Pound / New Zealand Dollar Rate Could Near 2.06 in Any Risk Averse Market

- Written by: James Skinner

- GBP/NZD remains buoyant in risk averse market

- Supported above 2.0220 & could approach 2.06

- If global market losses curb NZD/USD’s recovery

- Geopolitics & UK inflation in focus ahead of RBNZ

Image © Adobe Stock.

The Pound to New Zealand Dollar exchange rate uptrend could be set to extend over the coming days, with levels close to 2.06 possible if risk aversion blights global markets again and continues to weigh on the Kiwi currency, which was dealt a setback early in the new week.

New Zealand’s Dollar attempted to stabilise on Tuesday after opening the new week on the back foot alongside risk assets across the globe after Washington and other Western capitals sounded an alarm about the build-up of Russian military equipment and personnel along the Ukrainian border.

“The main channels through which we would likely be affected are oil prices and risk aversion, which can hit the NZD (increasing the pain at the pump), equities and credit spreads. Both Russia and Ukraine are significant exporters of energy, which has already become a significant source of inflation pressure and production bottlenecks, particularly in Europe and China,” says David Croy, a strategist at ANZ.

Speculation in U.S. and international media suggests a further incursion into Ukraine could begin from Wednesday, although White House officials have denied having any specific evidence to suggest this is the case and Russian representatives have also called the claims "empty and unfounded."

Nonetheless, the Kiwi and many other currencies would be vulnerable in the event of any further flare up in tensions, an outcome that could potentially lift the Pound to New Zealand Dollar rate briefly above the 2.06 handle, which would be its highest level since May 2020.

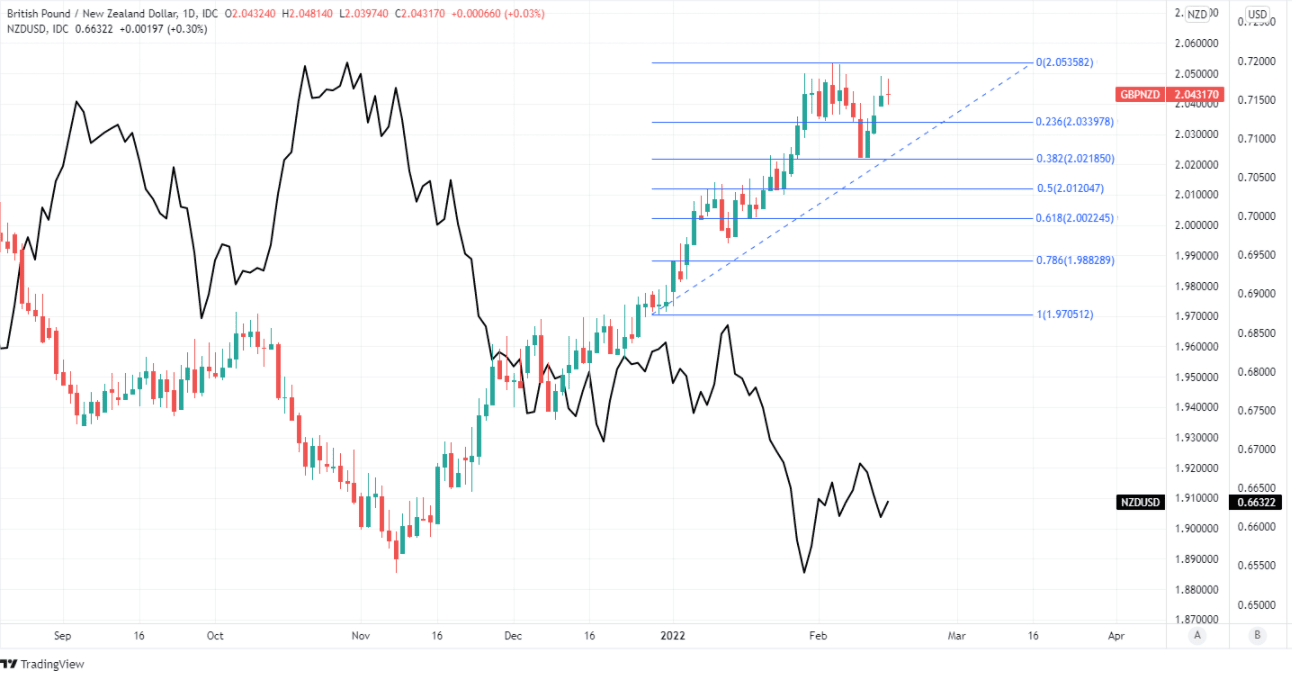

Above: GBP/NZD shown at daily intervals with Fibonacci retracements of late December’s extended rally indicating possible areas of technical support for Sterling, and shown alongside NZD/USD.

- GBP/NZD reference rates at publication:

Spot: 2.0444 - High street bank rates (indicative band): 1.9728-1.9872

- Payment specialist rates (indicative band): 2.0262-2.0342

- Find out about specialist rates, here

- Set up an exchange rate alert, here

“The Kiwi is moving with the ebb and flow of global sentiment, and is unlikely to become domestically focussed until next week’s MPS. NZ’s burgeoning COVID case load does actually seem to be weighing on Kiwi sentiment, but more at the edges than the core,” ANZ’s Croy and colleagues said Tuesday.

