UK Inflation To Plummet Below 2.0 As Early As May Says ING

- Written by: Gary Howes

Image © Adobe Stock

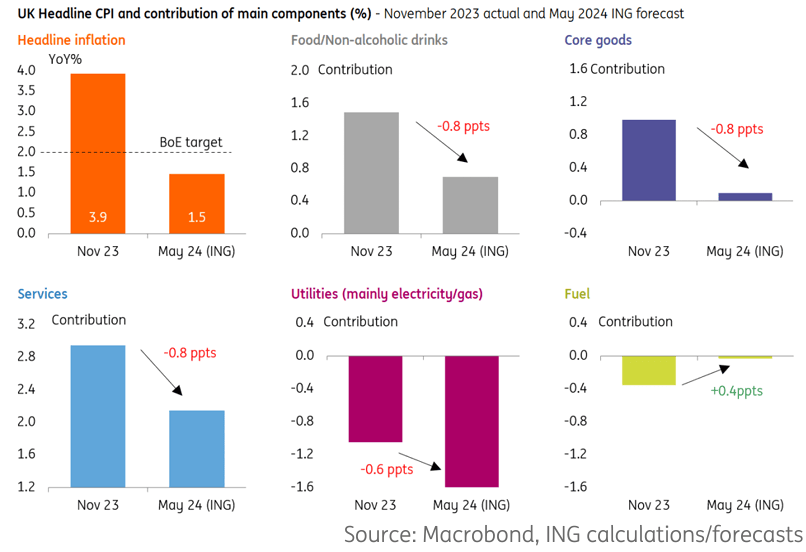

UK inflation will fall below the Bank of England's 2.0% target by May, according to new research.

ING Bank says UK inflation will be dragged as low as 1.5% by as early as the second quarter of 2024, helped by falling energy and food prices.

However, analysts say the decline in headline inflation does not mean the Bank of England will immediately cut interest rates, and it won't be until August until the first cut of the cycle lands.

"Lower natural gas prices are catching the headlines, but UK inflation is actually set for a fairly broad-based decline over the coming months. But the market risks getting ahead of itself by pricing a May rate cut, especially if tax cuts are announced in March," says James Smith, Developed Markets Economist at ING.

Last week we reported Deutsche Bank are also of the opinion an imminent return to 2.0% inflation is at hand.

"While it will be bumpy, we think the annual CPI rate will fall below 2% by April-24, driven in large part by a substantial drop in energy bills," says Sanjay Raja, Senior Economist at Deutsche Bank.

ING's warns that this Wednesday's CPI inflation release for December might be too early to see evidence of a rapid slide in inflation, and the consensus of economists only expects a fractional tick lower in the headline measure to 3.8%.

It’s a similar story for core, which strips out food and energy.

But by April, headline inflation is set to fall below 2% and drop to 1.5% in May, which means it won't be until June that sub-2.0% headlines hit the financial news.

ING expects inflation to stay below 2% until November.

"Natural gas is only part of the story, and the disinflation we’re projecting should be fairly broad-based. Except for petrol/diesel, we think most components should contribute a fair amount less to overall inflation by the spring," says Smith.

Food inflation will play a sizeable role in bringing headline inflation rates lower.

On a year-on-year basis, food inflation is still at 9%, but over the past three months, ING estimates food inflation is actually running at an annualised pace of just 2-3%.

"That suggests the contribution of food to headline inflation will continue to fall sharply over the coming months, not least because producer food prices have actually been falling in level terms recently," says Smith.

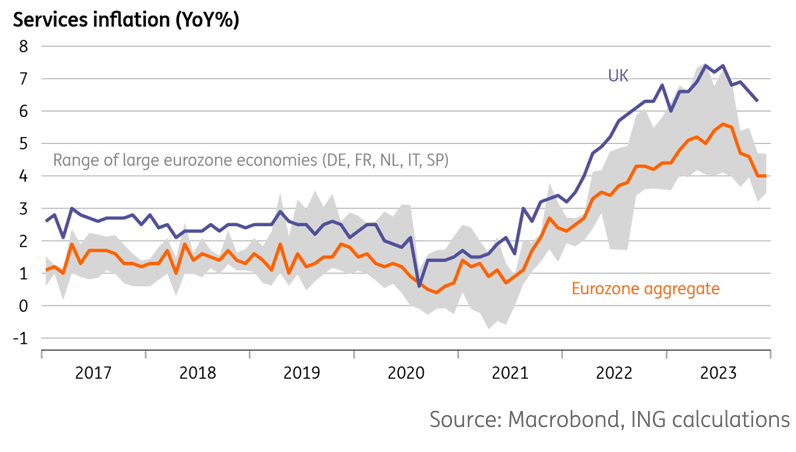

The Bank of England won't rush its first rate cut, however, as ING says services inflation will remain a concern.

The Bank has regularly reminded investors it is watching services inflation for any hint that broader inflation becomes entrenched.

ING reckons services inflation won't have made the progress the Bank of England is looking for by the time of the May decision, which markets have fully priced as being the date of the first cut.

"We think it would take a string of additional downward surprises here to convince the Bank to cut imminently, something it currently appears highly reticent to do," says Smith, who pencils in an August rate cut, followed by an additional 75 basis points of easing for the remainder of the year.