Fed Could Hike to 5.25% says Macro Hive

Image © Adobe Images

- By raising interest rates, the Fed is withdrawing support from the economy. This typically drives asset valuations down.

- Portfolios weighted towards equities, bonds and crypto will likely suffer in this environment.

- Macro Hive advise overweighting cash and commodities to survive the current bear market because equities and bonds will likely see further downward pressure as rates rise.

A year ago, US inflation was at an uncomfortable 5%. That was higher than in the UK (2.1%) and the euro area (2.0%). But, according to the Federal Reserve, it was nothing to worry about. Long-term inflation expectations remained anchored.

And, as Chair Jerome Powell put it, the price rises came down to ‘transitory factors’ that would soon abate.

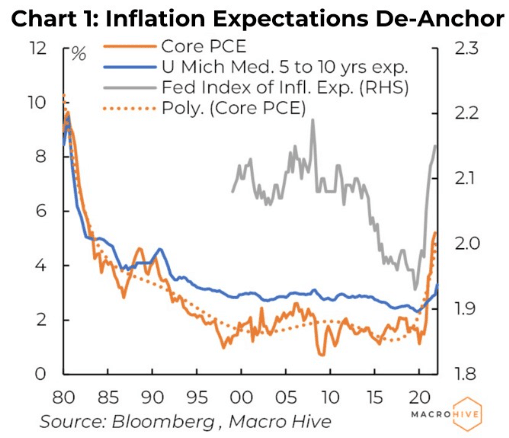

March forward to today and US inflation is the highest it has ever been at 8.6%. Inflation expectations are de-anchoring (Chart 1). And the ‘transitory’ narrative is dead in the water.

Inflation is clearly becoming entrenched in the economy. We see this with the broadening of inflationary pressures into the trimmed-mean Consumer Price Index (CPI). This measure of inflation excludes items with the largest price increases, thereby stripping out the noise in the standard CPI measurement.

When inflation is limited to just a few volatile items in the basket, trimmed-mean inflation hardly moves.

But as those price pressures infiltrate the broader economy, you begin to see rises in the trimmed-mean figure. It is now at 6.53%, and it has been advancing steadily since midway through 2021.

Another indicator that inflation is becoming entrenched is the spillover into wages. Unemployment is low: 3.6% in May, down from over 14% during the early pandemic.

This means businesses face stiff competition to find workers. And they overcome that by raising the wages they pay to account for inflation.

The Atlanta Fed’s Wage Growth Tracker puts wage inflation at 6.1% for May, up from 3.0% a year prior. It is a simple story: higher wages equal higher business costs and therefore higher prices as businesses pass on these costs.

Powell and the Fed know they must control inflation. Grilled by the House Financial Services Committee on Thursday 23 June, Powell stressed his commitment was ‘unconditional’. He admitted, ‘we are very far from our inflation target. We really need to restore price stability – get inflation back down to 2%.’

Clearly, the Fed is setting policy based on the latest inflation readings. The hot print just before the Fed’s latest policy meeting caused it to break media blackout (and March’s forward guidance of a 50bp hike for June and July) to pre-announce a 75bp hike. And it followed through.

75bp now seems likely for July, too.

How far could the Fed go? Well, markets currently think the Fed will tap out at around 3.4-4.0%.

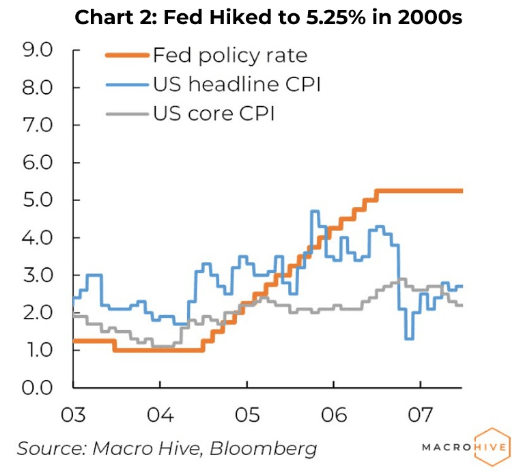

But it could be much higher. During 2004-2006, the Fed hiking cycle saw interest rates peak at 5.25% (Chart 2).

And that was with headline inflation of just 4.7% and core inflation at 2.4%.

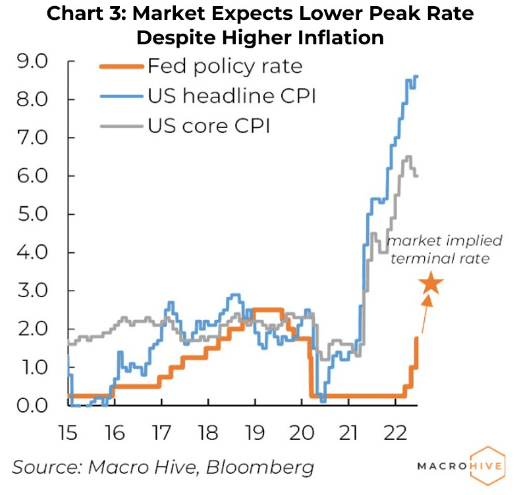

Today, we face 8.6% and core at 6.0% (Chart 3).

We think policy rates need to move closer to inflation rates such that real policy rates are positive. With consensus expectations of headline inflation of 6.5% by year end, this suggests policy rates should be far closer to the 2000s terminal rate of 5.25% than the 2015-2018 terminal rate of 2.5%.

The divergence between the market-implied terminal rate and the inflation rate is huge. And it suggests investors think the Fed will back off to protect equities or avoid a recession. But it may not.

Speaking to the Senate banking committee, Powell openly acknowledged that a US recession is ‘certainly a possibility’. While the Fed targets a soft landing, it acknowledges that outside factors like the war in Ukraine and the ongoing lockdowns in China complicate matters.

Our models currently put the probability of a recession at 54.7% within the next 12 months.

In an environment of rising rates and rampant inflation, risk markets suffer. The S&P 500 is already down 19% YTD, and the tech-heavy NASDAQ is down a miserable 28%. We are in a bear market. And if recent earnings momentum weakens (as we expect), it will worsen.

We stay short bonds especially given our Fed view and stay overweight commodities on poor supply dynamics. And, of course, we like to be overweight cash.

In terms of US equity sectors, we like to be overweight financials, homebuilders, large cap value, reopening trades, semi-conductors, and traditional infrastructure. We recently added clean energy to that list.

We like to be underweight large cap growth, consumer discretionary, materials and technology. We were underweight communications. However, following the recent fall of highflyers like GOOG and META, the sector now trades at reasonable P/E ratios.

So, we move communications from underweight to market weight. Aggressive investors could allocate to GOOG and META directly.

That said, we are bearish on equities overall.