Credit Suisse Downgrade Pound Sterling Forecast Targets

- Quotes at time of publication:

- Pound to Euro exchange rate today: 1.0988

- Pound to Dollar exchange rate today: 1.2886

Above: David Davis, Michel Barnier (C) European Commission.

Credit Suisse have announced they have downgraded their forecast targets for key Pound Sterling pairs as they take into account the currency's ongoing run of weakness.

Analysts at the Swiss bank have identified a number of recent developments that point to a lower profile for the UK currency; including what they see as the UK’s new Brexit strategy which is of particular concern.

“Both economic and political developments in the UK argue for a still weaker currency, despite the fact that few market players are truly surprised by this trend,” says Bhaveer Shah at Credit Suisse.

At the start of August the consensus forecast for the Pound to Euro exchange rate for year-end 2017 was at 1.12. The decline below consensus has made many researchers uneasy while others are confident a recovery back towards the consensus figure will ultimately shape up.

Latest forecast must-reads:

- Morgan Stanley’s Parity Forecast

- Capital Economics say GBP/EUR to Recover, Don’t be too Pessimistic on Sterling

- Bank of America Strategically short on Sterling for Remainder of Year

- Lloyds cut Sterling Forecasts

Paying for its Cake to Eat it: A Worrying New Strategy on Brexit

It is certainly not a typically quite summer market for Sterling which is nearly 3% lower against the Euro over the past month alone and 1.27% lower against the Dollar in the same period.

The currency is trending particularly reliably against the Euro and politics over Brexit are largely to blame we are told.

“It seems that far from the UK ‘having its cake and eating it’ as UK Foreign Secretary Boris Johnson would like, it is paying for cake through lower purchasing power on the global stage,” says Shah.

Focus appears to be shifting once more away from the Bank of England meeting earlier this August towards another round of Brexit negotiations commencing on August 28.

The focus on Brexit comes as the UK publishes two position papers setting out their agenda concerning trade and the Irish border ahead of the next round of talks.

The papers were welcomed by the European Commission in a daily press briefing held on August 16.

Above: Initial European Commission response to UK's publication of position papers.

Nevertheless, the new strategy adopted by Westminster is of concern for Credit Suisse who suggest, “the UK seems to be taking a riskier Brexit strategy than we expected.”

The following are cited as being indicative of the UK pursuing a riskier Brexit strategy argues Shah:

1) UK Brexit Minister David Davis appears to have ruled out revealing a figure for a divorce bill at all this year (“there won’t be a number by October or November”).

“If this were to happen, this would clash with the EU’s most pressing priority for this year’s negotiations. In our view the risk of further delays to Brexit talks, or a rushed trade deal, are a GBP-negative development.”

We would counter this view by pointing out that surely the final settlement cost is wholly dependent on the final deal - i.e what if the UK were to pay into the EU budget for certain market access. It appears to us that it is in fact the EU that has cornered itself here.

We would suggest that the EU might be happy to accept a commitment in principle to a settlement being paid, and will rather seek to negotiate a framework from which both sides will arrive at the final amount once a deal nears.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

2) Credit Suisse economists believe both visions for a post-Brexit transitional customs arrangement published by the UK government on Wednesday ultimately mean added red tape, uncertainty, and complications for businesses in the years ahead.

“It seems unlikely the EU would agree to a transitional deal that sees the UK retain effective access to the Customs Union, but be nonetheless free to control migration and strike trade deals, without exacting a heavy price elsewhere.”

This is certainly true but we would caution that the UK could well allow free movement - but under a different name - covering the timeframe it envisages running the transitional period.

3) The Conservative party is a problem as May’s failed election gamble has not delivered the prospect of a softer Brexit. “If anything the allegiances of some trusted softer-Brexiteers may now become more debatable,” says Shah.

“The political calendar certainly poses risks to our forecasts in the weeks ahead; not just with rounds of EU negotiations in late August and late September, but also in the lead up to the October 2nd-4th Conservative Party conference too,” says Shah.

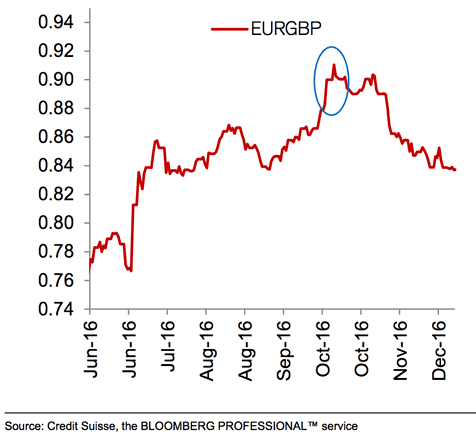

Above: 2016’s Conservative Party conference shifted the direction of EUR/GBP - could this be the case in 2017?

Other reasons to expect the trend lower in Sterling to continue include deeper cracks now becoming visible in UK data and a Bank of England that is in no mood to raise interest rates in the near future.

Data since the Bank of England's August inflation report have continued to disappoint against both the market and the BoE’s assumptions, with underlying trends being particularly negative as the one-off effects from 2016 increasingly phase out.

Credit Suisse economists interpret the August set of CPI data as adding to an impression of sidelining core inflation, easing import costs, and fading effects from the one-off Sterling shock over mid-2016.

Meanwhile, a recent mismatch between promising soft data (e.g., PMIs) and disappointing hard data (e.g., Q2 GDP growth) throws another challenge into the MPC’s hands argue Credit Suisse – “particularly because their own economic growth assumptions have so far been predicated on an efficient translation of the former into the latter.”

As seen in the chart above, UK hard data surprises have notably undershot UK soft data surprises over the last few months.

The trend differs notably from earlier this year; a time when many of the MPC’s hawks saw optimistic signs in the economy.

Of course, the trend could reverse and official data recovers sharply and provides some support for Sterling.

This is exactly what we saw with the most recent set of labour market figures which saw unemployment fall and wages rise faster than expected.

Forecast changes

Credit Suisse raise their EUR/GBP forecasts to 0.93 in 3 months and 0.94 in 12 months, from 0.90 previously.

This gives a lowering in GBP/EUR to 1.07 and 1.06 from 1.11.

This results in their implied GBP/USD forecast falling to 1.28 in 3 months and 1.30 in 12 months, from 1.32 and 1.35, respectively.

Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

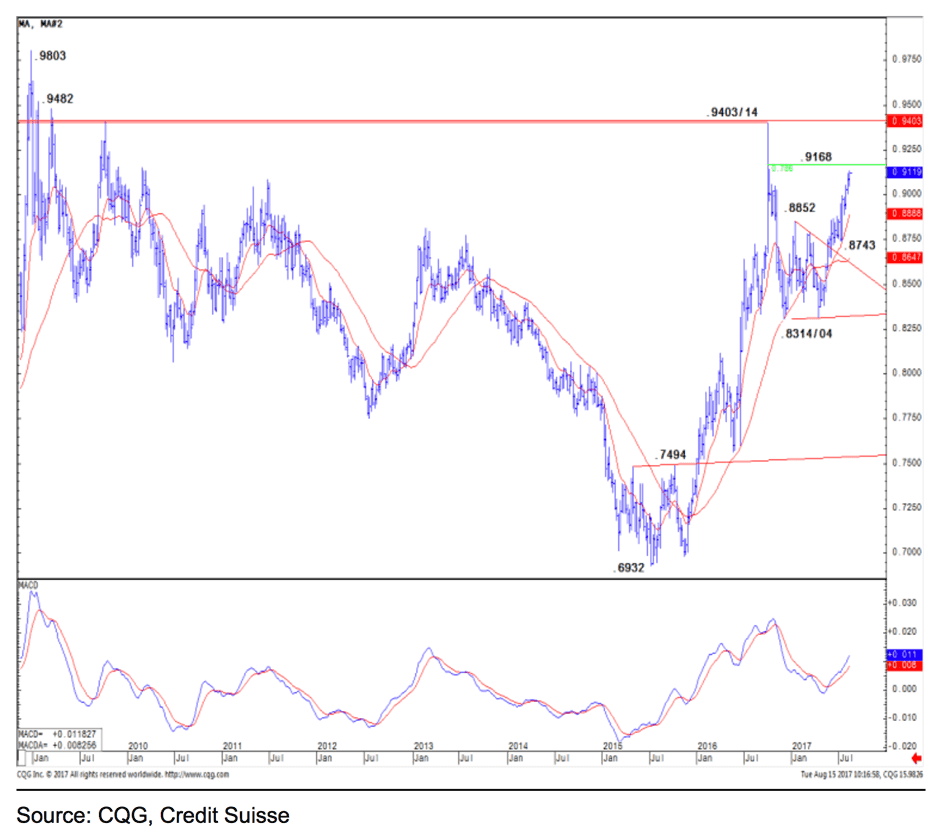

Technicals: Staying Bullish on the Euro

From a technical analysis perspective - this differs from the fundamental studies already discuss - the Euro looks like market momentum will likely send the Euro higher.

Credit Suisse’s technical analyst Christopher Hine says EURGBP has seen a strong rally since April this year and reinforced its large base set above 0.8852.

“This keeps the immediate risk still higher to test our next target at the 78.6% retracement of the October/December 2016 fall at 0.9142/68 next,” says Hine.

Should 0.9142/68 give way Hine warns there is a “price vacuum up until our core target at 0.9400/14.”

This is the measured objective from the base, and the October 2009 and 2016 spike highs.

“We would look for a ceiling here,” says Hine.

Note that the target at 0.94 gives us a Pound to Euro rate of 1.0633. So technicals and fundamentals appear to be aligned on this target.

Geopolitics: Europe's Battle with Terror Continues

Headlines will prove a distraction for markets on news of a major terror attack in Spain's Catalonia region.

13 people were killed in an attack in Barcelona after a van drove into crowds before five suspects have been shot dead as police intercepted a car that was running people down in the Spanish town of Cambrils.

A picture is emerging this morning of an apparently coordinated terror plot to hit multiple targets across the country’s Catalonia region.

"It was also a sea of red on European share market bourses. Investors showed favour for safer-haven assets like bonds, after a tragic terrorist attack in Spain," says Janu Chan, an economist with St. George Bank.