New Zealand Dollar Powers Ahead Aided by Chinese Sentiment Surge

- Written by: Gary Howes

Image © Adobe Stock

The New Zealand Dollar and other Asia-focussed currencies were boosted into the weekend on fresh reports that China was looking to loosen its strict zero-Covid policy stance.

A strong performance by Chinese equity markets was reflected in the outperformance of the Australian and New Zealand Dollars, two G10 currencies that have traditionally enjoyed a positive correlation with sentiment towards China.

Dr Guang Zeng, a former Chinese Center for Disease Control and Prevention (CDC) senior official, caused excitement in Chinese markets when he said he expects "substantive changes" to the current zero-COVID policy soon, predicting they will come "before spring."

The comments were made at a conference hosted by U.S. bank Citi.

"More public comments by officials and a shifting narrative that supports eventual reopening are a clear positive signal for reopening," says Mark Haefele, Global Wealth Management Chief Investment Officer at UBS AG.

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes

A Chinese economic rebound linked to a full reopening would benefit the economies of Australia and New Zealand, which depend heavily on Chinese trade.

It was also reported on Friday that China is working on plans to scrap a system that penalises airlines for bringing virus cases into the country.

According to a report, China's State Council, which oversees the country's bureaucratic processes, recently asked government agencies including the civil aviation regulator to prepare for ending the so-called circuit-breaker mechanism.

This is particularly relevant for New Zealand whose education sector benefits notably from Chinese students.

Friday's news follows on from reports out earlier this week that a new body was being set up to oversee the country's exit from zero-Covid.

Stocks rallied sharply on the rumours, as did currencies linked to Chinese economic performance.

In the wake of the latest developments the New Zealand Dollar rallied two-thirds of a percent against the U.S. Dollar to 0.5803.

Gains of a third of a percent were recorded against the Pound, with the Pound to New Zealand Dollar exchange rate quoting at 1.93, taking bank transfer rates to approximately 1.8759 and those at competitive independent payment providers to around 1.9240.

The New Zealand Dollar recovered during the course of October following significant declines registered in September.

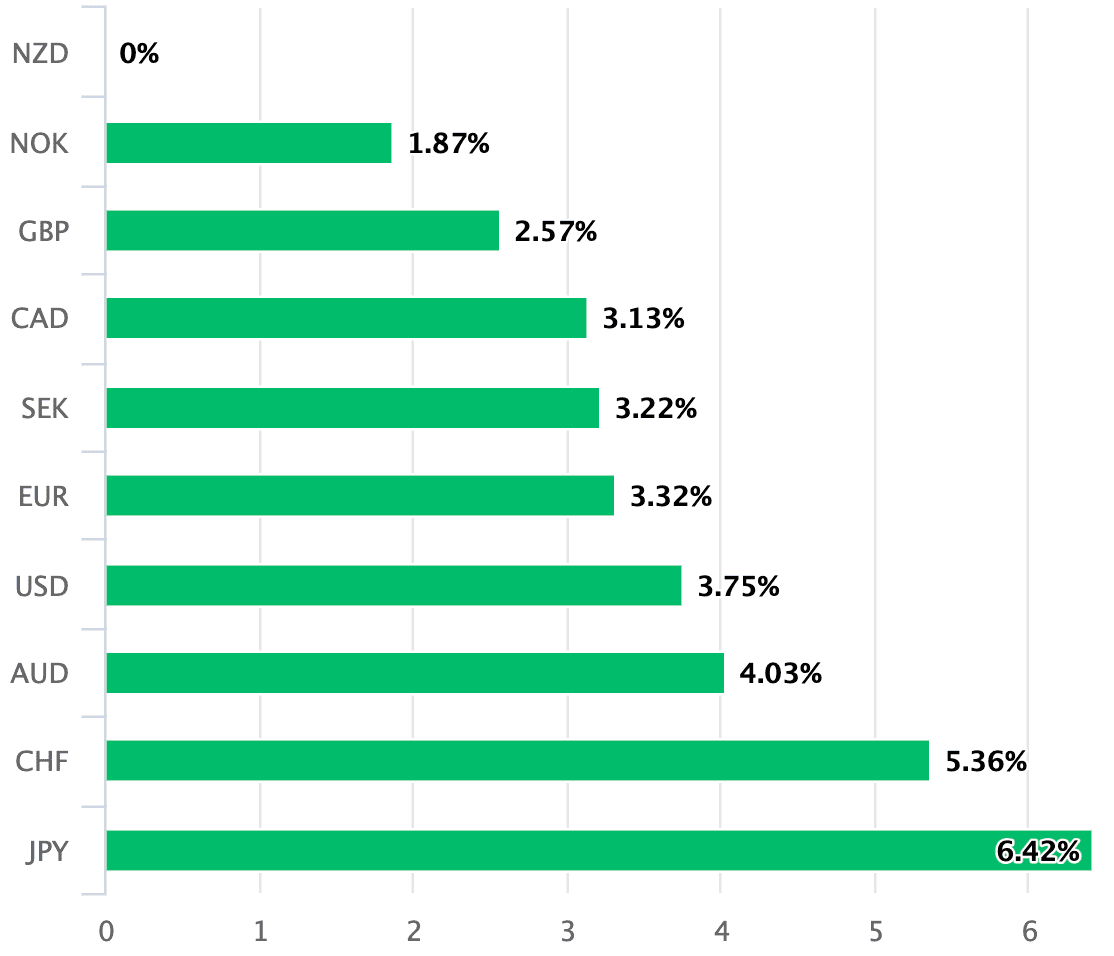

According to the performance dashboard, the Kiwi is in fact the best-performing major currency of the past month, thanks in part to the Reserve Bank of New Zealand's 'hawkish' tilt at its October policy update.

Above: NZD performance over the past month. To better time your payment requirements, consider setting a free FX rate alert here.

"The NZD outperformed, supported by the more hawkish RBNZ policy update, the lift in risk appetite and some month-end buying on NZGB’s inclusion in the WGBI," says Jason Wong, analyst at BNZ.

Looking ahead, Wong sees further outperformance by the New Zealand Dollar, particularly against the Pound:

"The combination of an energy crisis and fiscal austerity under the new government suggests tough economic times ahead," says Wong of the Pound's prospects.

"The policy outlook is still fluid and the outlook for the cross is uncertain," he adds.

BNZ's projections assume more New Zealand Dollar upside against the Pound "than downside from here."

(If you are looking to secure your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

Compare GBP to NZD Exchange Rates

Find out how much you could save on your pound to New Zealand dollar transfer

Potential saving vs high street banks:

NZ$5,350

Free • No obligation • Takes 2 minutes