GBP/NZD Rate's Big Sell-off to Fade this Week

- Written by: Gary Howes

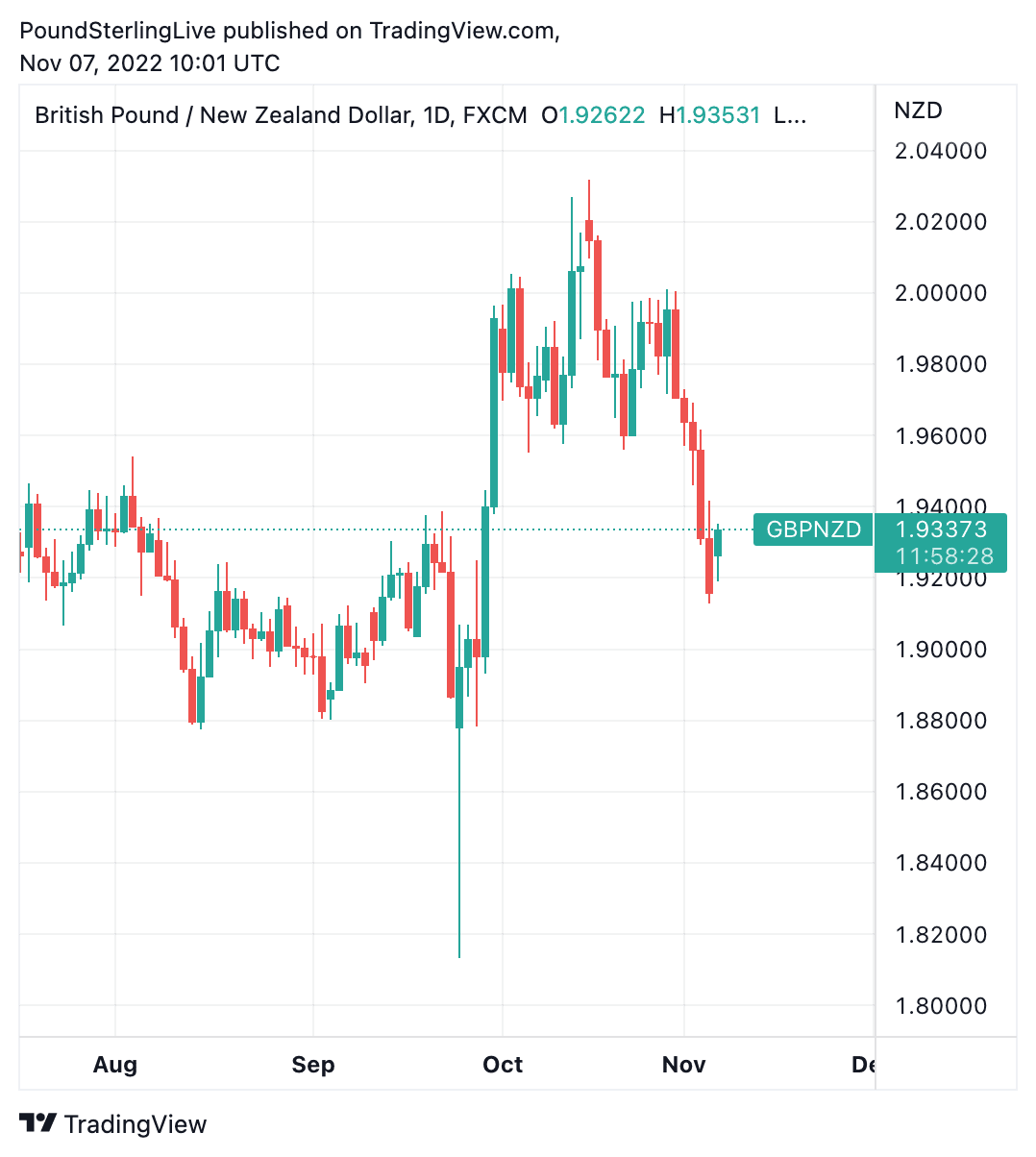

- GBP/NZD in biggest weekly drop since 2016

- As China reopening rumours swirl

- But GBP recovering somewhat at start of new week

- Suggesting some paring of recent losses likely

- But return to 2.0% unlikely near-term

Image © Adobe Stock

The New Zealand Dollar is the best-performing major currency of November, but this outperformance will likely fade over the coming days, offering the British Pound the chance to consolidate towards the middle of a long-held trading range.

