Why the Bank of England will Go 50bp

- Written by: Gary Howes

Image © Adobe Stock

The Bank of England looms as the final major domestic event in the UK of 2023 and expectations are settling on a 50 basis point hike as policymakers look to ease off the accelerator.

Money market pricing shows investors are anticipating a 50bp hike, which aligns with economist expectations and means a repeat of the 75bp move in November will be avoided.

A number of factors have conspired to allow the Bank to go for 50 and not 75 this month:

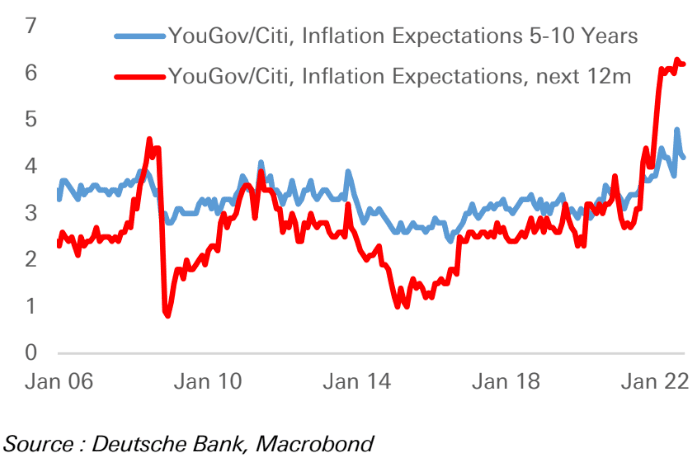

The Monetary Policy Committee (MPC) will feel emboldened to ease the tempo as it is becoming increasingly clear medium-term household inflation expectations have fallen, at least according to the much-watched YouGov/Citi inflation expectations monitor.

Above: "Household inflation expectations look like they have peaked" - Deutsche Bank.

"Some good news around softening inflation expectations and easing recruitment difficulties will allow the MPC to slow the pace of tightening, avoiding a second consecutive 75bps hike," says Sanjay Raja, Senior Economist at Deutsche Bank, who expects a 50bp hike on Thursday.

November's Citi/YouGov survey showed expectations for inflation in five to 10 years' time dropped to 3.9% in November from 4.2% in October, and well below the record 4.8% struck in August.

Between 2016 and 2020, when inflation was around the BoE's 2% target, these expectations averaged 3.0%.

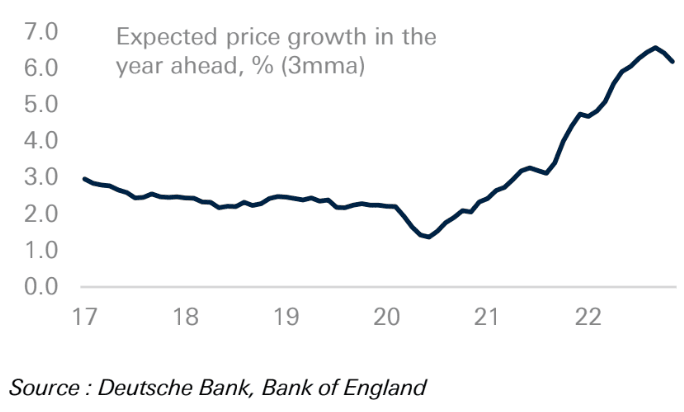

The November Decision Makers Panel (DMP) survey meanwhile shows firms' intentions to hike their prices are stabilising and starting to fall.

The survey is a key source of information the MPC consults when formulating policy.

Above: "The Bank's DMP survey highlighting a peak in price pass-through for the coming year" - Deutsche Bank.

Annual private sector output price inflation in the DMP was 7.4% in the three months to November, 0.2 percentage points lower than in the three months to October.

The single-month figure for November was 7.2%, down from 7.8% in October. Expected year-ahead annual output price inflation was 6.2% in the three months to November, down from 6.4% the previous month.

Other central banks are slowing down too, with the Reserve Bank of Australia this week hiking by 25 basis points and the Bank of Canada potentially having delivered their final hike.

But the Federal Reserve and European Central Bank are arguably more important from a financial system point of view and both are expected to decelerate their cycles to 50bp next week.

According to Bruna Skarica, UK and Scandinavian Economist at Morgan Stanley, coordination matters.

"All in all, the international context is also supportive of reverting to a 50bp hike next week," he says in a note detailing why his team anticipate a 50bp move on Thursday.

The lagged effect of monetary policy - i.e. the time between the hike and its impact on the economy - means the full impact of past hikes is yet to be felt.

The risk of hiking too aggressively on contemporary data is the Bank of England risks over-hiking and causing enduring structural economic damage.

"With monetary policy working with a lag of 18-24 months, the bulk of monetary policy tightening will have yet to filter through into the real economy," says Raja.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Economists are united in the belief the UK is entering a recession as inflation and interest rates impact activity and sentiment.

This would raise the prospect of the UK's labour market loosening and wage pressures easing, which would prompt domestic inflationary pressures to come off the boil.

"GDP fell in Q3, and activity indicators point to a slowing of the economy going forward. In fact, a recession may already have started. If it continues into next year, which is our forecast, we will likely also see a marked slowing of the labour market," says economist Knut A. Magnussen at DNB Markets.

Magnussen expects a 50bp move in December but like the majority of economists also anticipates further hikes from the Bank in 2023.

DNB expects the terminal Bank Rate level to be 4.0% and Morgan Stanley sees a similar level following a 25bp hike in February and a final move of 25bp in March.

Deutsche Bank sees a February hike of 50bps, followed by a 25bps move in March and May, taking the terminal level to 4.5%, putting them in line with market consensus.

Further rate hikes are expected because UK inflation remains elevated in double digits and core inflation, which is of greater concern to the MPC, was at 6.5% in October and therefore more than three times the mandated level.

Inflation will remain persistent says Raja, "we continue to see second-round effects in the inflation data. And we think inflation will remain a problem for the MPC for a little while longer."

The government's fiscal policy is meanwhile not expected to be anti-inflationary, although the headache presented by former Prime Minister Liz Truss' mini-budget has fallen away.

The government announced in the Autumn Statement it would look to ensure the country's debt starts to fall by cutting spending and raising taxes, which is a deflationary impulse that would take the pressure off the Bank to hike interest rates as aggressively as would be the case otherwise.

Indeed, expectations for the level of Bank Rate surged following Truss' ill-fated mini-budget as investors bet more tightening would be required of the Bank to cool the proposed inflationary tax cuts and spending boost presented by the energy support scheme.

Above: Rate hike expectations have fallen since the peak following the abandoned Truss budget. Image courtesy of Morgan Stanley.

But Prime Minister Rishi Sunak's plans see the bulk of the fiscal tightening falling towards the end of the coming five-year period.

"These changes are not set to start until 2024/25, which means fiscal policy tightening will not add to the expected recession next year. On the other hand, fiscal policy is unlikely to help the BoE in fighting inflation much either in the coming year and some further rate hikes hence seem necessary," says Magnussen.

From a currency market perspective, a 50bp hike would be neutral for Sterling.

What would likely be of more consequence is the guidance: if the Bank more or less confirms it is on course to take Bank Rate to 4.5%, in line with market expectations, the Pound would be supported.

But any pushback on this, as was the case at all previous MPC events in 2023, could result in some weakness.

However the degree of divergence between the market's expectations and the Bank's own plans appears to be narrowing, meaning the risk of a major surprise is greatly reduced compared to previous outings.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes