New Zealand Dollar Climbs as RBNZ Stays Interest Rate Course

- Written by: James Skinner, Contributions from Gary Howes

"It is still early in the recovery process and estimates of the wider economic impacts are highly uncertain. However, these events will likely result in somewhat higher-than-otherwise inflation in the near term" - RBNZ.

Image © Adobe Stock.

The New Zealand Dollar edged higher against a range of major currencies in mid-week trade after the Reserve Bank of New Zealand (RBNZ) said its latest analysis suggests that interest rates still need to rise in line with the forecasts and assumptions set out back in November.

New Zealand's cash rate was lifted from 4.25% to 4.75% in line with economist expectations on Wednesday while the RBNZ said in its statement that borrowing costs will still need to rise further in the months ahead if the bank is to be confident that it can return inflation to its price stability target.

"While there are early signs of price pressure easing, core consumer price inflation remains too high, employment is still beyond its maximum sustainable level, and near-term inflation expectations remain elevated," February's statement says in its opening.

"The Committee agreed that monetary conditions need to tighten further, as indicated in the November Statement, so as to be confident there is sufficient restraint on spending to bring inflation back within its 1 to 3% per annum target range," the statement says in partial conclusion.

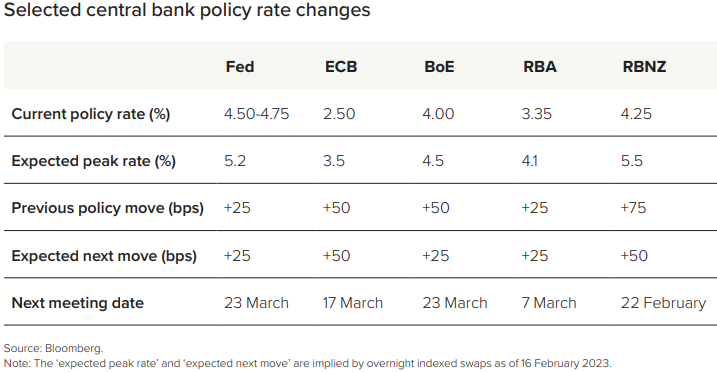

When compared with November, there was little change in the RBNZ's key judgments, forecasts and assumptions with the cash rate still seen rising to a peak of 5.5% at some time in the second half of this year where it's still expected to remain until some time in the second half of next year.

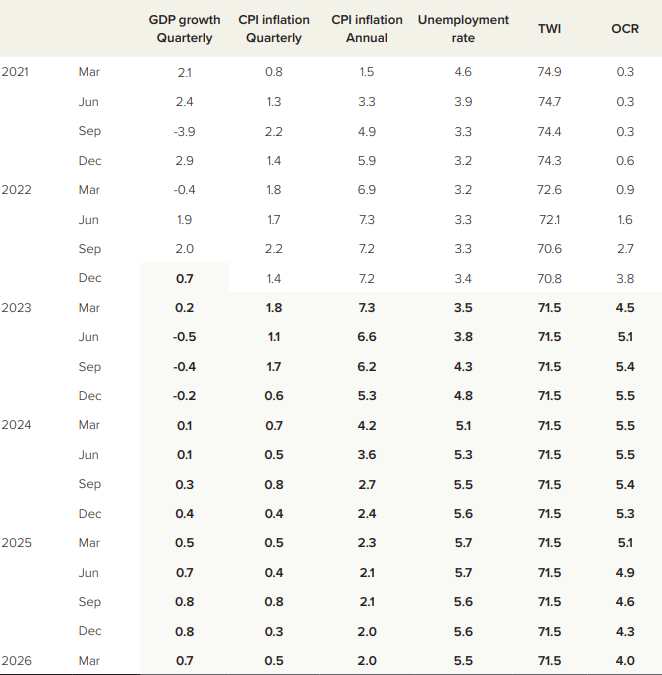

Above: February's key forecasts and assumptions. Source: Reserve Bank of New Zealand Monetary Policy Statement.

