GBP/NZD 5-day Forecast: Still Heavy, Supported at 2.0275

- Written by: Gary Howes

- GBPNZD has corrected oversold conditions

- Can stay above short-term support

- Watch Chinese data for guidance this week

Image © Adobe Stock

The Pound to New Zealand Dollar exchange rate (GBPNZD) can continue to stay supported above the 2.0275 level over the coming days as a 'relief' rally looks to extend further, however, data out of China could boost the Kiwi if it confirms a pickup in activity is underway.

GBPNZD has been under notable pressure since August but our previous week ahead forecast warned that a rebound was becoming increasingly likely given the oversold nature of the down-move.

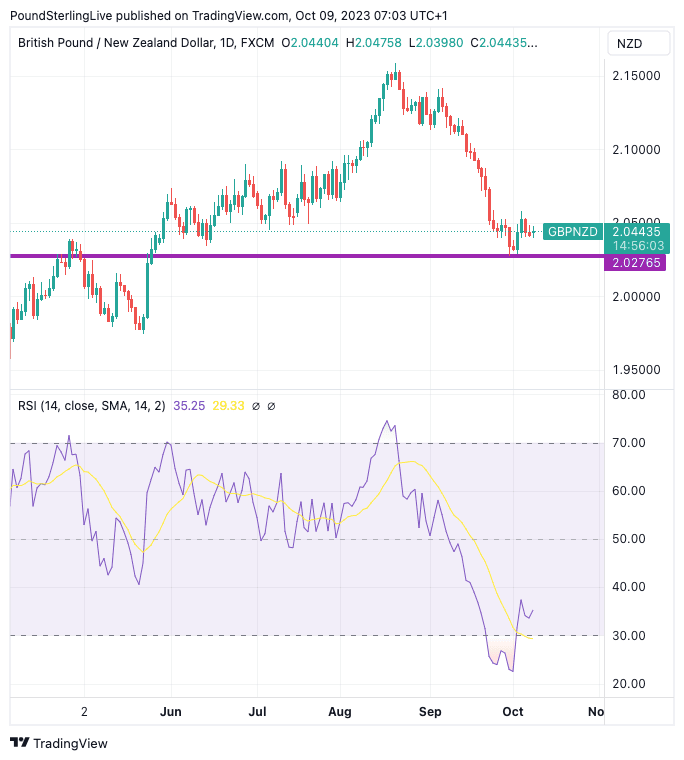

Having been as high as 2.1585 on August 21, the pair subsequently withdrew back to 2.0289 just last week, which took the RSI deep into oversold territory and put the market on watch for either a rebound or consolidation.

Helping to correct the market's oversold conditions was the Reserve Bank of New Zealand's September policy decision, which proved less 'hawkish' than the market was expecting, which gave the fundamental cover for GBPNZD to bounce and unwind some of its oversold conditions.

The pair certainly remains heavy (GBPAUD has recovered to a much greater extent) but we look for the pair to remain supported above the 2.0275 support zone in the near term although the upside will be limited:

Above: GBPNZD at daily intervals showing the recent correction from oversold conditions on the RSI in the lower panel. Exchange rate alerts: set up a daily rate alert email to track your exchange rate OR set an alert for when your ideal exchange rate is triggered ➡ find out more.

The New Zealand Dollar's data calendar is peppered with some lower-tier releases this coming week which should offer some interest, however, it will be external data release, specifically Chinese, that offers the market-moving potential.

Interest comes on Wednesday when Chinese money supply numbers are released and any positive surprises can provide a boost as it would suggest the world's largest economy continues to see a pick up in activity.

New loans are expected to have increased CNY2,500.0BN while loan growth is anticipated to have risen 11.2%. Last month's figures beat expectations and boosted China-facing assets, an asset class in which the NZD is included.

Second-tier data in the form of New Zealand electronic card sales should offer an insight into consumer confidence when released on Thursday, although the market impact on NZD should be relatively limited.

China is again in focus for the Kiwi Dollar on Friday when Chinese inflation numbers are released (2AM BST): look for a headline CPI increase of 0.2% year-on-year in September, with a beat potentially offering a boost to the likes of the NZD.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

Chinese export numbers are also due for release on Friday (4AM BST) and the market is looking for a -8.3% figure, a slight improvement on August's -8.8%. Imports are expected to read at -6.0% and any improvement could signal rising demand for New Zealand's agricultural exports, which is why this is an important release for the New Zealand Dollar.

The UK economic calendar comes back to life this week with Thursday's monthly GDP release and a number of other economic data prints.

The headline figure to watch is August's monthly GDP where a 0.2% expansion is expected in what amounts to a sharp recovery from July's weather-impacted -0.5% reading.

Should the number beat expectations it would amount to another positive surprise that could boost the Pound. Recall that data is in the driving seat on global currency markets at present and last week, we saw Sterling put in some decent gains following the upgrade to September's PMI readings.

There is interest elsewhere at 7AM on Thursday when manufacturing production and industrial production numbers are also released.

However, these tend to be overshadowed by the GDP figure, as does the monthly trade balance release.

Above: File image of BoE Governor Andrew Bailey. Still courtesy of Bloomberg.

Watch out for Bank of England Chief Economist Huw Pill, who is due to speak at 10AM on the same day. Pill's last speech made in Cape Town proved to be of relevance in it set out the Bank's desire to see UK interest rates stay elevated for an extended period.

More of the same could underpin the Pound's prospects against currencies where interest rate cuts are expected to commence earlier in 2024.

Governor Bailey speaks at 9:00 on Friday and could be expected to repeat the line that he expects inflation to fall notably over coming weeks, although the battle has not been won.

Therefore, he will likely parrot the Bank's official stance that it remains ready to hike interest rates again. On balance, this should support market expectations for a potential rate hike before the year is done, which would support Sterling.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes