Odds of a Bank of England Hike in May are Rising: Oxford Economics

- Written by: Gary Howes

Image © Adobe Images

The odds of the Bank of England raising interest rates again in May are rising says Oxford Economics, an independent research consultancy and provider.

The message comes in the wake of incoming data that paints a picture of a resilient economy still able to generate above-target inflation levels.

"This week's events suggest the chances of the MPC following March's hike with another 25bps rise in May are rising," says Andrew Goodwin, Chief UK Economist at Oxford Economics.

The Bank of England's Chief Economist Huw Pill meanwhile said in a speech delivered this week that it was too soon to consider pausing interest rates.

"In February, the MPC signalled that it had adopted a more ‘data-dependent’ stance. This was consistent with establishing a clear inflexion point in the upward path of Bank Rate – but not necessarily a pause, still less a turning point," he said.

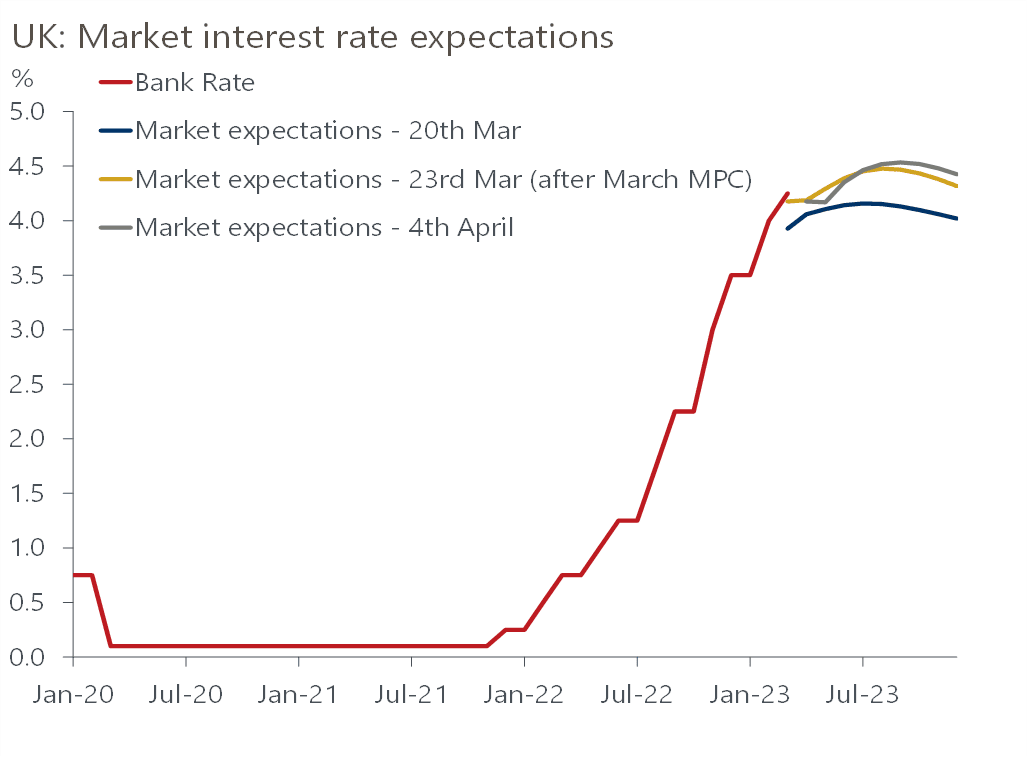

Market pricing reveals investors raised expectations for a 25 basis point hike in May to just above 70% following Pill's speech.

"Pill talked about needing to "see the job through", suggesting he's swaying towards voting for another 25bps hike," says Goodwin.

Above: Market implied expectations for a higher peak in Bank Rate are rising. Image courtesy of Oxford Economics.

The call comes on the same day Halifax reported the average UK house price had increased by 0.8% in March.

Housing was expected to be a sector particularly exposed to the Bank of England's interest rate hiking cycle, reports of robust activity will therefore potentially ease fears that the Bank has gone too far, too fast on rates.

