Euro Would Gain against Pound and Dollar if ECB Surprises with a 50 Basis Point Rate Hike

- Written by: Gary Howes

Image © European Central Bank

A record April inflation reading for the Eurozone means the odds of an outsized 50 basis point rate hike at the European Central Bank before year-end has become more likely, a development that could underscore the Euro's ongoing rebound against the Pound and Dollar.

Eurozone inflation printed at a record 8.1% year-on-year in April according to data released this week, while core surprised by coming in at 3.8%, heaping pressure on the ECB to take a more proactive approach to interest rate hiking.

Currently the market is poised for a 25 basis point hike in July and again in September given the clear communication for such moves given by ECB President Christine Lagarde recently.

However, market bets for further hikes are ramping up as a result of the inflation readings, with nearly 120 basis points of hikes now expected by the market for 2022.

This means the prospect of a 50 basis point hike is growing given it would take more than four 25 basis points of hikes from July to December to meet the market's expectation.

According to currency analysts at Commerzbank, for Euro exchange rates to find added impetus the odds of such a 50 basis point move must increase.

"The euro was unable to benefit further from the data, as the market had already priced in an ECB rate hike of 25bp each in July and September. For the euro to find additional support there would have to be increasing signs that the ECB is hiking rates more quickly and that it might even be considering 50bp steps," says Antje Praefcke, FX and EM Analyst at Commerzbank.

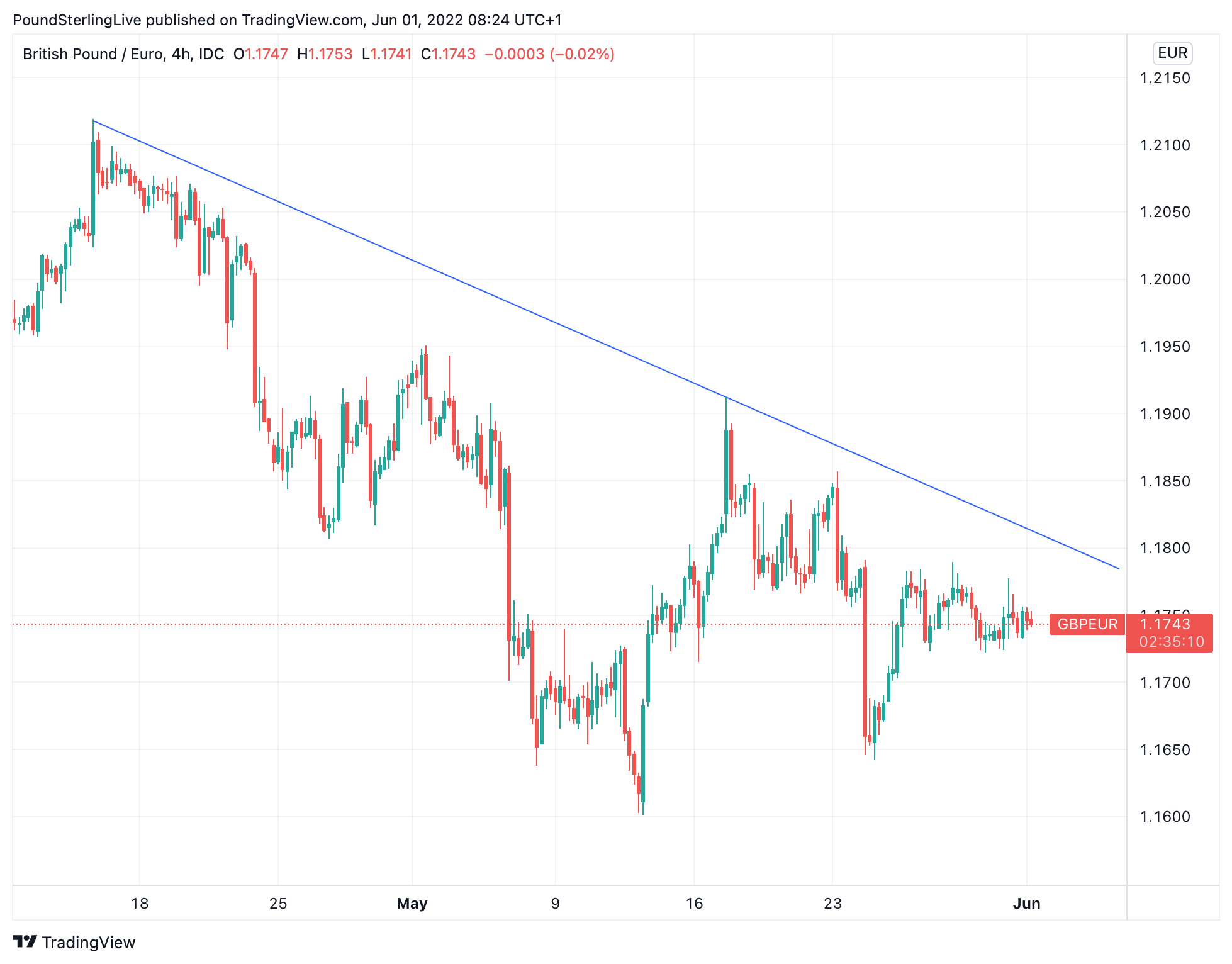

Further impetus in Euro exchange rates would pressure the Pound to Euro rate to extend an emerging near-term downtrend, which is clearly defined in the below 4-hour chart:

The ECB last hiked by 50 basis points in 2000 and the Commerzbank analyst says it is too soon to anticipate such a move from the current crop of policy makers.

"However, there are no signs of that happening as yet. Gradual rate hikes still seem to be the ECB Council's choice of action," adds Praefcke.

But Deutsche Bank has become the first major investment bank to officially call a 50bp hike in 2022.

Economists at the bank released their ECB preview ahead of next week’s meeting yesterday and say they expect the ECB to implement at least one 50bp rate hike by September.

They say a 50bp hike is more likely in September but there's a risk it comes in July, an outcome that would surprise consensus and potentially underscore a rally in the Euro.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Deutsche Bank's economists also believe the ECB will be underestimating inflation with their forecast updates at next week’s meeting, necessitating a bigger rate increase early in their hiking cycle.

They also expect the ECB to get rates 50bps above neutral by the middle of next year.

Stephen Gallo, European FX Strategist at BMO Capital, says the Euro should benefit from a permanent exit from Negative Interest Rate Policy at the ECB, but he sees reasons to remain cautious on the Euro in the short run for a variety of reasons.

These include the Eurozone economy running a rare current account deficit in the current environment of surging commodity prices, given the region is a net importer of energy.

This applies headwinds to the Euro's appreciation potential.

Concerns might also emerge as the yield paid on the debt of various Eurozone economies starts to diverge: for instance the yields paid on Italian government bonds vs German bonds is rising substantially faster, a sign of potential stresses.

"While it seems clear that the ECB's gradualism on policy normalisation is well understood by investors, the near-term path of inflation in Europe is likely to be a key driver of sentiment as 'stagflation risks' are assessed. So, our caution on EUR appreciation against a variety of G10 currencies remains in place for the time being," says Gallo.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes