Bank of England Must Continue with Interest Rate Hikes as UK Financial Conditions Have Eased Warns Mann

- Written by: Gary Howes

Above: Catherine L. Mann, image: Pound Sterling Live and Bank of England.

The Bank of England must continue hiking interest rates and avoid a 'pivot' as UK financial conditions have eased warns Catherine Mann, an external member of the Bank of England's Monetary Policy Committee (MPC).

Mann has presented new research that shows those expecting inflation to suddenly be vanquished by the delayed impact of previous rate hikes will be disappointed, risking the prospect that inflation remains elevated above 2.0% for longer.

"Further tightening and sooner rather than later likely is needed to ensure the effectiveness of monetary policy to achieve the objective of 2% sustainably in the medium term," says Mann.

Speaking at the Resolution Foundation she says she sees a "troubling change in expectations" regarding the outlook for inflation amongst households and businesses which suggests to her inflation will remain elevated than currently anticipated.

The Bank of England has been raising Bank Rate for more than a year now, and by 390 basis points in total, leading some on the MPC to vote against further rate hikes as the impact of this tightening is yet to be fully felt.

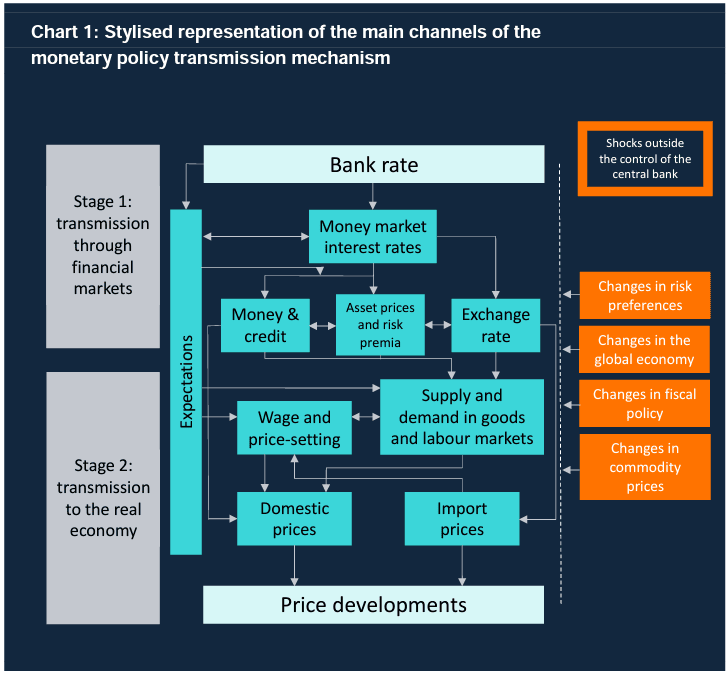

This thinking is based on an enduring economic consensus that sees monetary policy decisions operating with a delay and hikes will eventually 'work through' the financial system and into the real economy.

But Mann's latest research finds financial markets have already absorbed a substantial degree of this tightening to date.

Interest rates are raised by central banks with a view to tightening monetary conditions, which in turn slows the economy, increases unemployment and brings inflation lower.

But Mann says UK interest rate rises might be having a more limited impact on the economy than many might think thanks to years of unorthodox policies, most notably quantitative easing.

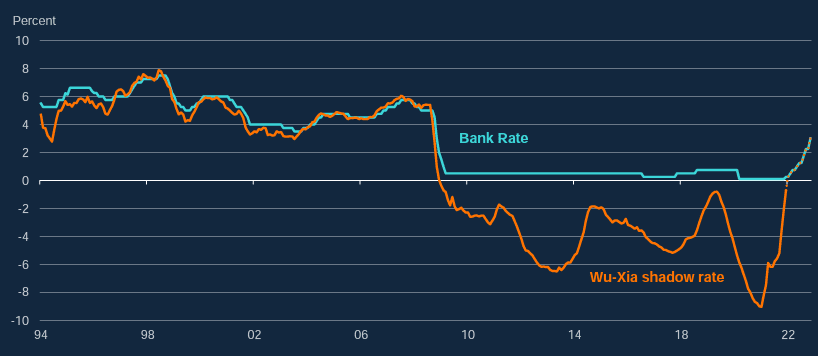

This quantitative easing worked alongside, and in addition to, lower interest rates, creating a "shadow rate".

The shadow rate means that although central bank interest rates can fall to zero, the effective interest rate that is 'felt' by the monetary system can in fact fall lower.

(Economists Jing Cynthia Wu and Fan Dora Xia, now at the Bank of International Settlements, devised an alternate shadow fed funds rate that can be negative, reflecting the Federal Reserve's quantitative easing.)

This shadow rate is also alive in the UK and means that recent interest rate rises at the Bank of England might have only merely brought the shadow rate back to zero:

Above: Wu-Xia shadow rate and Bank Rate. Image: Bank of England.

As such, monetary conditions in the UK economy might not be as tight as many assume and therefore further rate hikes will be required.

"Over the last year and a half, monetary conditions have tightened significantly over a short period of time, in response to the MPC’s Bank Rate increases. But, are the conditions tight?" asks Mann.

