Canadian Dollar: BoC Goes 50bp, but it's a Yellow Card Offence

- Written by: Gary Howes

"The Bank of Canada flashed a yellow card on its rate hiking team" - CIBC.

Above: File image of BoC Governor Tiff Macklem. Image: Bank of Canada.

The Canadian Dollar fell in the hours after the Bank of Canada raised interest rates 50 basis and some of Canada's most prominent economists said this could be the last hike ahead of a pause.

Although a 50bp hike was expected it was not a sure-fire bet, which helped explain an initial knee-jerk rally in the local currency.

"The Bank of Canada hiked the overnight rate by 50 bps today, more than we and the market expected but in line with predictions by roughly half of analysts surveyed," says Marc Desormeaux, Principal Economist at Desjardins.

The overnight rate rises to 4.25% and the Bank Rate reaches 4.5%.

But gains for CAD ultimately proved short-lived amidst signals the Bank of Canada (BoC) is now prepared to slow the pace at which it raises interest rates.

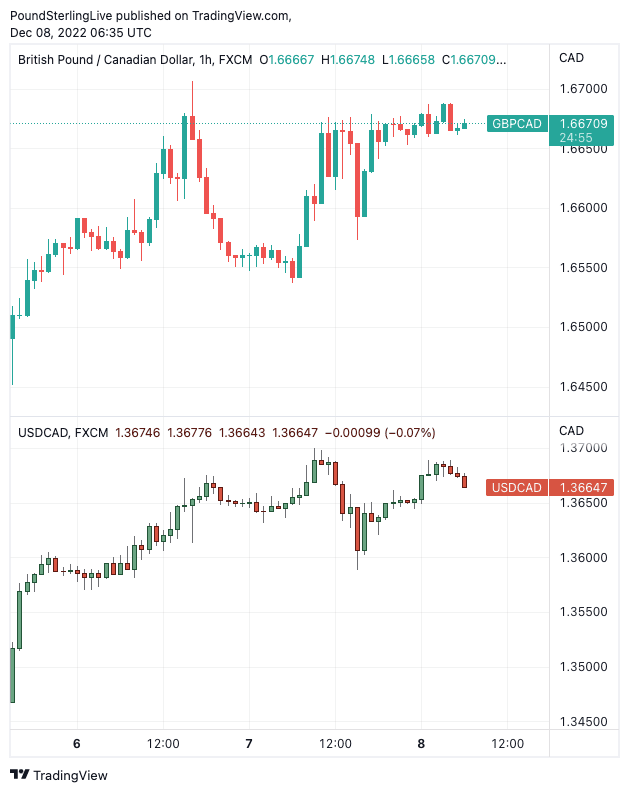

Above: GBP/CAD and USD/CAD (bottom) at one-hour intervals, showing post-BoC CAD strength proved fleeting. Consider setting a free FX rate alert here to better time your payment requirements.

In a statement, the BoC acknowledged previous rate hikes were impacting consumer demand and that the housing market was slowing.

"Tighter monetary policy is restraining domestic demand: consumption moderated in the third quarter, and housing market activity continues to decline," said the BoC.

But it added, "GDP growth in the third quarter was stronger than expected, and the economy continued to operate in excess demand. Canada's labour market remains tight."

Although there were signs of moderating inflation the BoC's ultimate assessment was "inflation is still too high and short-term inflation expectations remain elevated."

The Pound to Canadian Dollar exchange rate (GBP/CAD) fell a third of a percent in the thirty-minute window following the decision before paring those losses to 1.66. This takes bank transfer rates to around 1.6146, competitive cash and holiday money provider rates to around 1.6233 and competitive transfer provider rates to around 1.6560.

Against the U.S. Dollar, the Canadian unit was 0.20% stronger in the thirty-minute window as USD/CAD retreated to 1.3618.

But incoming post-match analysis suggests ultimately the market could read this as a CAD-negative event.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

CIBC Capital Markets says the BoC is readying to take its foot off the accelerator, in a similar fashion to colleagues at the Reserve Bank of Australia who raised rates by a smaller 25bp increment earlier in the week.

Both Australia and Canada have particularly highly leveraged property markets relative to the likes of the U.S. and UK and have placed emphasis on the sector when formulating policy.

"The Bank of Canada flashed a yellow card on its rate hiking team by sounding more cautious about its willingness to press on to even higher interest rates in 2023 even as it tightened today," says economist Avery Shenfeld at CIBC in Toronto.

Of note, previous statements concluded with a message that rates "will need to rise further," but December's conveys the BoC's committee will "be considering whether the policy interest rate needs to rise further".

"While the tightening cycle likely has reached its zenith, we’ll need the pain of these higher rates to persist for a while to stall economic growth and thereby cool inflation. While the market hadn’t fully priced in a 50 basis point move, the reaction to the larger hike will be tempered by the hint that a pause might be in the offing," says Shenfield.

"The Bank appears ready to pause its aggressive efforts to contain inflation soon, in respect of the cooling momentum in both price pressures and domestic demand. So, while this was more a hawkish rate move than we anticipated, the future course of monetary policy does not look dramatically different than we predicted," says Desormeaux.

National Bank of Canada says there’s a good chance that this hike will be the Bank’s last.

"Today’s decision was always bound to be a surprise to some given how evenly split the 25 vs. 50 bps rate hike debate had been leading up to this meeting. While the Bank opted for the more aggressive option, the statement reads dovishly to us," says economist Taylor Schleich at NBC's market's division.

The BoC’s first policy meeting in 2023 is set for January 25.

"The Bank is likely to let the data do the talking, which could set up a repeat of this recent inter-meeting episode, where no clear consensus on the Bank’s next move was formed," says Schleich.

Josh Nye, Senior Economist at Royal Bank of Canada, says the guidance provided by the BoC (Governing Council will be considering whether the policy interest rate needs to rise further) "clearly opens the door to a pause as soon as the next meeting in January".

RBC says the BoC will likely choose between a 0 and 25bp move.

(If you are looking to protect or boost your international payment budget you could consider securing today's rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes