9.1% Inflation Deepens Eurozone's Cost of Living Crisis

- Written by: Gary Howes

Image © Adobe Stock

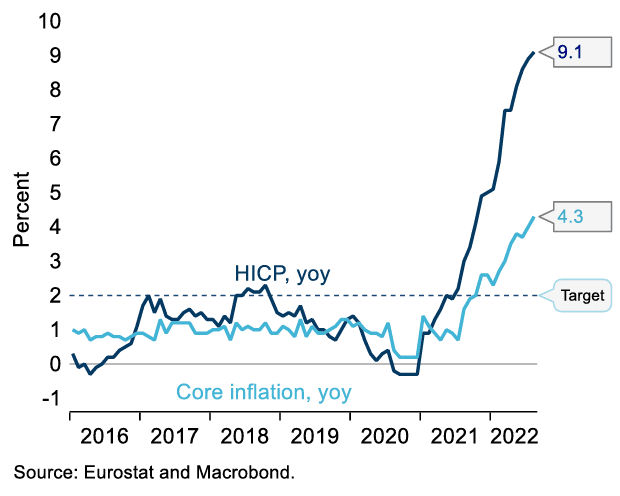

Eurozone CPI inflation rose 9.1% year-on-year in August according to Eurostat, up from 8.9% in July and beating expectations for a reading of 9.0%, deepening the region's cost of living crisis.

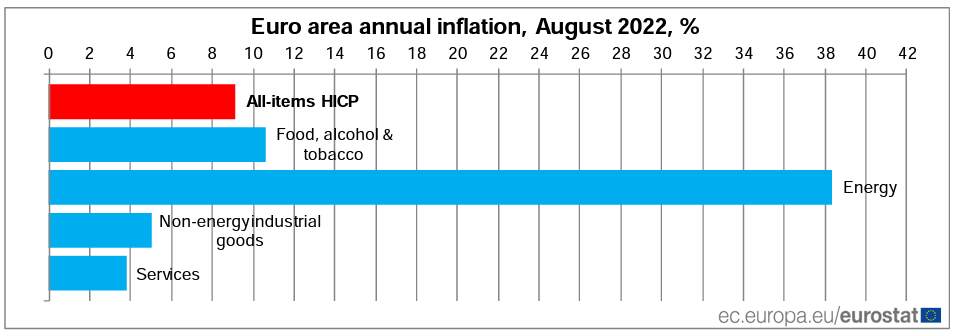

Although rising energy costs were the main culprit behind the surge, core inflation went up to 4.3% from 4.0%, and was well above expectations for 4.0%, placing pressure on the European Central Bank (ECB) to hike interest rates again in September.

Looking at the data, economist Bert Colijn at ING Bank N.V. says his main concern is the surprise increase in goods inflation.

"The increase from 4.5% to 5% was much larger than expected and fuels worries about second-round effects from the input cost shock lasting longer," says Colijn, who is ING's Senior Economist for the Eurozone at ING.

Above: Eurozone inflation breakdown shows energy costs continue to surge.

It is these second-round effects that are of particular concern to the ECB, and the data will solidify the market's current expectations for a 75 basis point hike in September.

However, Colijn notes second-round effects from wages and consumer demand are largely absent. "The latest negotiated wage growth data for 2Q came in at 2.1%, which means there is no evidence of a wage-price spiral at this point," he says.

This could imply the ECB's rate hiking cycle will be a short-lived affair.

"The economy is slowing rapidly – and perhaps already contracting at this point – the question is how much the ECB needs to slam the brakes," says Colijn, "the big question is how the ECB will respond after this, if indeed signs of economic distress become more apparent, and inflation remains highly driven by supply-side factors."

Above image courtesy of Handelsbanken.

Looking ahead, further price rises are likely.

"Euro area inflation is only heading higher from here, in part due to further upside pressure from the surge in natural gas prices, but also as several government subsidies, such as the German €9 public transit ticket, come to an end in the next couple of months," says a response note from TD Securities.

Salomon Fiedler, economist at Berenberg Bank, says Europe faces an expensive winter.

"Eurozone inflation is likely to rise further and may exceed 10% in Q4. Natural gas prices are set to be the major driver of inflation rates for the remainder of 2022 and in 2023," he says.

Berenberg's forecasts assume benchmark wholesale prices would settle below €250 per MWh and decline after the cold season.

Higher gas prices, passed on to consumers with a lag, pose an upward risk to their forecasts.

Berenberg expects the ECB to hike interest rates by 50bp on its 8 September policy meeting, seeing a good chance of a 75bp move.

"If the ECB raises rates more quickly now, it may ultimately get away with a lower level of interest rates over the medium term than otherwise," says Fiedler.

Economists at Handelsbanken say following today’s inflation release, coupled with ECB member statements, they now see an increased probability of a 75bp hike in September.

"We now see upside risks in the order of 50-75bp to the policy rate by that date, which suggests that we may see more rate hikes next year, in addition to a possible higher hike next week," says Erik Meyersson, Senior Economist at Handelsbanken.

Key Statistics:

German CPI came in higher than expected at 7.9% year-on-year, vs. 7.5% previously and 7.8% expected.

French CPI came in lower than expected at 5.8% year-on-year, vs. 6.1% previously and 6.1% expected.

Italian CPI came in higher than expected at 8.4% year-on-year, vs. 7.9% previously and 8.1% expected.