GBP/NZD Week Ahead Forecast: Cooling Off from Overbought

- Written by: Gary Howes

- GBPNZD was overbought, consolidation likely

- Multi-week GBP upside still preferred

- NZD still has 'carry' in its corner

- Key risk for GBP is June 21 inflation reading

Image © Adobe Stock

Pound Sterling remains in a multi-week uptrend against the New Zealand Dollar and while this medium-term trend remains fully intact some short-term losses could be expected.

The Pound to New Zealand Dollar exchange rate (GBPNZD) last week hit a new multi-year high at 2.0738 - the strongest level for Kiwi buyers since May 2020 - but the achievement looks to be something of a blow-out moment for the uptrend.

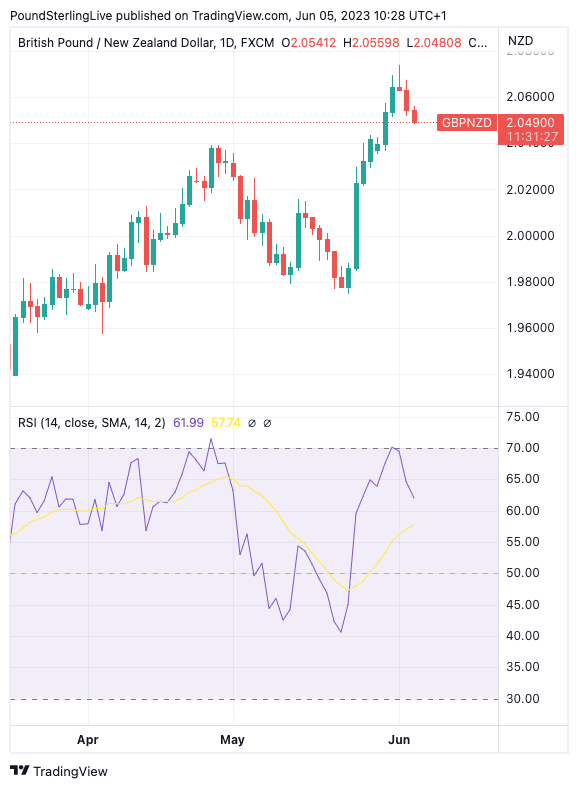

The recent rise has been frantic and this left Sterling looking overbought against the Kiwi, something evident on the daily GBPNZD chart:

The above plots GBPNZD's rise against the Relative Strength Index in the lower pane. The RSI is a trend indicator and it confirms the trend is firmly in favour of GBP upside.

However, the RSI is also useful in telling us whether a financial asset is overbought or oversold. A reading above 70 signals overbought conditions and raises the prospect that a pullback and consolidation are falling due.

This appears to be playing out in GBPNZD and the coming week could be one in which the market catches breath.

Therefore, for NZD sellers, this presents a welcome break in which to transact and manage against the risk that the trend continues.

For NZD buyers, GBPNZD weakness could extend to 2.03, the late April resistance zone that turns to support.

However, over a multi-week timeframe further upside is preferred at this juncture (with some caveats, see below).

Last week we reported the New Zealand Dollar can recover some of its recent losses against the Pound, however, any comeback is unlikely to mean the 2.0 level in GBP/NZD is breached on a sustained basis.

This is according to Australian and New Zealand lender ANZ which has released its latest in-depth assessment of the New Zealand Dollar's prospects, revealing a recovery against the Dollar can be expected.

The Kiwi is one of the G10 currency sphere's laggards for 2023 with losses being recorded against all peers apart from the Yen and Krone.

Part of the reason is the Reserve Bank of New Zealand's (RBNZ) recent indication that it has finished raising interest rates, therefore denying the New Zealand dollar further 'carry' support.

But make no mistake, at 5.5% the RBNZ's base rate means New Zealand offers some of the best returns on financial assets in the developed world, but the end of the hiking cycle has resulted in the NZD losing ground of late.

ANZ's analysts say interest rates can offer the New Zealand Dollar support over the near term; "carry has been a key consideration for the Kiwi for decades, thanks to the tendency towards higher interest rates in New Zealand, and a tendency for higher-yielding currencies to appreciate," says Sharon Zollner, chief economist at ANZ.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

New Zealand Dollar strength is nevertheless likely to be limited over the medium term as the Chinese economic recovery continues to disappoint against the lofty expectations at the start of 2023.

This year was supposed to be about the Chinese economic revival as the country shed Covid restrictions. Certainly, the consumer continues to recover but the manufacturing and construction sectors have disappointed.

To be sure, New Zealand is not a big 'hard' commodity exporter like Australia, but it remains a commodity currency as a host of agricultural and forestry exports to China are key currency earners for New Zealand.

Until China starts firing on all cylinders again the antipodean currencies might struggle.

New Zealand is also labouring under one of the widest current account deficits in the developed world as the country imports more than it exports.

This places pressure on its balance of payments position, particularly at a time when the economy is forecast to slow down as the impact of high interest rates becomes felt.

"We have a record current account deficit and we're running Budget deficits for the foreseeable future. In other words, we've been living well beyond our means and it’s not clear that'll change any time soon," says Zollner.

The British Pound is meanwhile supported by expectations for further rate hikes at the Bank of England where at further 75-100 basis points of hikes are still expected owing to the UK's elevated inflation rates.

In a world of 'carry' this puts GBP at the top of the pile.

But key risks in June include inflation data undershooting (data due on June 21) which would prompt a rapid repricing lower of Bank of England interest rate expectations which would be expected to weigh on Sterling.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes