Businesses' Inflation Expectations at 11-month Low

- Written by: Gary Howes

Image © Adobe Images

The Bank of England can be increasingly confident the impact of previous interest rate hikes are having an impact as British businesses reported in July that their expectations for inflation had fallen to an eleven-month low, while hiring intentions also fell.

The findings are part of Lloyds Bank's monthly Business Barometer survey, which reveals business confidence in July was pulled lower by weaker economic optimism as more companies reported concerns about rising interest rates.

Trading prospects, however, were resilient, having increasing to a 14-month high.

Headline business confidence in July fell by 6 points to 31%, down from June’s 13-month high of 37%. That is still above the survey's long-term average of 28%.

Economic optimism fell to a 5-month low, dragging the overall confidence index lower, with the fall partly related to the share of companies reporting rising interest rates as their biggest concern, said the report.

But it is business inflation expectations that are of potentially greater importance for decision makers at the Bank of England, who will on Thursday raise interest rates again.

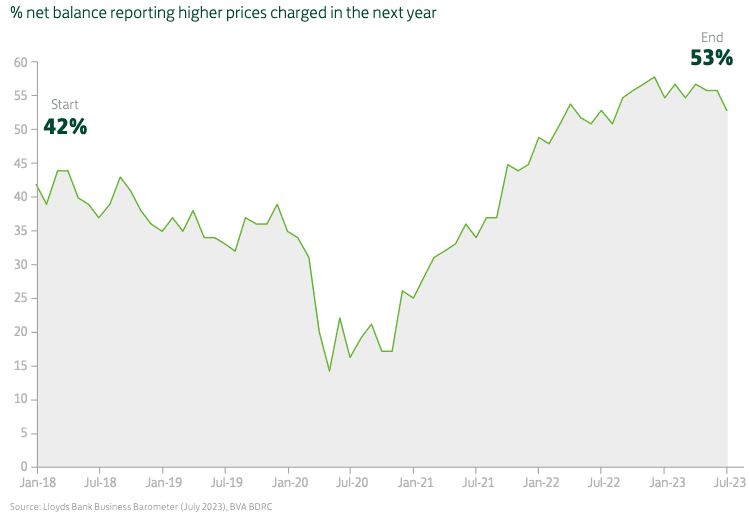

Businesses' own price expectations fell to the lowest in nearly a year, with a smaller share of companies anticipating an increase in their prices.

Above: "Start of a downtrend for prices?" - Lloyds Bank Business Barometer.

Furthermore, hiring intentions remained positive but cooled this month, reflecting a slight uptick in the proportion of firms planning to shed staff.

Taken together the findings suggest the odds of a wage-price inflation spiral is unlikely to materialise in the UK, easing pressure on the Bank of England to push interest rates much further.

"The Barometer presents a complex picture for firms this month, with data showing that trading prospects remain strong and businesses feeling under less pressure by inflation to raise prices," says Hann-Ju Ho, Economist at Lloyds Bank.

The report nevertheless confirms wage pressures remained widespread, suggesting it will take a further easing in conditions to bring wage price pressures lower.

The share of firms expecting higher wage growth rates remained high compared with pre-pandemic levels, finds the report.

In July, the proportion expecting at least 2% pay growth edged up 1 point to 49% but that was in line with the Q2 average. The proportion expecting at least 3% pay growth was unchanged at 27%, also in line with Q2.