Bank of England to Hike in June, August and September Suggest Money Markets in Wake of Surprising Inflation Data

- Written by: Gary Howes

Image © Adobe Stock

The Bank of England is expected to hike interest rates on a further three occasions according to market-based expectations following the release of inflation data that was stronger than analysts were expecting.

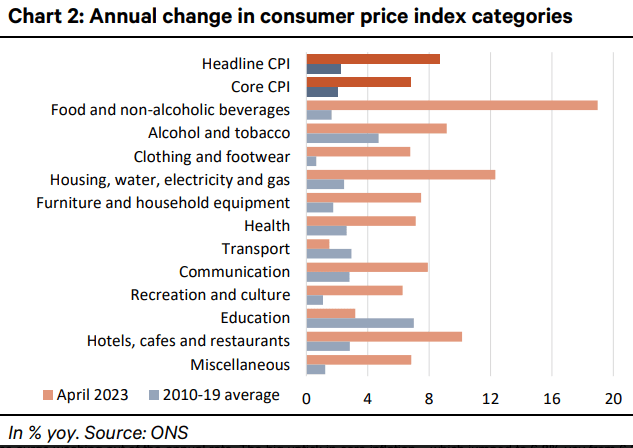

UK headline CPI inflation slowed sharply in April to 8.7% year-on-year from 10.1% in March but exceeded the Bank of England's projection (8.4%) for the third time in a row.

Core inflation rose to 6.8% yoy from 6.2% in March.

"April inflation data that exceed the BoE's forecast would likely underpin another 25bp rate hike to 4.75% at the 22 June meeting," says Kallum Pickering, Senior Economist at Berenberg Bank.

But money market pricing suggests investors are prepared for as many as three more rate hikes from here.

One week ago, markets had projected one full 25bp hike in June, with a further 10bp priced in for September, to take the bank rate to a peak of 4.85%.

In the wake of the inflation data, financial markets now expect the Bank to hike by a full 25bp in June, August and September, with a further 10bp priced in for November to a peak bank rate of 5.35%.

"We had been expecting the Bank of England (BoE) to remain on hold in June, but this data is undeniably hawkish. Despite preliminary signs of labour market tightness, signs of persistence in core inflation raises the risk that the Bank will have to tighten again," says Modupe Adegbembo, G7 Economist at AXA Investment Managers.

Above: Inflation to be dragged down in coming months by falling PPI inflation says Berenberg. Image courtesy of Berenberg.

Given the strength of domestic core inflation, the Bank of England will be wary of a wage-price spiral where workers press for higher wages and businesses raise their prices in response.

It is here that Bank of England policy can make an impact.

"What about domestic price pressures? That depends a lot upon the spending behaviour of households and their reaction to the BoE’s tightening," says Pickering.

Berenberg says the pass-through of higher interest rates to consumption via the housing market now takes longer as a consequence of the shift away from floating-rate mortgages towards fixed products over the past decade.

This creates the risk that the impact of already-delivered rate hikes squashes economic activity further down the road.

Indeed, economists remain of the view big falls in inflation are coming, even if they appear to be slow in arriving.

Image courtesy of Berenberg.

"Even though consumer price inflation has not yet started to fade quite as quickly as expected, it still remains a question of when rather than if inflation moderates," says Pickering.

There are signs of sharper falls ahead as producer price (PPI) pressures eased by more than expected in April (see chart 1).

PPI Output prices slowed to 5.4% yoy in April from 8.5% in March, while input prices eased to 3.9% from 7.3% over the same period.

"If history is any guide, the big drop in producer price pressures should lead consumer prices for goods lower within three to six months," says Pickering.

Further falls in headline inflation in coming months are guaranteed as energy price base effects fall away and food prices moderate.

"Headline CPI will continue to fall sharply over the coming months as base effects weigh. Tomorrow, Ofgem will announce the price cap for household energy prices, which we expect to fall to around £2,000 from July, which will ensure that energy's contribution continues to decline further over the coming months," says Adegbembo.