Euro Boosted by Gas Price Fall, But Now Looking Expensive against Pound and Dollar say Analysts

- Written by: Gary Howes

- EUR boosted by another drop in gas prices

- But now looking expensive say analysts

- EUR also supported by 'hawkish' ECB policy

- But ECB 'doves' could fly again in Feb

Image © European Central Bank

The Euro can continue its rise in the near-term as wholesale gas prices register significant declines but some analysts warn the rally is becoming increasingly extended and now leaves the 'overvalued' Euro at risk of a retracement.

The Euro is one of 2023's better-performing currencies as negative sentiment amongst investors eases following an ongoing decline in the price of wholesale gas which has lowered the prospects of a Eurozone recession in 2023.

Better economic prospects have meant the Euro has advanced by over a percent against the Dollar in January - adding to December's 2.90% gain - taking spot back to 1.0824.

Tumbling gas prices means they are back below levels last seen ahead of Russia's invasion of Ukraine.

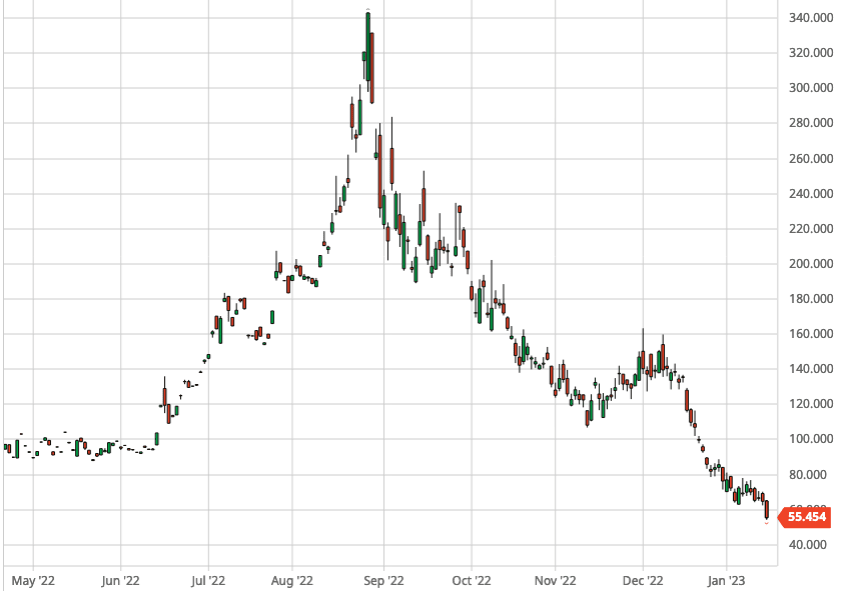

Dutch TTF natural gas futures - the EU wholesale gas benchmark - fell more than 12% to €56/MWh on Monday, the lowest level since September 2021 as more LNG cargos may be heading to Europe.

Above: TTF gas contract for February 2023 delivery.

Gas stocks in China are also forcing importers to divert February and March shipments to Europe, according to Celtic Financial Planning.

Falling gas prices are also being registered in the UK but the Pound has been unable to resist the Euro's advance, meaning the Pound to Euro exchange rate is down to 1.1275.

(Bank transfer rates down to approx. 1.1051, cash and holiday money rates at competitive providers to 1.1176, competitive money transfer provider rates down to approx. 1.1243).

Gas market developments have combined with a Chinese economic reopening (China is a key destination for Eurozone exports) and expectations for a more hawkish European Central Bank where interest rates could rise by at least another 100 basis points.

"The less downbeat view on the European economy, the inflows into stocks, the prospect of a narrowing Fed/ECB rate differential and improving demand from China all bode well for the single currency over the medium term," says strategist Kenneth Broux at Société Générale.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Overbought...

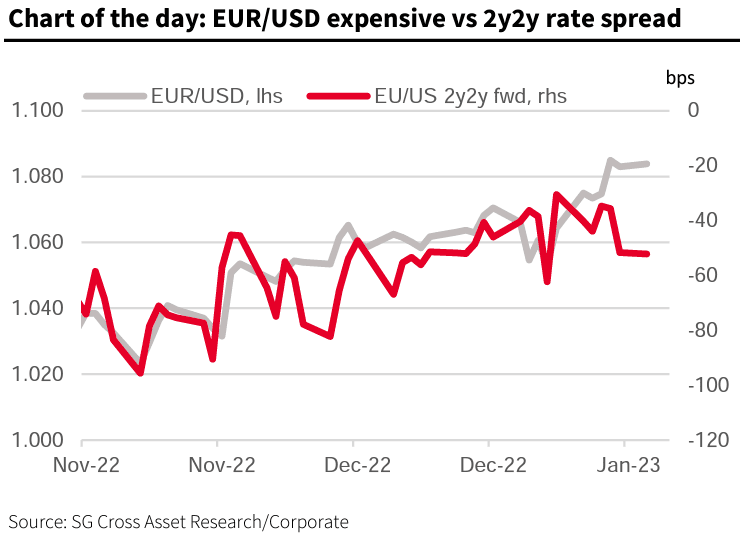

However, an analysis from Société Générale finds the Euro is looking expensive relative to fundamentals and the potential for a pullback is therefore increasing.