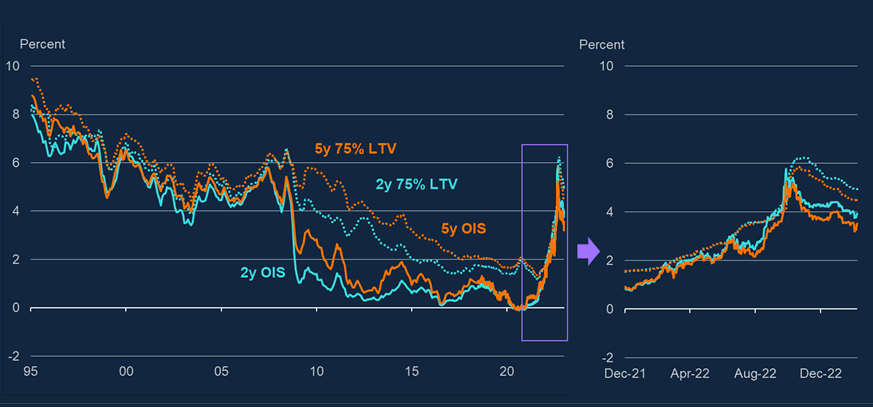

Mann says there are signs of easing financial conditions in the economy - basically put, the cost of money has actually fallen - despite the Bank hiking rates to 4.0% in December.

This is evident in falling mortgage rates into year-end from highs in October, despite further rate hikes.

Above: Mortgage rates and OIS rates. Solid lines show OIS rates, and dotted lines the maturity-matched 75% LTV mortgage rates. Image: Bank of England.

"Mortgage rates are definitely looser than they were last autumn, even as Bank Rate has risen further since," says Mann.

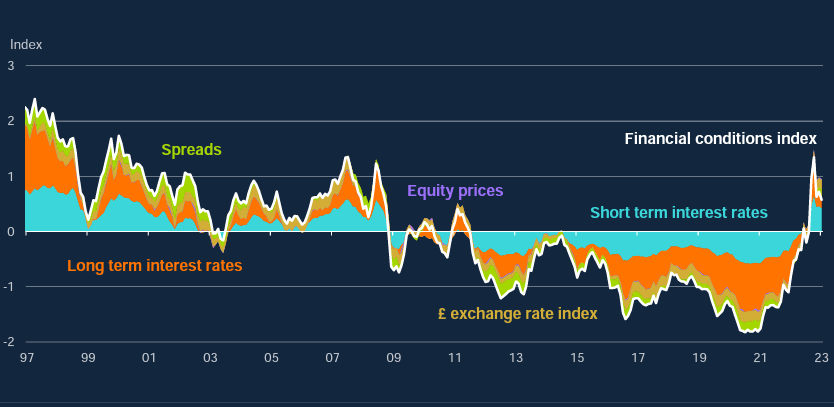

Further evidence of easing UK financial conditions includes the rally in equity markets and the decline in the Pound-Dollar exchange rate.

Putting all the various factors together, Mann introduces a UK financial conditions index that shows UK conditions have loosened from highs in September.

Above: UK financial conditions index. Image: Bank of England.

This tells her that interest rates are required to rise further if inflation is to be brought under control on a sustained basis.

Why have conditions eased, then?

Mann says investors have looked forward to a time when the Bank of England, and other central banks, will end their rate hiking cycle.

This then allows them to price lower rates in the future, now. This is a problem for central banks that need rates to impact economic behaviour and expectations sufficiently to bring down inflation.

"In my view, we have more to do. Because, as markets have looked forward to the soon-to-be expected peak in policy rates," says Mann. "financial conditions have again begun to loosen."

She adds:

"Financial conditions are looser relative to what they might be otherwise, due to the depreciation of Sterling and a falling equity risk premium, which have global factors embedded in them. To me, as both the level as well as the delta matter in assessing the effectiveness of transmission of monetary policy, this implies that the forward-looking nature of financial markets has been absorbing some of the intended tightening, which impact the long and variable lags of folk wisdom."

Mann says that although the Bank of England has been aggressive in raising interest rates by historical standards, the pace has not been aggressive enough.

"A greater degree of front-loading would have reduced the risk of an increasing share of backward-looking households and firms," she says.

Mann says her research finds evidence households and businesses do not look forward to the prospect of falling inflation, but rather back to the peak, which stood above 10% in the UK.

So while financial markets look forward to falling interest rates and create looser financial conditions, firms and households look back to elevated inflation levels of the past which engenders elevated inflation expectations.

This leads to higher wage demands amongst workers and inflationary increases to goods and services at businesses, both inflationary behaviours that the Bank is keen to guard against.

"I worry that this constellation could yield extended persistence of inflation into this year and the next," says Mann.

"I believe that more tightening is needed, and caution that a pivot is not imminent. In my view, a preponderance of turning points is not yet in the data," she adds.

The Bank of England is expected by financial markets to hike by 25 basis points in March and again in February, taking the peak in Bank Rate to 4.5%.