Odds of U.S. Recession Have Receded says Goldman Sachs

- Written by: Gary Howes

The odds of a U.S. recession have receded says Goldman Sachs.

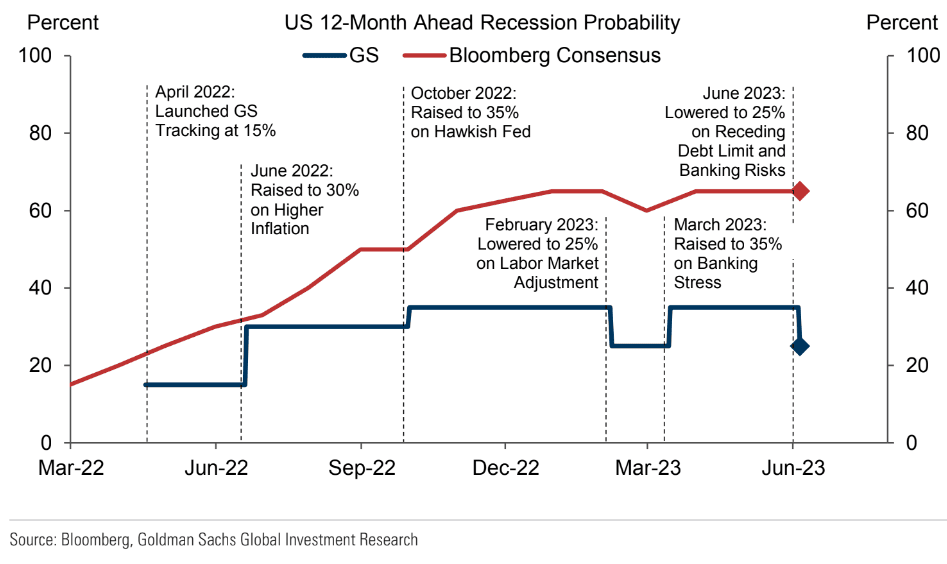

Jan Hatzius, Chief Economist and Head of Global Investment Research at Goldman Sachs, says the probability of the economy entering a recession within the next 12 months has been revised downward to 25%, undoing the previous upward revision to 35% shortly after the SVB failure.

He attributes this change to a couple of key factors:

"The tail risk of a disruptive debt ceiling fight has disappeared. The bipartisan budget agreement to suspend the debt limit will result in only small spending cuts that should leave the overall fiscal impulse broadly neutral in the next two years," states Hatzius.

The resolution of the debt ceiling issue removes a significant source of uncertainty and contributes to a more favourable economic outlook.

Furthermore, Hatzius emphasizes growing confidence in their baseline estimate, noting that "the banking stress will subtract only a modest 0.4 percentage points from real GDP growth this year."

This confidence stems from several positive indicators, including the stabilisation of regional bank stock prices, a slowdown in deposit outflows, resilient lending volumes, and lending surveys pointing to limited tightening ahead. These factors indicate a more optimistic outlook for the banking sector's impact on economic growth.

Additionally, Hatzius highlights the substantial boost to the economy from the recovery in real disposable income and the stabilization in the housing market. These factors, combined with the improved banking sector outlook, contribute to Goldman Sachs' 2023 growth forecast of 1.8% (annual average).

This projection surpasses both the private-sector consensus and the view held by the Federal Reserve.

But will the Federal Reserve ultimately need to generate a recession to bring inflation back to the 2% target?

"We agree with Ben Bernanke and Olivier Blanchard that the key issue to watch is whether the labour market can rebalance smoothly. Most of the news in this regard has been positive," says Hatzius.

In this regard, he notes:

- Although nonfarm payrolls grew another whopping 339k in May, the unemployment rate actually edged up 0.26pp to 3.65%.

- Even though the JOLTS measure of job openings showed a surprise increase to 10.1 million in April, the private-sector measures from LinkUp and Indeed declined further in April and May.

- The quits rate has returned to the top end of the pre-pandemic range.

- The share of Russell 3000 earnings calls that mentioned labour shortages fell further to 3.0% in 2023Q1, relative to a peak of 16.5% in 2021Q3.

- Both average hourly earnings and Goldman Sachs' revamped sequential wage tracker have continued to trend down (albeit more slowly than in 2022).

"Each of our preferred measures of labour market balance has now reversed significantly more than half of its post-pandemic overshoot, but most still have some way to go before they are consistent with 2% inflation," says