"The main trigger for the kiwi’s rebound has been the RBNZ’s latest policy update overnight that has disappointed expectations for less hawkish rate guidance," says Lee Hardman, a senior currency analyst at MUFG.

The new information in the latest cash rate projection is that the benchmark is seen as likely to be cut to 4% in the opening quarter of 2025.

Forecasts for other variables were tweaked a little more in February with the latest anticipating modestly weaker GDP growth for 2023 and a somewhat improved outlook for next year, which was accompanied by minor reductions in projections for inflation over 2023 and 2024.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

The better development for Kiwis was a small decline in unemployment rate projections for 2024 and 2025, suggesting the effort to return inflation to the target range will be less costly for the labour force than previously expected.

"Some people have lost their lives. Many people have lost their homes, vehicles and possessions. Others have had their businesses disrupted. There has been significant damage to crops, land, inventories and equipment. Apart from these financial and material losses, the emotional stress continues to be immense and our thoughts are with those affected," the bank said of February's natural disasters in New Zealand.

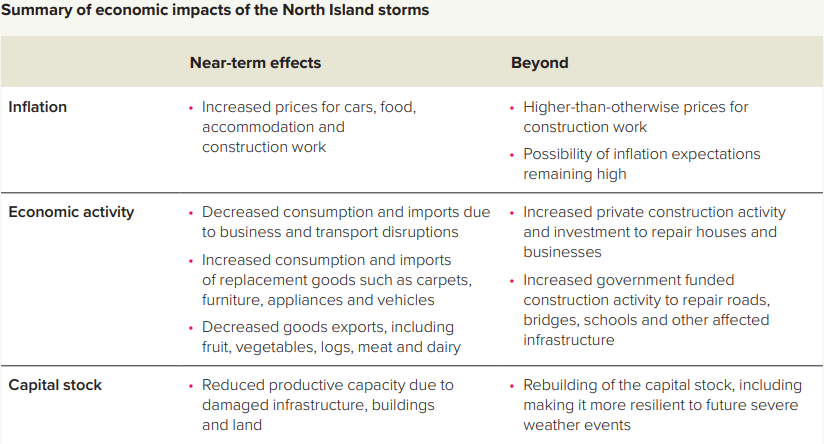

"It is still early in the recovery process and estimates of the wider economic impacts are highly uncertain. However, these events will likely result in somewhat higher-than-otherwise inflation in the near term. They have destroyed capital stock, thereby reducing supply, and will increase demand over coming years (table A1)," the quarterly Monetary Policy Statement says.

Source: Reserve Bank of New Zealand Monetary Policy Statement. Click image for closer inspection. To optimise the timing of international payments you could consider setting a free FX rate alert here.

Wednesday's announcement was followed by gains for the New Zealand Dollar in relation to just more than half of the G10 and G20 baskets with its strongest increases in relation to the U.S. Dollar, Australian Dollar, Pound Sterling, Chinese Renminbi, Canadian Dollar and South African Rand.

The RBNZ decision helped to offset for the Kiwi the impact of earlier increases in bond yields elsewhere in global markets, which had prompted losses for international asset prices and risk aversion among investors on Tuesday.

Stock indices had fallen almost across the board on Tuesday as U.S. and European bond yields rose in the wake of S&P Global surveys suggesting a January rebound in activity for manufacturing and services sectors in most parts, with the UK surveys seeing the largest bounce.

"As discussed in chapter 3, improved financial market sentiment following lower global inflation outturns and the reopening of China has contributed to an appreciation of the New Zealand dollar relative to that which was assumed at the time of the November Statement," the RBNZ said on Wednesday.

"Risk sentiment in global financial markets has improved recently. Global equity indices have increased, and the US dollar has depreciated. This reflects increasing confidence among investors that headline inflation has peaked across most economies, together with a slight improvement in the global economic growth outlook, particularly for China and the euro area," it added.

Source: Reserve Bank of New Zealand Monetary Policy Statement. Click image for closer inspection. (If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes