"Blistering" Services Spending Kicks Fed Rate Cut to December

- Written by: Gary Howes

U.S. consumers are spending heavily on services. Image © Adobe Images.

Donald Trump could be the sitting U.S. President who oversees the first interest rate cut in years from the Federal Reserve.

While pollsters see the vote outcome as 50/50, money market pricing shows investors are increasingly certain about the timing of the first rate cut, with December 13 now the expected date.

U.S. growth figures released Thursday read at 1.6% q/q annualised, undershooting expectations for 2.5%, but disappointing international trade figures accounted for this miss.

When you open the data package's hood, you are greeted by a hot engine: the core PCE price deflator came in at 3.7% q/q annualised, well ahead of the expected 3.4%. The PCE price deflator is simply a measure of consumer spending and the strength points of incredibly hot demand.

"Don't underestimate this economy," says Tim Quinlan, Senior Economist at Wells Fargo Economics. "Consumers are still spending, they are just prioritising activities in the service sector."

Spending on non-durable goods stalled in the quarter and outlays on big-ticket durable goods items contracted at a 1.2% annualised rate.

"That was not nearly enough to offset the much larger services category, where consumers spared no expense in the first quarter," says Quinlan. "Like a relief pitcher in the late innings, services spending came in throwing heat in the first quarter with a blistering 4.0% annualised growth rate—the fastest surge in consumer services spending since the stimulus-fueled binge in 2021."

Excluding 2020 and 2021, services spending has only come in above 4.0% three times in the last two decades. "Higher rates are intended to cool consumer demand; the trouble for the Fed is: it's not working," says Quinlan.

Markets now see the first rate cut coming in December, prompting a decline in U.S. equity markets and a rally in the value of the Dollar.

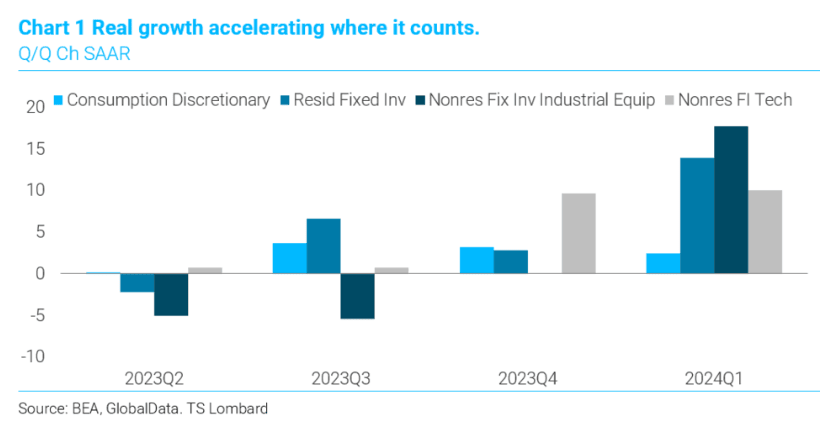

"This is a big, broad, diverse economy. Not every sector, not every region, grows at the same pace. Capital spending is what will drive growth forward in the quarters ahead and this is on the upswing," says Steven Blitz, an economist at TS Lombard.

"There is the issue of imports supplying this spending more so than it used to, a reflection of a too strong dollar. What does the Fed do against all this? Stand still for now, as the probability of any cuts this year continues to ebb away. But, in the end, this is a real growth story, a good thing," he adds.

But James Knightley, Chief International Economist at ING, says he expects to see more subdued activity in upcoming quarters.

"The divergence between business surveys and official data is very wide. We strongly suspect that business caution will translate into weaker hiring and wage growth and subdued business capex, and that will eventually show up in the official GDP data," he says.

Above: The Pound dropped against the Dollar in the minutes following the data, confirmation that markets are pushing back the timing of the expected first Fed rate hike.

ING expects the move higher in market borrowing costs to weigh on activity and eventually dampen price pressures in the economy. "Nonetheless, there is next to no chance of a rate cut before September," says Knightley.

Ali Jaffery, economist at CIBC says the Fed will need to see both the economy and price pressures sustainably cool "to feel confident in easing policy. We expect them to see that by September this year."

Ian Shepherdson, Chief Economist at Pantheon Macroeconomics, is still holding out for a June interest rate cut. "Q1’s sluggish increase in GDP likely sets the tone for the rest of 2024."

"The 2.5% rise in personal consumption also printed below the consensus, by 0.5pp, and was 0.2pp below its average growth rate in 2023. And a sharper slowdown looms, given that real after-tax personal income rose by just 1.1% in Q1 and probably will increase at an even slower pace over the coming quarters, as payrolls growth weakens. Only the very wealthiest households still have substantial excess pandemic savings that can be tapped to support consumption, so spending growth likely will converge towards income growth soon," he says.

But even Shepherdson acknowledges, "it’s a close call".