The Pound endured a 4.0% loss in value against the New Zealand Dollar last week - its largest weekly fall since 2016 - amidst a combination of improved sentiment towards China and demand for New Zealand government bonds.

The falls came just as a rally in the Pound to New Zealand Dollar exchange rate (GBP/NZD) was building a head of steam, allowing it to prod the psychologically significant 2.0 level.

But a pullback ensued after the New Zealand Dollar outperformed all its major peers amidst rumours China was looking to begin dropping its zero-Covid policy.

Further support came after New Zealand government bonds were admitted to the FTSE-Russel World Government Bond Index, a move that that could see NZ$2BN of inflows into local bond markets booked in November alone.

Domestic wage data meanwhile suggested the Reserve Bank of New Zealand does not have the luxury of stepping back from its rate hiking cycle and would have to hike further than previously expected, developments that further supported domestic bond yields.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

But the start of the new week sees these themes fade somewhat, particularly with relation to China.

The New Zealand Dollar was a laggard after China's National Health Commission (NHC) reiterated a commitment to eliminating Covid-19 at a press conference on Saturday, warning the situation was set to become even "more severe and complex" as the country entered the winter flu season.

"Over the weekend China authorities reaffirmed a commitment to their zero Covid policy stance. This follows the recent increase in the reported number of infections, which on Sunday rose to the highest level since May. Latest economic data for China showed a smaller-than-expected rise in the country’s trade surplus as weak global demand weighed on exports," says a note from Lloyds Bank at the start of the week.

The New Zealand Dollar has given back some of the previous gains in sympathy of the official pushback to the previous week's rumours.

(If you are looking to secure your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

China is New Zealand's largest trading partner and the New Zealand Dollar often trades as a proxy for investor sentiment towards China.

The Pound experienced its largest weekly drop since 2016 against the New Zealand Dollar last week amidst rumours China was looking to ease its zero-Covid policy and after the Bank of England disappointed investors with an intensely 'dovish' monetary policy update.

Above: GBP/NZD at daily intervals. To better time your payment requirements, consider setting a free FX rate alert here.

"The NZD and AUD were almost 3% higher, helped by the surge in the CNH and broader optimism around China," says Nick Smyth, an economist at BNZ. "On the week, the NZD was the top performing currency".

"The GBP was by far the weakest currency on the week, down over 2%, reflecting the Bank of England’s dovish messaging at its monetary policy meeting, with Governor Bailey saying the Bank thought the market was overpricing the likely extent of tightening," he adds.

Near-term the Pound could retrace some of the losses given the already hefty negative sentiment that hangs over the currency, although it looks set to experience a soft November, according to analysts we follow.

The New Zealand Dollar could meanwhile see its recent outperformance fade as the China reopening theme is challenged by authorities, suggesting it might only be 2023 when a broader reopening occurs.

Given rumours of the demise of zero-Covid are now 'in the price' it is hard to see how this theme can offer material gains.

"The NZD enjoyed some buying interest last week, predominantly driven by IMM flows. Our FX flow data points at banks and real money investors inflows, as well as corporates and hedge funds outflows. All in all, the NZD is now in overbought territory," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole.

For the NZD's rally to restart with gusto, we would likely need to see some official announcements from authorities.

For GBP/NZD it therefore now appears the levels located around 2.0 are unlikely to retested near-term and that some time spent towards the middle of a multi-year range centred around 1.93 is likely.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes