New Records for European Inflation Stoke Debate Over ECB’s Policy Shift

- Written by: James Skinner

“Normalisation has a natural focus on moving in units of 25 basis points, so increases of 25 basis points in the July and September meetings are a benchmark pace. Any discussion about other moves would have to make the case for moving more strongly than this sequence of hikes in July and September,” ECB chief economist Philip Lane.

© European Central Bank, reproduced under CC licensing

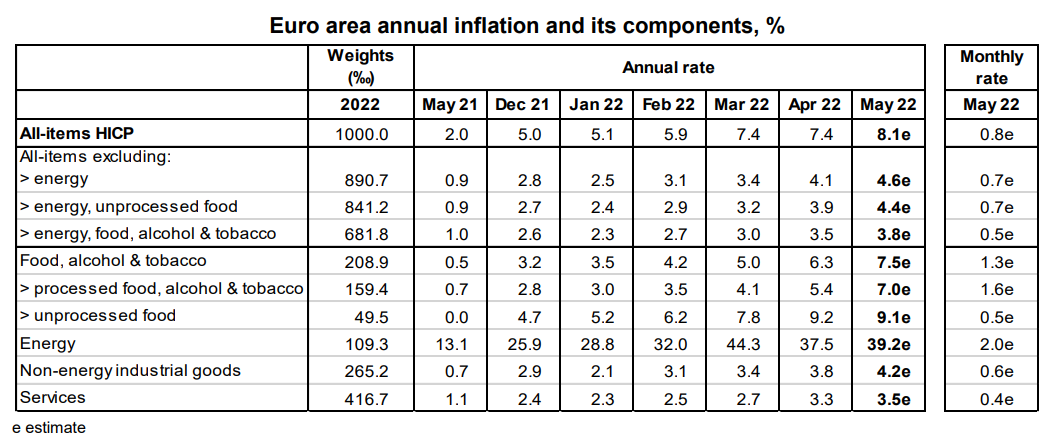

Europe’s inflation rates leapfrogged the market consensus again when climbing to new records for the month of May, vindicating in the process an shift in the monetary policy stance underway at the European Central Bank (ECB) but also likely adding fuel to an already impassioned debate.

Eurostat figures suggested on Tuesday that Europe’s main inflation rate rose from 7.5% to 8.1% this month, echoing increases announced in France and Germany during the prior session while leapfrogging a market consensus that had looked for annual price growth to reach only 7.7%.

This was higher than some professional forecasters had anticipated even after taking account of Monday’s figures from France and Germany.

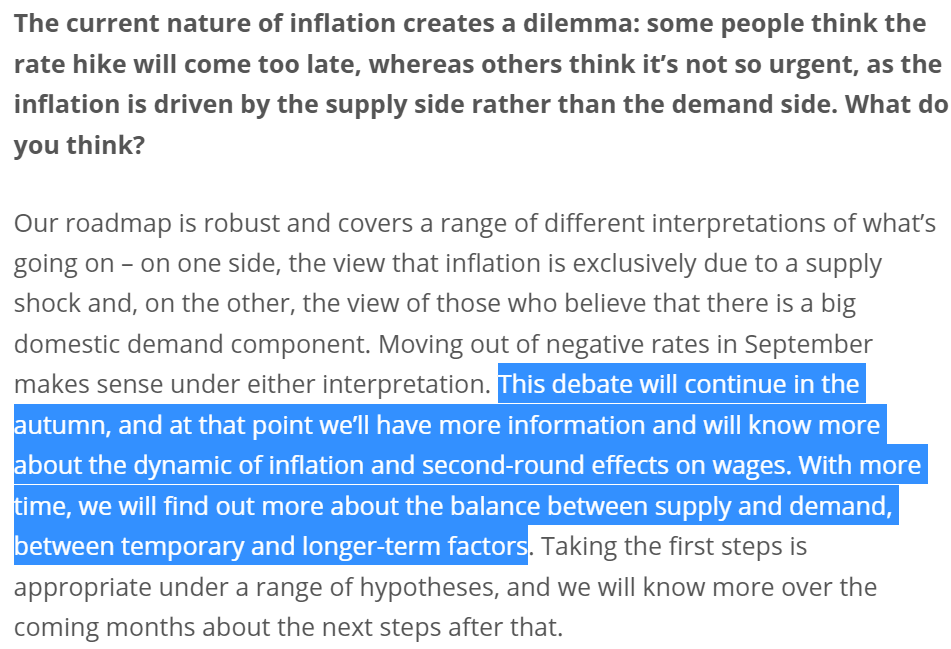

Core inflation rose by less, however, with the annual rate climbing from 3.5% to 3.8% and in the process indicating the substantial extent to which Eurozone price pressures are being driven by inorganic and largely imported factors.

“Inflation increased across the board thanks to continued energy market volatility on the back of sanctions, soaring food prices and core inflation increasing due to businesses pricing through high producer prices,” says Bert Colijn, a senior Eurozone economist at ING.

Source: Eurostat. Click image for more detailed inspection.

Source: Eurostat. Click image for more detailed inspection.

The core inflation rate removes volatile prices of mostly-imported commodity goods like food and energy from the consumer basket so is seen as a better representation of domestically generated inflation pressures

Energy prices rose by an annualised 39.2% in May, up from 37.5%, although the food, alcohol and tobacco segment saw the second strongest increases from what were already high levels of inflation when rising from 6.3% to 7.5%.

Core inflation also overlooks prices of alcohol and tobacco.

Still, it being lower compared with the main measure of inflation will be of little comfort to the European Central Bank given that it’s close to twice the level of the ECB’s symmetric two percent target and is still rising.

“The main concern is around core inflation. The jump from 3.5 to 3.8% today shows that high input prices are being pushed through to the consumer at a fast pace. While selling price expectations from businesses have ticked down slightly in May, expectations are that core will remain well above target for the coming quarters as higher input prices trickle through,” ING’s Colijn said Tuesday.

Source: Eurostat. Click image for more detailed inspection.

Source: Eurostat. Click image for more detailed inspection.

Tuesday’s data vindicates the European Central Bank for its December decision to begin steadily shifting its monetary policy in the direction of a less stimulatory calibration, although it also leaves the bank in a bind.

This is because the data effectively throws gasoline onto an already fiery Governing Council debate about the pace at which it should move up ahead.

“I think it was important for President Lagarde to lay out a roadmap signalling the end of net asset purchases in July and the end of negative interest rates in September. It is a robust and appropriate decision, although it is too early to know what will happen after that, as it will depend on how the economy evolves,” the ECB’s chief economist Philip Lane told Spain’s Cinco Dias in an interview published on Monday.

“Normalisation has a natural focus on moving in units of 25 basis points, so increases of 25 basis points in the July and September meetings are a benchmark pace. Any discussion about other moves would have to make the case for moving more strongly than this sequence of hikes in July and September,” he added in conversation with Nuño Rodrigo and Laura Salces.

The interview transcript can be accessed here.

Source: European Central Bank. Click image for more detailed inspection.