Pound Sterling a Sell as Nomura Sees a Consensus-Busting Downside Miss in UK Inflation Next Week

- Written by: Gary Howes

Image © Adobe Images

Jordan Rochester, a currency market strategist at Nomura, adds a short position on GBP/USD to his portfolio in anticipation of a consensus-beating fall in UK inflation expected to be announced next week.

Rochester, expressing a conviction level of 3 out of 5 for the 'short' Pound Sterling position, says "given the prevailing circumstances, we believe shorting GBP/USD is a prudent move at this time."

Rochester outlined several key factors that contribute to the bearish outlook on the currency pair.

"We have identified four primary reasons for our recommendation. Firstly, we anticipate a significant cooling of inflation in the upcoming week. Secondly, we have observed cracks appearing in the UK labour market. Thirdly, global growth expectations are declining. Lastly, GBP positioning is relatively clean, with real money slightly long GBP."

One major catalyst for the bearish view is the expected moderation of inflation in the UK.

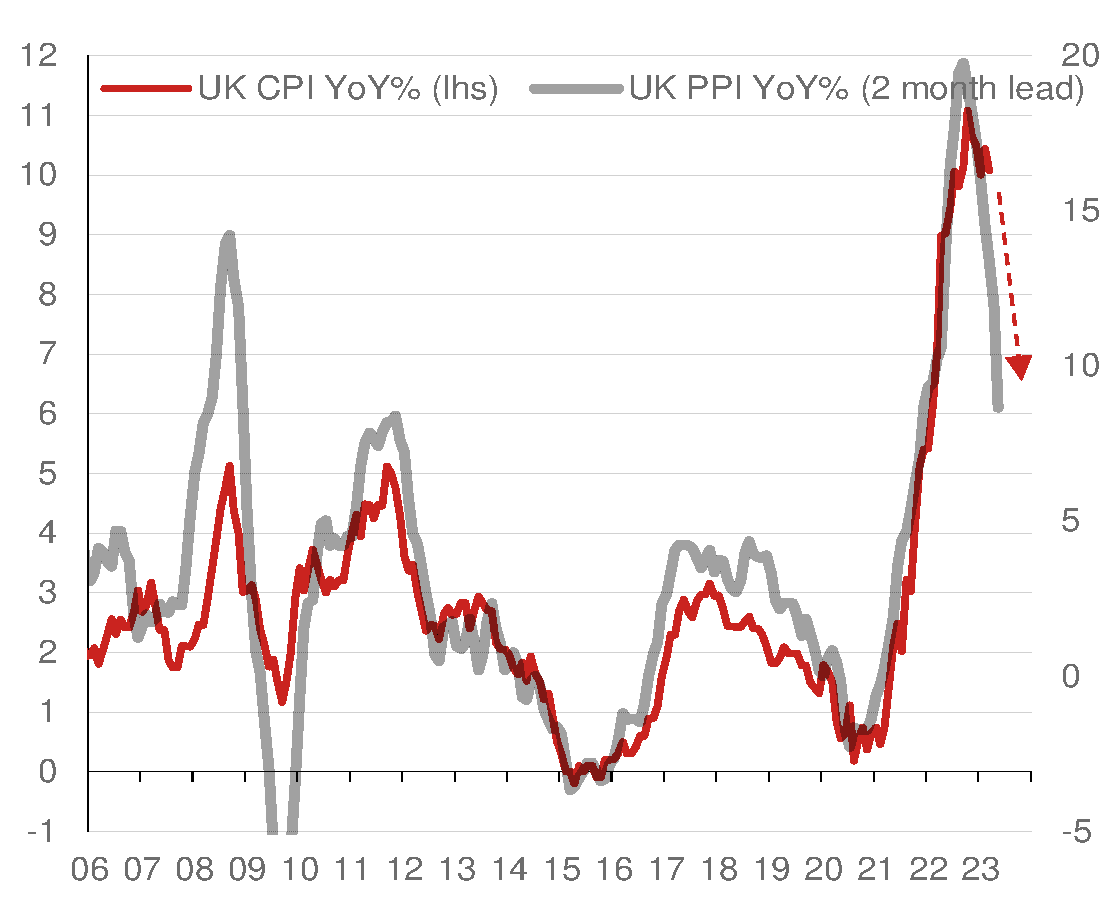

"Headline inflation has been in double digits for eight out of the past nine months. However, we anticipate a sharp fall in April, primarily driven by energy prices. Our projections suggest that headline CPI could drop from the current 10.1% to approximately 7.9% next week, which is below both the Bank of England's expectation of 8.4% and the consensus estimate of 8.0%," says Rochester.

Highlighting concerns in the UK labour market, Rochester said "this week's labour market report was weaker than expected, with a notable decline in payrolls, lower earnings momentum, and a faster pace of falling job vacancies.

"Additionally, job-to-job flows continue to ease, and the unemployment rate has increased. The surprising monthly decline of 136,000 PAYE numbers in April, the first since the start of 2021, aligns with the warnings from the REC survey in recent months."

Regarding global growth expectations, Rochester commented, "European and Chinese data surprises are in free fall, with indicators such as ZEWs, industrial production, factory orders, and retail sales reaching lows last seen during the depths of the COVID-19 crisis in 2020.

Above: UK inflation is expected to fall sharply from here. Image courtesy of Nomura.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

China's post-COVID recovery is meanwhile losing steam due to weak consumer and business investor confidence, creating risks of slower activity growth, rising unemployment, disinflation, falling market interest rates, and a weaker currency.

All this tends to support the U.S. Dollar, which is considered a 'safe haven' financial asset.

Examining market positioning, Rochester notes CFTC futures data to reveal 'real money' investors have significantly reduced their short positions in GBP/USD and currently hold net long positions.

Leveraged funds, on the other hand, maintain a slight net short position but have been less active in the FX futures space compared to real money investors.

Rochester also provided insights into other potential trades:

"We have been biased toward long EUR/GBP positions, expecting 0.90 in Q2. However, we have been waiting for the right moment as EUR/GBP has been on a downward path in May. If the CPI comes in weak next week, it may trigger an upward movement in EUR/GBP, potentially causing short GBP/USD positions to outperform short EUR/USD trades."

Nomura's short on GBP/USD targets 1.20 by mid-July.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks