U.S. Retail Sales: Flashback to the Start of the 2008-2009 Recession

- Written by: Gary Howes

Image © Adobe Images

U.S. retail sales were significantly higher than expected in October, but there are signs this spending is being funded by an increasing debt burden that offers flashbacks to behaviour that preceded the 2008-2009 recession.

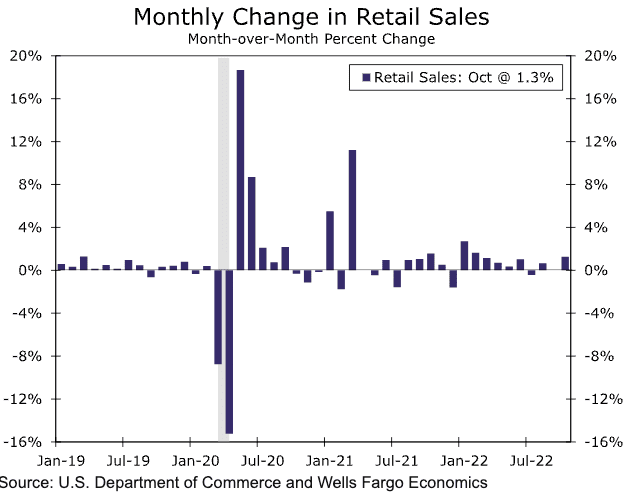

It was reported U.S. retail sales rose 1.3% in October, an acceleration from the 0% recorded in September, and ahead of the 1.0% increase the market was expecting.

Core retail sales were even more robust, posting an impressive 1.3% gain, more than tripling the 0.4% expected by the market and 0.1% printed in September.

"The feared rollover in spending is nowhere to be seen, despite significant pressure on real incomes," says Kieran Clancy, Senior US Economist at Pantheon Macroeconomics. "People have been willing to run down savings accumulated during the pandemic to maintain consumption as real incomes have been squeezed, and they can continue to do so for some time yet."

The consumer is therefore willing to spend, which will likely keep inflation rates elevated and push back somewhat against the notion that the Federal Reserve can afford to relax and end its interest rate hiking regime.

Recall that the fall in inflation reported last week, backed up by this week's softer-than-expected PPI inflation, had dollar bulls on the run over recent days.

The retail figures provide an antidote to this theme, and the Dollar found some relief as a result.

But Tim Quinlan, Senior Economist at Wells Fargo Securities, says consumers are struggling to keep up the pace.

"Last time credit card borrowing was growing like it is now, we were heading into the 2008-2009 recession," he says in a note following the retail sales release. "Even with continued consumer resilience, some cracks are slowly forming in the foundation."

The Wells Fargo economist says households have increasingly relied on credit to spend and increased overall debt $351 billion in the third quarter.

This puts the total debt burden for households at $16.5 trillion, according to data released yesterday by the NY Federal Reserve.

"That's an increase of 8.3% from a year earlier, the biggest annual increase since a 9.1% jump in Q1-2008 at the start of the 2008-2009 recession," says Quinlan.

The increase in borrowing to boost spending comes despite the Federal Reserve lifting short-term interest rates from a top-end range of 0.25% earlier this year to 4.00% at present; the fastest increase in short-term borrowing costs since the 1980-1982 tightening cycle.

This increase in the cost of finance will nevertheless catch up with consumers and weigh heavily on spending going forward.

"Near-term consumer resilience will come at a further deterioration in household finances as households draw down savings and accumulate debt to spend. That may eventually spell economic trouble," says Quinlan.