New Zealand Dollar Sold on 'Restrained' RBNZ Hike

- Written by: Gary Howes

Above: RBNZ Governor Adrian Orr. File Image © Pound Sterling, Still Courtesy of RBNZ.

Central bank interest rate hikes are supposed to deliver gains for their currency, according to the foreign exchange playbook.

Of course the reality is more nuanced, as per the case of the falling New Zealand Dollar following the decision of the Reserve Bank of New Zealand (RBNZ) to raise interest rates by 25 basis points.

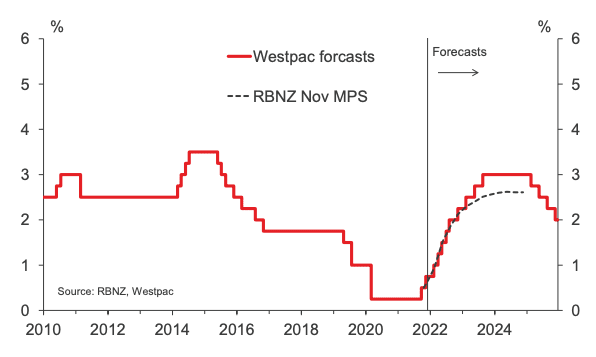

The RBNZ hiked rates as expected and guided that further hikes were likely on the horizon that could ultimately take the OCR to as high as 2.61%.

The most obvious explanation for the currency's loss of value is that a rate hike was fully expected, therefore investors were able to buy and sell financial assets - the currency included - in the weeks and days preceding the actual decision.

This confirms the more reliable rule in the foreign exchange playbook to be that it is surprises that move currencies more than anything.

Above: GBP/NZD daily chart.

- GBP/NZD reference rates at publication:

Spot: 1.9360 - High street bank rates (indicative band): 1.8682-1.8818

- Payment specialist rates (indicative band): 1.9186-1.9263

- Find out about specialist rates, here

- Or, set up an exchange rate alert, here

"As universally expected by domestic analysts, the RBNZ today raised the Official Cash Rate 25bp to 0.75% and indicated that they think they have a lot more work to do yet," says Sharon Zollner, Chief Economist at ANZ.

Pound Sterling Live reported on Tuesday in a pre-RBNZ piece that the RBNZ would only likely trigger gains in the New Zealand Dollar if a more strident 50 basis point hike was delivered.

This was because market pricing showed the odds of 50 point move had been falling in likelihood over recent days, raising its 'surprise factor' potential.

Analysts said that a 25 basis point move would either be met with a flat reaction or losses, a view that looks to be correct.

"The fact that the RBNZ went for a 25bp hike led to some pullback in markets, with a sharp drop in short-term interest rates and a modest fall in the New Zealand dollar," says Michael Gordon, Acting Chief Economist at Westpac.

The Pound to New Zealand Dollar exchange rate has fallen by two-thirds of a percent to 1.9357, thereby extending November's rebound.

The New Zealand Dollar to U.S. Dollar exchange rate fell by a similar margin to 0.6909, extending the November downtrend.

The RBNZ said Q3 lockdowns had resulted in a sharp contraction in economic activity, but despite these lockdowns, underlying economic strength remains supported by aggregate household and business balance sheet strength, fiscal policy support, and strong export returns.

It said capacity pressures have continued to tighten and therefore more interest rate rises were necessary.

"While it decided against a larger 50bp move this time, its projections suggest a substantial amount of tightening to do over the next couple of years to bring inflation to heel," says Gordon.

Image courtesy of Westpac.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

Nick Tuffley, Chief Economist at ASB says the market focus is increasingly turning to: how far will the OCR eventually go.

A higher plateau for interest rates implies greater returns for investors in New Zealand monetary assets in the longer-term, thereby increasing their attraction.

ASB says financial markets had recently been pricing in an OCR peak of around 3%, therefore, the 2.6% end-point guided by the RBNZ will have disappointed against more hawkish assumptions in the market, resulting in some NZ Dollar weakness.

Despite some pull back in pricing today markets are still factoring the OCR goes up further than the RBNZ’s latest forecast.

ASB are still forecasting a 2% OCR peak.

Image courtesy of ASB.

"We are mindful, though, that borrowers could prove quite sensitive to rising interest rates, and that the RBNZ may avoid being too dogmatic in the future about swiftly driving inflation back down to 2%. Moreover, the RBNZ has a lot of good news baked into its near-term outlook," says Tuffley.

As such, he sees the market as "pretty richly priced for good news", which makes the certainty of fixing the cost of borrowing as coming with a price.

It also implies the potential upside for the New Zealand Dollar on the RBNZ rate hike story might be reaching its limits.

The key message from Governor Adrian Orr was that the approach to raising interest rates would be a gradual.

He said in a press conference that the Committee did consider a 50 basis point rate hike, but it was decided to take a more gradual approach.

This would be to account for high levels of household debt and the hit to business and consumer sentiment from recent lockdowns.

Orr said the central bank intends to raise rates by 25 points at alternate meetings in 2022, but this path could be accelerated or decelerated depending on prevailing data and conditions.

"These rates hikes will be occurring while the RBA remains on hold, so we remain short AUD/NZD and continue to believe the cross will head towards parity in the coming year," says Valentin Marinov, Head of G10 FX Strategy at Crédit Agricole.