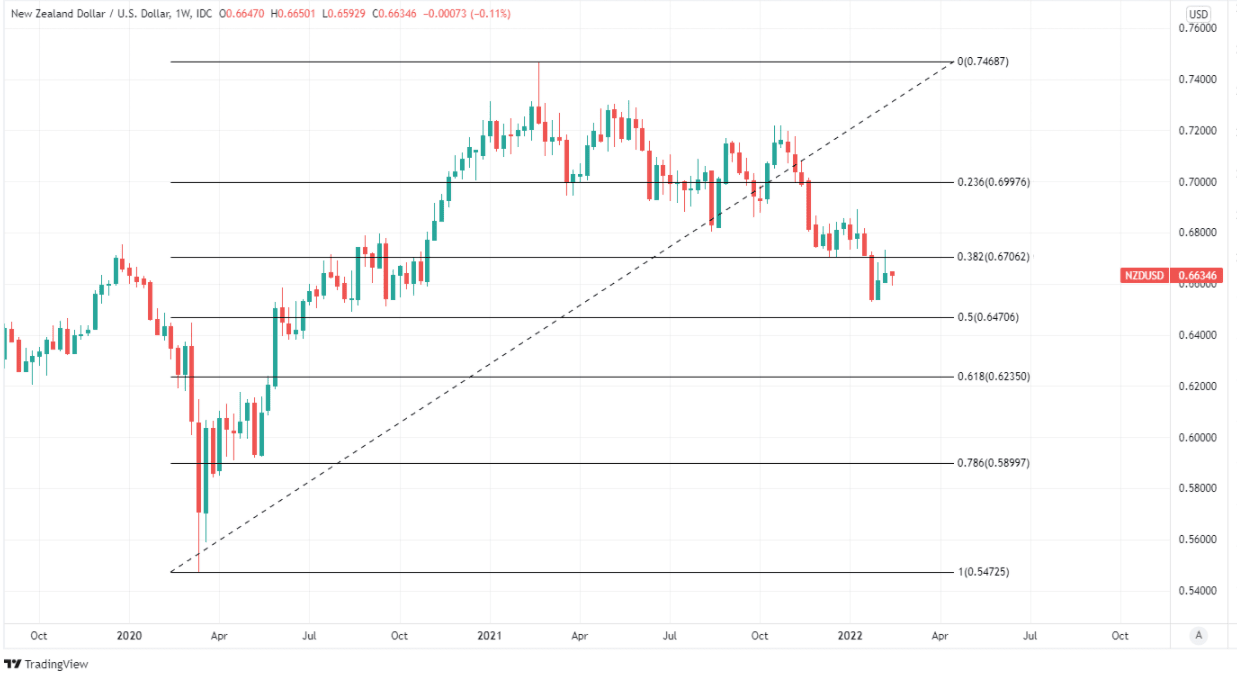

The main Kiwi exchange rate NZD/USD tends to fall further and faster than its Sterling equivalent GBP/USD during periods of market risk aversion - and vice versa - while these two exchange rates are together the primary drivers of GBP/NZD.

GBP/NZD tends to closely reflect the relative performances of GBP/USD and NZD/USD but often demonstrates a negative correlation with the latter, hence why Sterling advanced into Tuesday after NZD/USD abandoned last week’s attempt at recovery.

“Minor support at 0.6600 has held twice this month, but Ukrainian developments and the acceleration in NZ’s covid cases this week weigh. In addition, today’s REINZ report showed the housing market is starting to cool amid higher mortgage rates,” says Imre Speizer, head of NZ strategy at Westpac.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

“Medium term, while the NZD should retain solid fundamental backing, it is likely to be dominated by USD developments. We see potential for another significant rally in the USD once the Fed cycle is underway, which could push NZD/USD back down to 0.6500,” Speizer and colleagues said on Tuesday.

Tuesday’s global markets were calmer than Monday’s while U.S. Dollar exchange rates were lower across the board in what was favourable price action for NZD/USD, which would potentially push GBP/NZD back toward an important technical support level around 2.0220 if it persists.

For both pairs much depends this week on developments around Ukraine but the Pound to New Zealand Dollar rate will also be sensitive to Wednesday’s January inflation figures from the UK, which could potentially reinforce market expectations of the Bank of England (BoE) for the months ahead.

“NZD/GBP broke below 0.49 [GBP/NZD above 2.0408] yesterday. Short term price is still weak; a break below the 2022 low of ~0.4860 [GBP/NZD above 2.0576] would be a bad sign technically,” says ANZ’s Croy.

Above: NZD/USD shown at weekly intervals with Fibonacci retracements of 2020 rally indicating likely areas of medium-term technical support for Kiwi.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Financial markets have come to expect an increasingly aggressive pace of interest rate rises from the BoE, which has been supportive of Sterling in recent months and could remain so this week even if this ultimately sees some investors left disappointed at various points in the months ahead.

The week ahead is devoid of major events in the New Zealand calendar although the Kiwi currency faces two-way risks next Wednesday when the Reserve Bank of New Zealand (RBNZ) announces its latest interest rate decision and economic forecasts.

“NZD/USD risks remain skewed to the downside in our view. However, substantial falls are unlikely and we expect 0.6531 will prove a strong support level. Interest rate markets are pricing similarly aggressive tightening by both the RBNZ and the FOMC over the remainder of 2022,” says Kim Mundy, a senior economist and currency strategist at Commonwealth Bank of Australia.

“Nevertheless, there remains a risk of further NZD weakness if expectations for FOMC tightening sparks another equity market sell-off. There are no policy-relevant data releases scheduled in New Zealand this week. An invasion of the Ukraine would put AUD/NZD under pressure given AUD’s greater positioning,” Mundy and colleagues said on Monday this week.