Goldman Sachs Bring Forward Bank of England Rate Lift-off Date by More than a Year

- Written by: Gary Howes

Image © Bank of England

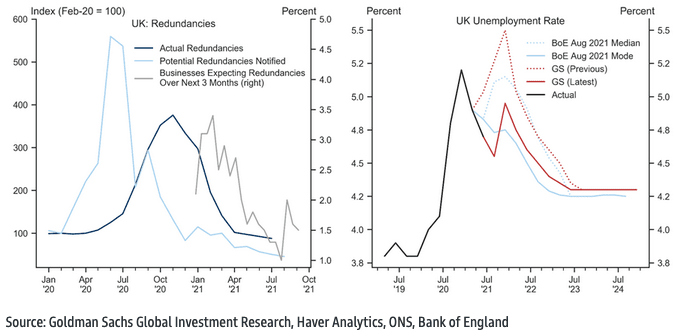

Goldman Sachs have pulled forward the date they anticipate the Bank of England to raise interest rates by more than a year, following this week's stronger-than-expected UK employment report.

"The recent data on the UK labour market have been stronger than expected, and indicators imply a smoother furlough unwind than we previously assumed," says Steffan Ball, Chief UK Economist at Goldman Sachs.

The UK's ONS on Tuesday reported employment levels were back to pre-crisis levels while wage growth increased 8.3% in July.

"Our analysis suggests that underlying wage growth is strong and inflation pressures are firming more than anticipated," says Ball.

Above: Wage growth projections from Goldman Sachs.

The Bank of England's Governor Andrew Bailey said on September 09 that the economic rebound meant that the minimal requirements had been met to justify raising interest rates.

He also revealed that three other members of the 8-person Monetary Policy Committee agreed.

"MPC member commentary, combined with the new Chief Economist appointment, suggests that a majority of the committee now view the minimum conditions for starting monetary policy tightening have been met," says Ball.

As a result, Goldman Sachs bring forward their baseline forecast for Bank Rate lift-off to next May.

Goldman Sachs' previous baseline forecast was for the first Bank Rate increase in the third quarter of 2023.

Above: "Furlough Aftermath Still Uncertain, But Likely Less Disorderly" - Goldman Sachs

They expect an initial 15bp hike to be followed by subsequent increases of 25bps every two quarters, putting Bank Rate at 0.5% in the fourth quarter of 2022, 0.75% in second quarter of 2023 and 1.0% in the fourth quarter of 2023.

"Given this path, we expect balance sheet unwind to start with ceasing reinvestments in 2022Q4. We look for active asset sales to begin in 2024, during which period we expect the BoE to pause the hiking cycle in order to assess the impact of these sales," says Ball.

However, there remain some risks to the hawkish shift in stance, namely an unexpectedly large jump in unemployment once the government ends its furlough scheme.

But likewise, "if the furlough scheme unwinds smoothly and underlying wage pressures firm in coming months, the BoE may tighten earlier than May," says Ball.

They now see headline CPI inflation peaking at 4.5% in the first quarter of 2022, well above the 4.0% peak anticipated by the Bank of England.

It is seen falling sharply to 2.2% by the end of 2022, which means it would finish the year above the Bank of England's 2.0% target.