New Zealand Dollar at Risk of House Price Declines says JP Morgan

- Written by: Gary Howes

- NZ has lower savings rate than other comparables

- This heightens impact of higher RBNZ interest rates

- NZ house price declines particularly pronounced

- "Implications for NZD are relatively larger through this channel"

Image © Adobe Stock

New Zealand is witnessing one of the sharpest pullbacks in house prices in the developed world, and the currency won't be immune to the fallout says a leading Wall Street Bank.

JP Morgan says house prices matter for currency markets and developments in New Zealand prompt it to hold a "bearish bias" on the New Zealand Dollar.

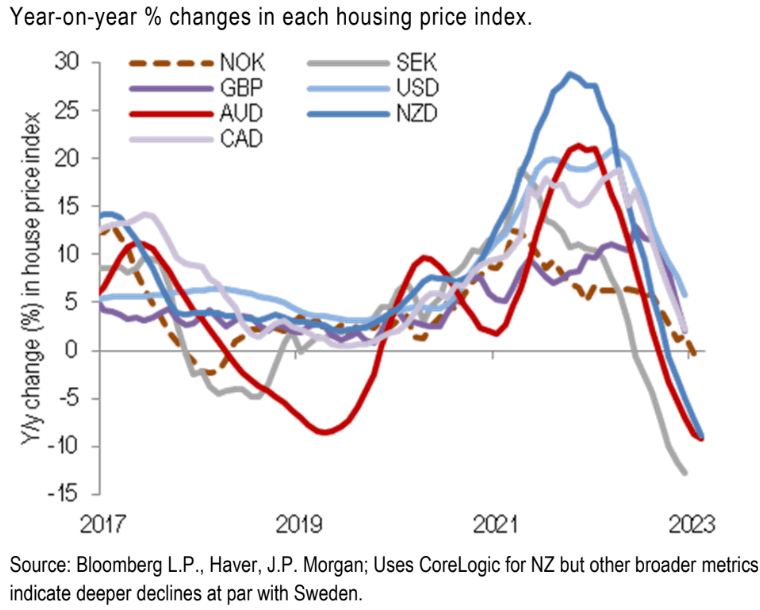

"House prices have fallen in the Antipodeans but the decline has been deeper for New Zealand, where they are down 16% from the peak," says Meera Chandan, an economist and currency analyst at JP Morgan in London.

JP Morgan's New Zealand strategists meanwhile note the deeper decline in New Zealand's housing sector "is symptomatic of weaker credit demand/activity, and household consumption is more sensitive to that in NZ than Australia."

The Reserve Bank of New Zealand (RBNZ) raised the Overnight Cash Rate (OCR) to 4.75% in February and said borrowing costs will still need to rise further in the months ahead if it is to bring inflation back to 2.0%.

"The Committee agreed that monetary conditions need to tighten further, as indicated in the November Statement, so as to be confident there is sufficient restraint on spending to bring inflation back within its 1 to 3% per annum target range," the RBNZ said in a statement.

The cost of borrowing matters for New Zealand's economic and currency outlook, potentially more than elsewhere, says JP Morgan. It notes the saving rate in New Zealand runs structurally lower than in Australia and as a result, Kiwi households are more reliant on credit growth.

Data shows that in the year to the third quarter the savings rate averaged 10% in Australia, compared to 3% in New Zealand.

"So the implications for NZD are relatively larger through this channel," says Chandan.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

"Like with Scandis, NZD appears to have decoupled from relative rate differentials as house prices started declining a year ago; we expect this to persist," she adds.

JP Morgan said in a year-ahead currency research briefing that 2023 would see NZD, SEK and CAD as the currencies most vulnerable to domestic housing stress.

They recommended underweights in all three, partly informed by these drags.

Indeed, while house prices have started to wane in all developed market economies, evidence shows house prices in Sweden, New Zealand and Australia have led the way lower.

JP Morgan expects the transmission mechanism from falling house prices into New Zealand Dollar value to come via "the yield channel".

i.e. central banks with vulnerable housing would be constrained by how much they can raise rates.

It could also be transmitted via the local markets channel, explains Chandan: if these central banks did raise rates prioritizing inflation, that would be a drag for local growth and risk markets, which in turn could reduce capital inflows.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes