How Many More ECB Interest Rate Hikes are Likely?

- Written by: Gary Howes

Image © European Central Bank, reproduced under CC licensing

How many more interest rate rises are likely to be delivered by the European Central Bank? Analysts have assessed the Bank's July policy update and given their verdict with some even seeing the potential for a 75 basis point hike on the horizon.

The ECB opted to raise its main interest rates by 50 basis points on Thursday, while also announcing the creation of a mechanism that would ensure the Eurozone's financial system remained orderly as interest rates increase.

In the wake of the decision the market moved to price in just over a further 55bp of rate increases for the September meeting with an additional cumulative increase of around 176bp by the end of the year.

For the first time the market now expects the ECB to deliver more rate hikes by the end of the year than they expect of the Bank of England (168bp worth).

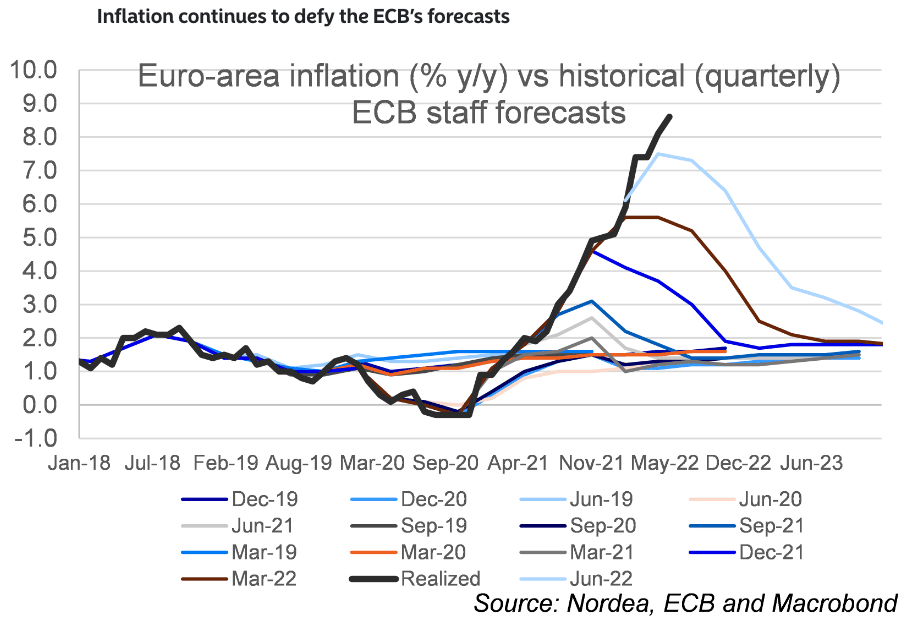

Economists however do not agree with the market's agressive pricing, many have nevertheless ramped up their own precictions.

"We see 50bp rate hikes in September and October and a shift to more moderate 25bp hikes in December," says Jan von Gerich, Chief Analyst at Nordea Bank.

"Risks are clearly tilted towards a 75bp move in September," he adds.

Above: The market's rate hike expectations, image courtesy of Goldman Sachs.

Economists are now able to hold more diverse opinions as to how hard and far the ECB will go because the Governing Council has now ditched a policy of forward guidance.

In the past forward guidance allowed for a great deal of predictability as to how the ECB would proceed with policy rates.

But following a series of shocks and highly uncertain economic developments forward guidance has been replaced and the Bank says it will respond to the data.

"Without any firm guidance, the market is now even freer to price in whatever the data warrant," says von Gerich.

Holger Schmieding, Economist at Berenberg, says the flexible approach may, for instance, imply that a possible 50bp hike in September could be followed by smaller moves later this year.

"But a 25bp increase in September seems possible as well. A 75bp move cannot be fully ruled out either. Still, such a big Fed-style move does not seem likely in our view as the ECB called the 50bp hike today frontloaded," says Schmieding.

Nick Bennenbroek, International Economist at Wells Fargo Securities, says inflation remains elevated enough, and inflation risks worrisome enough, to continue with a more forceful pace of rate hikes for the time being.

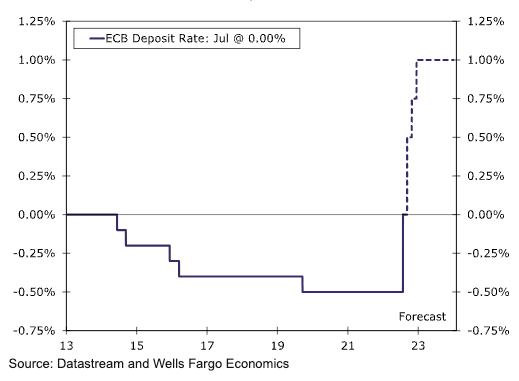

"Our view remains that today's hike will be followed up by another 50 bps Deposit Rate increase at the September meeting," he says.

While inflation remains elevated and until Eurozone economic growth slows in a much more meaningful manner, Wells Fargo also sees a steady series of rate increases as more likely than not.

"In that context, we also forecast a 25 bps rate increase at the October and December meetings, which would bring the Deposit Rate to 1.00% by the end of 2022," says Bennenbroek.

In short, Wells Fargo anticipates a shorter, sharper rate hike cycle from the ECB than previously.

Goldman Sachs maintains a forecast the Governing Council will hike 50bp in both September and October before slowing to a 25bp pace in December, but they now also expect the 1.75% terminal rate to be reached already in March 2023.

"While a faster build-up of second-round effects could entail more rapid tightening in September, the remaining threat of further Russian gas flow disruptions and the possibility of renewed sovereign stress skew the risks to the ECB’s rate path to the downside, especially beyond the near term," says Sven Jari Stehn, Chief European Economist at Goldman Sachs.