Barclays: ECB Rate Hikes to Contribute to Eurozone Recession

- Written by: Gary Howes

"We forecast a mild technical recession at the turn of the year" - Barclays.

Image © European Central Bank, reproduced under CC licensing

The European Central Bank is expected to confirm at Thursday's policy meeting that interest rates will rise in July, but a series of rate hikes will ultimately contribute to an economic recession say economists at Barclays.

Barclays now expects the ECB to hike in increments of 25 basis points at each meeting from July to December 2022, and once more in the first quarter of 2023, bringing the deposit rate to 0.75%.

"We expect a pause thereafter on the basis that in Q1 2023 inflation should be on a downward trend, with clear evidence that the euro area is in a slowdown phase," says Silvia Ardagna, Chief European Economist at Barclays.

At the June 09 monetary policy meeting Barclays expect no change to ECB policy rates and the announcement that APP purchases will be concluded at the end of the June, with a possible extension of EUR5BN in the first week of July.

They expect the ECB to signal it will raise policy rates starting from the July 21 meeting.

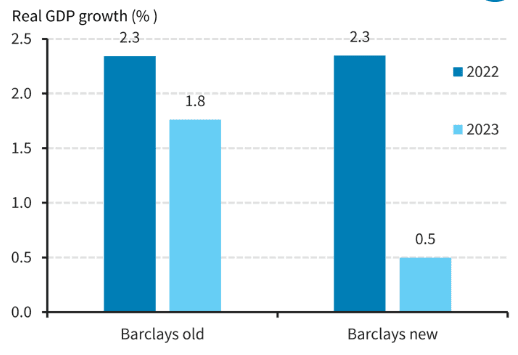

Barclays this week revise their real GDP growth forecast for the Eurozone in light of lower global growth, high and more persistent inflation and the tighter financing conditions posed by rising interest rates.

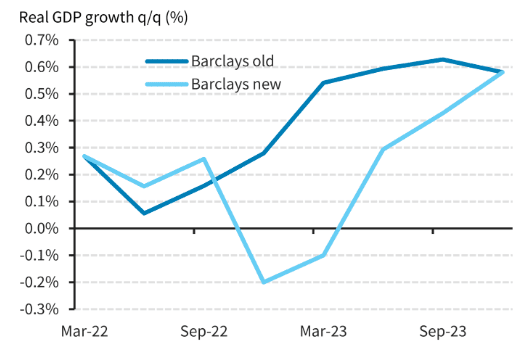

"We forecast a mild technical recession at the turn of the year and real GDP growth to average 0.5% in 2023 from 1.8% previously," says Ardagna.

Above: Barclays now expect moderate growth in Q2-Q3 2022. Image source: Barclays Research.

Previously Barclays had called for two 25bp rate hikes in 2022 and four 25bp rate hikes in 2023.

"There are risks on both sides to our call: more tightening in case of evidence of a wage-price spiral or upside de-anchoring of inflation expectations, but less tightening in case of the re-emergence of financial market fragmentation and disorderly core-peripheral spread widening," says Ardagna.

Core-peripheral spread widening refers to instances where the yield paid on government bonds in various parts of the Eurozone rise at different speeds in response to higher central bank interest rates.

Bonds belonging to 'core' Eurozone nations such as Germany and France would typically be expected to rise at a slower pace than the bonds of peripheral countries such as Greece and Italy.

This means the cost to peripheral nations of higher ECB rates is greater and a concern is that the ECB could destabilise the Eurozone and be forced into abruptly halting their rate hiking agenda.

Above: Barclays foresee "a technical recession at the turn of the year". Image source: Barclays Research.

But Barclays believe such risks would only occur if the ECB were to raise rates by a more substantial 50 basis points at one of the upcoming meetings.

"We believe a 50bp increase in policy rates would increase the risk that core-peripheral spreads widen further and in a disorderly fashion, and that the ECB would have to end the tightening cycle much sooner than we expect and/or start a new QE programme to close spreads," says Ardagna.

Such an outcome would almost certainly weigh on Euro exchange rates.

However, for now at least, the prospect of higher Eurozone interest rates are proving supportive of the Euro which has recovered from recent multi-month lows against the Pound through the course of May and June.

The single currency has meanwhile recovered from multi-year lows against the U.S. Dollar and the 2022 lows might well be in the past if the ECB proceeds with a steady albeit modest rate hiking cycle.

A downside risk to the Euro would be the ECB ending its hiking cycle sooner than markets currently anticipate, which would leave Eurozone interest rates well below those in the UK, U.S. and other developed markets.

This could happen if Eurozone economic growth undershoots the ECB's current projections, which Barclays anticipates.

"We think the ECB might raise policy rates one more time in Q1 and then pause, as we expect economic activity to contract at the turn of the year and forecast inflation to be trending down by then. Compared to market pricing and analysts' consensus, our call remains dovish," says Ardagna.