ECB Has Entered Policy Mistake Territory says Fidelity

- Written by: Gary Howes

Above: ECB press conference on May 04. Copyright European Central Bank.

The European Central Bank's latest interest rate hike was not required to ensure inflation falls back to the 2.0% target and its impact will result in the Eurozone's economy falling into recession.

This is the assessment of Fidelity International following the ECB's 25 basis point hike of May 04.

"We continue to believe that the extent of policy tightening delivered by the ECB to date is already sufficient to cause a recession," says Anna Stupnytska, Global Macro Economist at Fidelity International.

The market was split as to whether the ECB would opt for a 50bp or 25bp hike heading into the May policy meeting that saw the Governing Council deliver its smallest incremental hike since the start of the hiking cycle in July 2022.

The ECB said it would base future rate decisions on incoming inflation data.

The Euro fell after the central bank's statement struck a 'dovish' tone, noting that policy tightening so far is already feeding into financing and monetary conditions "forcefully" and that the transmission mechanism itself remains uncertain.

The hike comes after it was revealed Eurozone core inflation eased back in March and the ECB's own lending data showed a tightening in bank lending conditions.

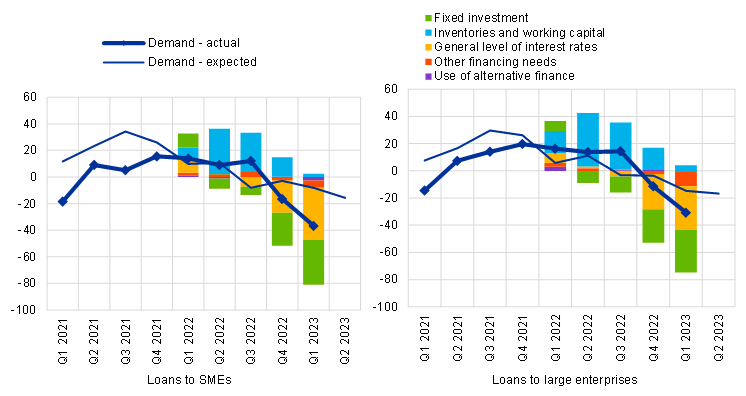

Above: Net percentages of banks reporting an increase in demand, and contributing factors. Source.

The effects of tighter financial conditions are already obvious in the U.S., where the Fed has had a headstart on its peers in terms of hiking rates. The Fed signalled overnight it was ready to pause its hiking cycle.

"Given lags in the transmission mechanism, the Euro area real economy is yet to face the hit," says Stupnytska.

"Even without further acute stress in the banking system in Europe, tight credit conditions are here to stay, ultimately leading to credit contraction and recession. Renewed banking stress in the US adds another layer of uncertainty to the already complex outlook," she adds.

With the Fed on pause, the U.S.-EA policy divergence cannot go far argues Fidelity in a suggestion that the ECB might soon pause.

"We continue to stress that the ECB is very likely already in the policy mistake territory that would ultimately require a rapid course correction in coming months," says Stupnytska.

The Euro fell against Pound Sterling, the Dollar and other majors after the decision, a nod by currency markets to the prospect of the nearing peak in the Eurozone's base interest rate.

The ECB's main refinancing rate is now at 3.75% and the deposit rate at 3.25%, meaning Eurozone base rates are at their highest in almost a decade.

The rise in rates has attracted foreign investor capital and encouraged the repatriation of Eurozone-resident investor funds as domestic asset returns improve.

This has been a fundamental driver of Euro exchange rate appreciation since late 2022.

Key to the Euro's future performance will be how many further hikes the ECB can deliver and the statement issued by the Governing Council confirms future rate decisions will be based on the regional inflation outlook.

But the Euro's downside could be limited as the ECB announced something of a 'hawkish' surprise by announcing it will increase the pace it reduces its holding of bonds acquired during the period of quantitative easing.

The current run-rate sees the ECB reduce its bond holdings by €EUR 15BN per month, which will continue through May and June.

But from July the pace doubles to €EUR 30BN per month as the ECB ends altogether its policy of reinvestmenting in bonds that reach maturity.