"In FX land, the euro had a great second week of the year, but tactically, the appreciation is starting to look long in the teeth. Both EUR/USD and EUR/GBP are expensive based on 2y2y rate differentials," says Broux in a regular currency research briefing.

There is little to suggest a major trend reversal will transpire soon and Broux says retracements are still likely to be viewed as a buying opportunity.

But Robin Brooks, Chief Economist at the IIF, says the Euro is looking overvalued on a fundamental basis and current levels are difficult to justify.

"Euro has erased most of its drop since Russia invaded Ukraine. That's markets saying that the fallout from war is transitory & Europe is back to business as usual," says Brooks.

Despite the 'back to normal' sentiment being reflected by financial markets, "we know whole business sectors are operating at reduced capacity, so this is a big mispricing," says Robin Brooks.

"The Euro is overvalued," he adds.

Regarding the Pound vs. Euro outlook, Brooks' research finds the UK will emerge from recent shocks in better shape than the Eurozone.

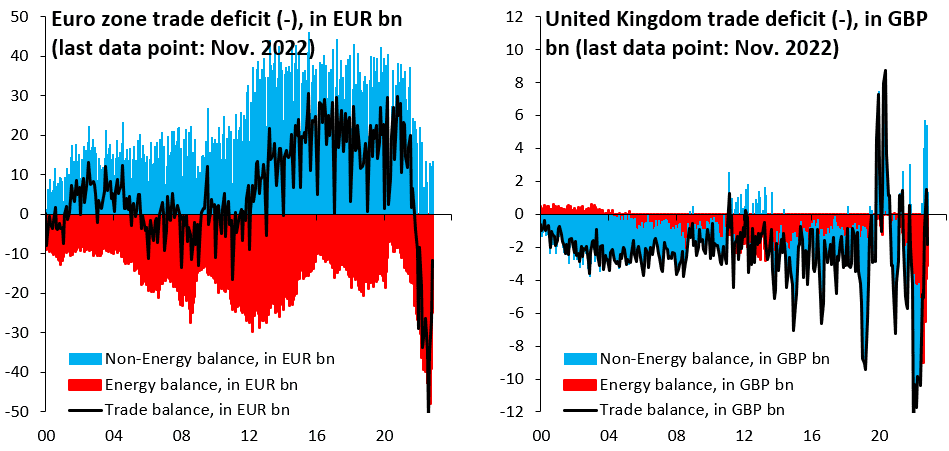

He presents the following chart:

Image courtesy @RobinBrooksIIF.

"The Euro zone non-energy trade surplus is down to €10BN per month from €40BN on average pre-COVID (lhs, blue). But the UK non-energy trade balance has risen into surplus from deficit (rhs, blue)," says Brooks.

This implies the UK's current account deficit, a long-standing source of negative sentiment undermining the Pound, could limit depreciation potential.

ECB: A Potential Trigger to a EUR Retracement

The obvious trigger to a reversal in the Euro's fortunes lies with a spike in European energy prices, however meteorological forecasts and LNG delivery projections suggest another imminent 'blowout' is not imminent.

Rather, it could be a shift in ECB rate hike expectations that prompts a retracement.

A new poll of economists on the future of ECB interest rate policy finds the consensus expects two half-point hikes at the February and March meetings, followed by a 25 basis-point increase in May or June.

Surprisingly, the median analyst prediction then sees the central bank cut the rate back to 3% as soon as the start of the third quarter.

This would represent a significant shift in expectations as ECB policymakers have so far only communicated an intention to hike rates and keep them at its final resting place for an extended period.

A cut would therefore upend the recent narrative that the ECB is the most 'hawkish' central bank in the room and implies some looming surprises as ECB members signal a willingness to slow down.

This could come as early as February after the Federal Reserve downshifts to a 25 basis point hike, which could be the last of the current cycle.

So while the ECB has been a driving force behind Euro strength over December and January, February could see this support begin to be questioned.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes