New Zealand Dollar Forecast: ANZ says Beware of Disappointment in 2022

- Written by: Gary Howes

Image © Adobe Stock

The New Zealand Dollar's fortunes in 2022 will rest heavily on how fast the Reserve Bank of New Zealand pursues higher interest rates, and given elevated expectations there is ample scope for disappointment says ANZ.

The antipodean lender says the New Zealand Dollar has "lofty expectations" with regards to RBNZ hikes and there is a risk the central bank moves slower than the market anticipates.

"As a global leader in the post-pandemic reflation cycle and expectations for policy normalisation, the fortunes of the NZD rest on the strength of the domestic economy," says Daniel Been, Head of FX and G3 Research at ANZ.

In a year-ahead currency forecast Been and his colleagues recognise the market is expecting the RBNZ to deliver a substantive 200bpt of hikes.

"So far, there is little to indicate that market pricing has moved too quickly, with New Zealand facing some of the strongest capacity constraints since the 1970s," says Been.

He says labour supply constraints are translating into growing pressure on wages and multi-decade highs for core inflation. "The breadth of these inflationary pressures is expected to push the RBNZ into 150bp worth of hikes in just six months," says Been.

"However, the RBNZ could end up facing a tough trade-off between supporting growth and controlling inflation," he adds.

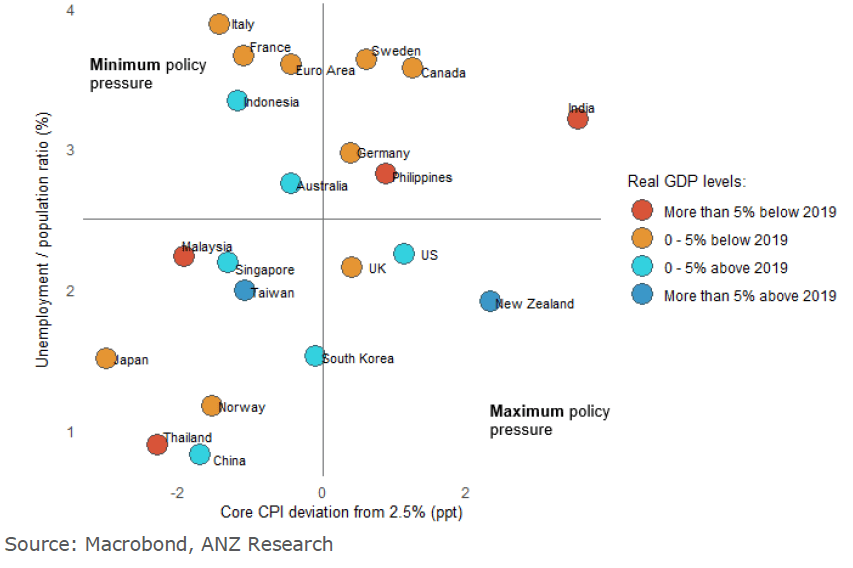

Above: "Domestic policy pressure will remain front of mind" - ANZ.

- GBP/NZD reference rates at publication:

Spot: 1.9680 - High street bank rates (indicative band): 1.8990-1.9128

- Payment specialist rates (indicative band): 1.9500-1.9580

- Find out about specialist rates, here

- Set up an exchange rate alert, here

- Book your ideal rate, here

The RBNZ hiked interest rates in November and guided that further hikes were likely on the horizon that could ultimately take the OCR to as high as 2.61%.

The RBNZ said lockdowns during the third quarter had resulted in a sharp contraction in economic activity, but underlying economic strength nevertheless remained supported by aggregate household and business balance sheet strength, fiscal policy support, and strong export returns.

The RBNZ's own projections suggest a substantial amount of tightening will be required over the next couple of years to bring inflation to heel.

But, "with the long lag involved with monetary policy operations, there is a risk that the RBNZ will move more slowly than anticipated," says Been.

"With so much priced into the New Zealand curve, disappointment is also a risk for the currency," he adds.

ANZ finds says a growing yield advantage will provide some downside protection, but there is a lot of good news already in the price.

"This leaves us with a relatively flat forecast over the course of 2022, with the NZD likely to fluctuate around the USD 0.72 mark," says Been.

ANZ's point forecasts for the GBP/USD rate are set at 1.35 for the end of the first and second quarters of 2022, with 1.36 set for the end of the third quarter and 1.37 for year-end.

This gives a Pound to New Zealand Dollar cross forecast for 1.88 by the end of the first and second quarters, 1.89 for the end of the third quarter and 1.90 for the end of 2022.