The Bank of England's Decision Makers Panel survey for March was also released on April 06 and revealed business uncertainty continued to decline in March. 47% of firms reported that the overall level of uncertainty facing their business was high or very high, down from 53% last month.

The Bank would expect to see signs of deteriorating economic activity, which will ultimately cool inflation, as confirmation previous rate hikes are having an effect.

But the DMP survey also reveals firms continue to see inflation remaining well above the Bank's 2.0% target over the medium-term, potentially fueling fears on the Monetary Policy Committee (MPC) that inflation expectations are anchoring too high.

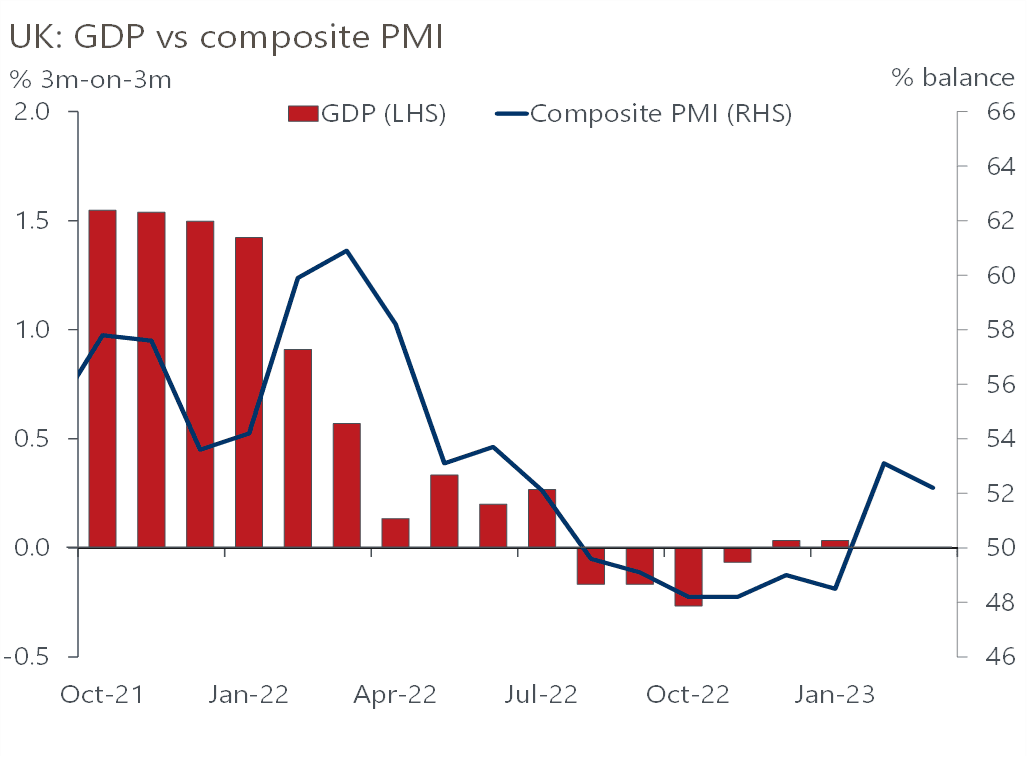

Above image is courtesy of Oxford Economics.

After all, a firm that expects elevated inflation will price its goods and services accordingly, thereby contributing to a self-fulfilling inflationary loop.

Oxford Economics says survey data also points towards signs of UK economic resilience.

March's final S&P Global/CIPS surveys suggest the economy grew again in March and signals "the upturn appears to have some durability, with new business volumes rising in both services and manufacturing," says Goodwin.

Oxford Economics says the odds of a May hike are, however, finely balanced.

"The recent resilience of activity has clearly reignited the concerns of some MPC members about the risk that a tight labour market will keep wage and price inflation high. But even the more hawkish members accept that there's already a lot of monetary tightening in the system, and that much of the impact on activity and inflation is still to be seen," says Goodwin.

"It's clear that the near-term monetary policy landscape has changed significantly since mid-March. And as things stand, the May MPC meeting is very much live," he adds.