GBP/NZD Week Ahead Forecast: GBPNZD Momentum Remains Positive

- Written by: Gary Howes

- GBPNZD has unwound overbought conditions

- Momentum remains positive on most timeframes

- Test of 2023 high possible

- Watch NZ current account and GDP data this week

- UK jobs and GDP data also pose key risks

Image © Adobe Stock

The Pound to New Zealand Dollar exchange rate (GBPNZD) remains in an uptrend and a positive bias remains preferred over the short- to medium-term timeframe that could allow for a restest of 2023's highs.

That said, the coming week could be defined by further churn below that 2023 high located at 2.0738 given the busy economic data dockets in both the UK and New Zealand and the uncertainty posed by the midweek Federal Reserve interest rate decision.

Pound Sterling has been in the ascendency against its Kiwi counterpart during 2023 with the trend of appreciation accelerating towards the end of May, a development that left GBPNZD overbought on short-term timeframes.

Indeed, according to the previous GBPNZD week ahead forecast, a setback was likely as these overbought conditions required a rebalancing in the NZ Dollar's favour. Last week's decline has proven that forecast to have been accurate.

Where does this leave GBPNZD at the start of the week? We note the Relative Strength Index (RSI) on the daily charts has fallen back below 70, telling us the pair has indeed corrected its overbought status:

Above: GBPNZD daily with RSI indicator in lower panel.

But, the RSI remains above 50 and is therefore positive, advocating further advances. Furthermore, the pair remains above its key moving averages.

A test of the upside is therefore preferred and the 2023 high at 2.0738 can be delivered if the data comes through in line with expectations.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

New Zealand: Recession Confirmed?

The release of GDP data on Wednesday and current account figures on Tuesday make up the domestic highlights for the New Zealand Dollar which remains a laggard in the global FX space for 2023 amidst a combination of slowing global and domestic data, as well as the Reserve Bank of New Zealand's recent signal that it has ended raising interest rates.

The RBNZ's signal that it has completed the hiking cycle could be affirmed if New Zealand GDP for the first quarter reads negative, meaning the country has entered a technical recession, something analysts at New Zealand lender BNZ are looking for.

"NZ business indicators released for Q1 weren't flash and they allowed us to firm up our GDP estimate to a 0.2% q/q decline, following on from the 0.6% contraction in Q4," says Jason Wong, FX analyst at BNZ. "Our estimate is weaker than the RBNZ’s +0.3% pick."

"The standard forecasting error means that either of those two outcomes are both plausible, but clearly a negative outturn would get media writing about the economic recession beginning late last year," says Wong.

Westpac meanwhile estimates GDP fell by 0.4% in the December quarter.

"This would be the second straight quarterly decline, and would be weaker than market and Reserve Bank forecasts. There’s a high degree of uncertainty around the quarterly result, as Covid-19 has significantly disrupted the usual seasonal patterns in the data. However, the underlying picture is that the economy is losing momentum – as we’d expect to see after the accumulated monetary tightening over the last year and a half," says Westpac.

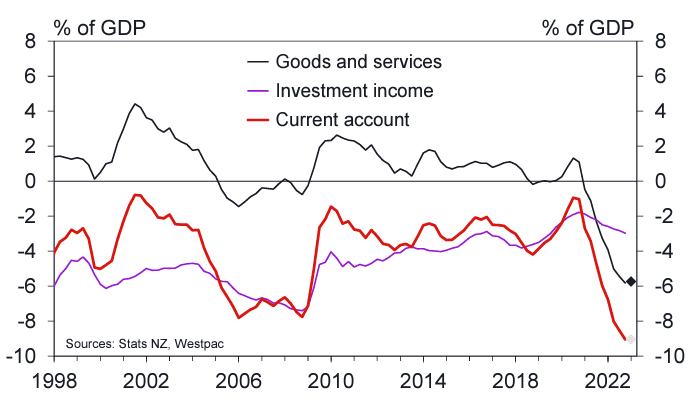

Ahead of the GDP release comes New Zealand's current account statement which is expected to confirm the country is running a notable deficit with the rest of the world; a fundamental negative for the NZ Dollar's longer-term outlook..

The market is looking for a –9.0% reading as "New Zealand’s current account deficit has blown out over the last two years," says Westpac, adding:

"The loss of overseas tourist revenue (until recently) and the sharp rise in import prices and shipping costs have been a factor. But more broadly, the widening deficit is a symptom of an overheated economy – we are continuing to spend beyond our current means."

Above: NZ current account, image courtesy of Westpac.

Economists at the bank expect the deficit to reach a fresh high of 9% of GDP for the year to March.

"The services balance is improving as overseas tourists return. However, the goods deficit worsened significantly in the March quarter as export prices fell sharply. A fall in import prices was offset by a rise in volumes," says Westpac.

Sharon Zollner, head of New Zealand economics research at ANZ, says New Zealand has been running deficits for years and rating agencies aren't yet ringing the alarm bells over the matter.

But, "a day of reckoning is coming," says Zollner, "and when it comes, it could be brutal."

For now, there is no catalyst to spark this reckoning, "so, while we continue to forecast a gradual appreciation in the NZD, we also continue to fret about when that day of reckoning might come," she says.

The Pound: Labour Market Data

Turning to the British Pound, which remains top of the leaderboard for 2023, two data releases this coming week will amount to the first real domestic test for the currency of this month.

"The GBP remains one of the best-performing currencies in G10, mainly due to the superior quality of the incoming UK data as well as the build-up of BoE rate hike expectations," says Valentin Marinov, Head of FX Research at Crédit Agricole. "The latter continues to boost the rate appeal of the GBP across the board."

The UK is expected to have added 150K jobs during the three months to April when labour market figures are released on Tuesday, with the average earnings index (with bonus) expected to have increased at an inflation-boosting 6.1% in April.

UK GDP (Thursday) is meanwhile forecast to have risen 0.2% in the month of April, taking the year-on-year reading to 0.6%. A swath of industrial, manufacturing and trade data are also due for release on the day.

An undershoot in the data would potentially trigger a decline in the Pound, whereas a beat would keep the Pound elevated near current levels against the New Zealand Dollar.

"Focus will be on the latest UK labour market data for May and the monthly GDP data for April. FX investors will want to see if the incoming data would give the GBP's flagging relative rate advantage another boost before buying the currency in the near term," says Marinov.

The global picture is dominated by the U.S. Federal Reserve interest rate decision on Wednesday.

The Fed is expected to forgo another interest rate hike on Wednesday, but signal that a July hike is likely.

The overall tone of the guidance could be the single most important event for financial markets this week, with implications for the New Zealand Dollar which has a high sensitivity to overall global investor sentiment.

If the Fed delivers a surprise rate hike U.S. yields could spike and equity and commodity markets could fall, bringing an end to New Zealand Dollar outperformance.

The Fed would however be expected to meet market expectations by forgoing a rate hike, nevertheless, the tone about the prospect for future hikes could nevertheless yet be considered 'hawkish' as it guides to a July hike.

If this were the case, the Kiwi could come under pressure.