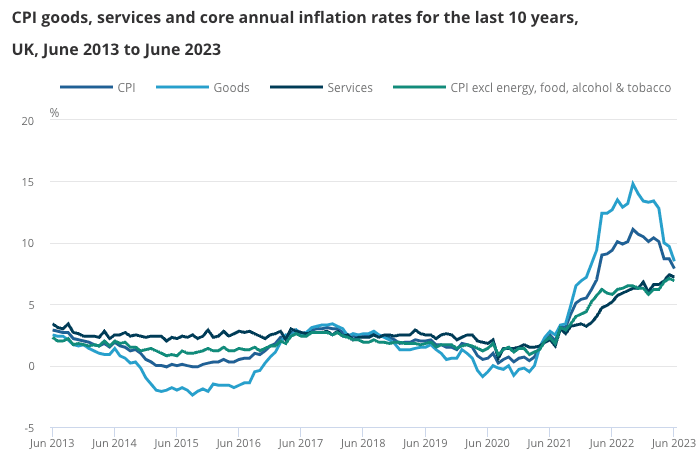

Image source: ONS.

Concerning the outlook for UK inflation, the Bank of England will take into consideration that the pipeline for goods inflation is decidedly deflationary with factory output prices falling 0.3% m/m in June, with May's reading revised lower to -0.6%.

Factory input inflation reads at an outright deflationary -1.3% m/m, lower than May's -1.2%.

To be sure, external inflationary pressures are easing, but domestic price pressures are likely to remain relatively elevated thanks to UK wage increases, which are at multi-year highs.

The average earnings index, excluding bonuses, rose 7.3% in May, which means the Bank of England will remain vigilant and push through another rate rise in August.

"With both headline and the core readings softer than expected, the bar for another 50bp rate hike in August will be too high for the MPC and should tip them into a smaller quarter point rise," says Jamie Dutta, Market Analyst at Vantage.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes