Pound / Euro Rate at Risk of Setback from BoE in March

- Written by: James Skinner

- GBP/EUR at risk of setback this March

- If BoE prompts November style upset

- With patient approach to 3rd rate rise

Image © Adobe Images

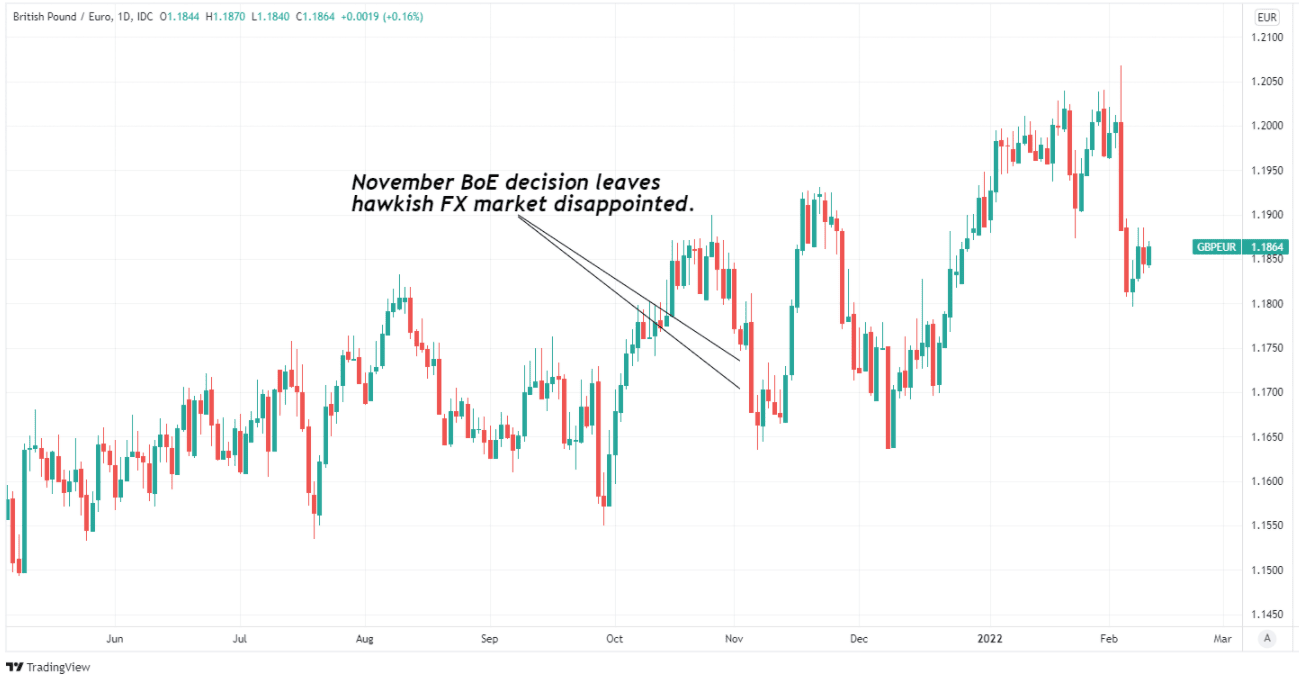

The Pound to Euro rate has benefited significantly from the ‘hawkish’ stance of Bank of England monetary policy but a growing list of indications suggests the BoE could upset market expectations at least once in the months ahead, which would risk another November style setback for Sterling.

Pound Sterling recovered its footing against the Euro during the opening half of the week after sustaining heavy losses in the wake of February’s monetary policy decisions from the BoE and European Central Bank (ECB) last Thursday.

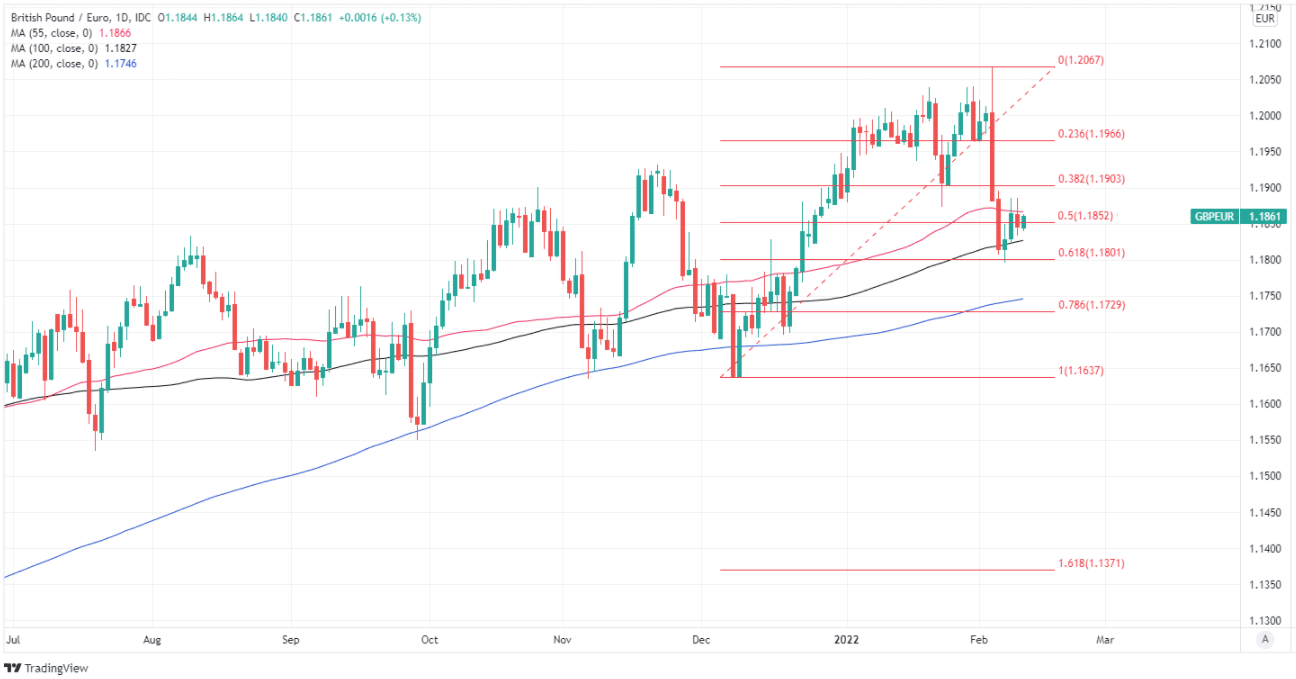

GBP/EUR steadied above a cluster of technical supports located around the 1.18 handle on Monday before rebounding through much of the week but risk of a further setback remains and will grow by the day as the March 17 policy decision of the BoE draws nearer.

“BoE communication after the near-miss on 50bps has been more dovish than one might expect. They seem to be worried about hiking into weakness, and they are keen to impress upon the market that this may or may not be the start of a true rate hike cycle,” says Brent Donnelly, president at Spectra Markets and a veteran currency trader.

"That third week of March is going to be pretty epic. I have added the 0.8550 digi [EUR/GBP FX option trade idea] to the sidebar. I think it’s a 4.5-star idea (higher conviction than average)," Donnelly wrote in a Wednesday note to subscribers.

Above: GBP/EUR shown at daily intervals with Fibonacci retracements of December rally indicating possible areas of technical support for Sterling. Major moving-averages indicate possible support and resistances.

- Reference rates at publication:

GBP to EUR: 1.1861 - High street bank rates (indicative): 1.1550 - 1.1632

- Payment specialist rates (indicative: 1.1757 - 1.1805

- Find out more about specialist rates and service, here

- Set up an exchange rate alert, here

Donnelly told subscribers on Wednesday that one of his top trades for the weeks ahead is buying EUR/GBP, which is equivalent to selling the Pound-Euro rate, ahead of a March 17 interest rate decision from the BoE that has the potential to cause an upset for Sterling.

This is after the chief economist Huw Pill appeared to disapprove of the market’s assumptions for the BoE’s Bank Rate, particularly around how quickly it would be likely to rise further during the months ahead, in a speech at the Society of Professional Economists conference on Wednesday.

“The considerations I have outlined in this talk help to explain why I voted with the majority on this occasion. First, I am sceptical of efforts to return Bank Rate quickly to some predefined neutral level or terminal rate, given the inevitable conceptual and empirical uncertainty surrounding such a level or rate. As we have seen, such an approach risks increasing inflation and output volatility if policy is mis-calibrated,” Pill told the audience.

“Better to adopt a more measured and data-dependent approach, which learns from how the economy responds to each step taken rather than pre-commits to a concept surrounded by uncertainty. This is likely to produce a steadier, more persistent and more purposeful path for policy rates. Second, I worry that taking unusually large policy steps may validate a market narrative,” he also said in concluding remarks.

{wbamp-hide start}

{wbamp-hide end}{wbamp-show start}{wbamp-show end}

Pill was one of five on the nine seat Monetary Policy Committee who voted last Thursday to lift Bank Rate from 0.25% to 0.50% when a four member minority on the committee had voted to lift the benchmark for borrowing costs by a larger increment that would’ve left it sitting at 0.75%

He seemed to argue on Wednesday that the BoE should be patient in its approach to raising Bank Rate, taking account of incoming UK economic data along the way and its implications for the inflation outlook, rather than mindlessly following the steep path envisaged by financial markets.

This echoes the sentiments expressed by Governor Andrew Bailey at last Thursday’s press conference and may even reflect the view of the majority on the BoE’s Monetary Policy Committee, which would indicate there’s a risk of the market being left disappointed by next month’s policy decision.

“I think there is a strong case in my own view for taking a step, observing what happens, observing what evidence we've got coming in, whether we're seeing a few turning points on things or not, and then we will come back together again and do it all over again. But you can take two views,” Governor Andrew Bailey said in response to a question from Bloomberg News.

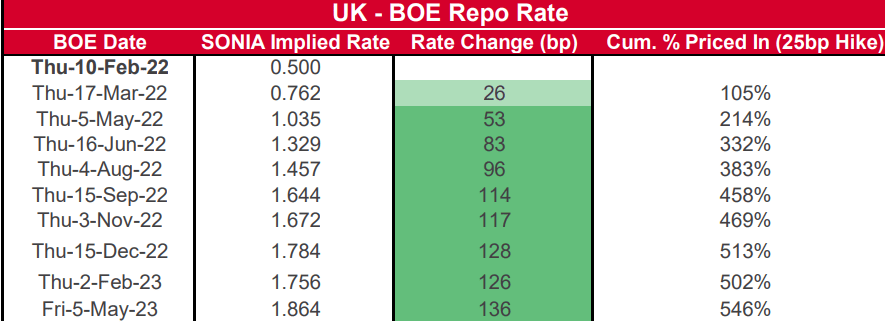

Above: Overnight Indexed Swap market expectations for BoE’s Bank Rate at each meeting date.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Last Thursday’s interest rate rise was the second consecutive step by the BoE to withdraw the monetary support provided to the economy at the onset of the coronavirus crisis, which has led financial markets to wager confidently that the bank would be likely to lift its interest rate another five times over the coming year or so including in each of its next three monetary policy decisions.

“The BoE’s Monetary Policy Report (MPR) was released as the Bank announced its 25bps rate rise and outlined a benign profile for inflation, after remaining above target into end 2023. A key assumption in this profile is that demand growth will slow due to higher energy prices crimping aggregate real income while fiscal and monetary support are reduced,” says Tim Riddell, a London-based senior markets strategist at Westpac.

The potential rub for Sterling is that last week’s second rate rise was only announced after a one month interlude through January and the most recent remarks of Governor Bailey and chief economist Huw Pill suggest there may be a preference on the Monetary Policy Committee to observe incoming economic developments before acting further.

To the extent that this is correct it could mean that next month will see Sterling and financial market participants exposed to the risk of disappointment given that pricing in the overnight-indexed-swap market indicated this Thursday that investors and traders see the BoE as certain to raise Bank Rate again as part of its March 17 monetary policy decision.

Above: Pound to Euro exchange rate shown at daily intervals.