"Outright Fall" in UK House Prices Expected

- Written by: Gary Howes

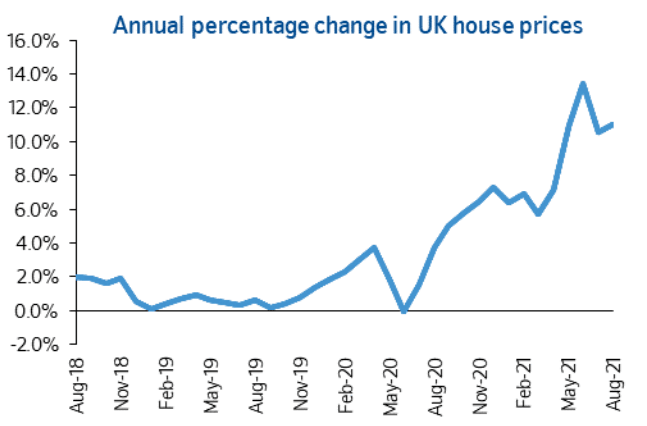

UK house price growth notched its second-largest monthly gain in 15 years in August according to Nationwide and some industry professionals say they expect the heat in the housing sector to remain elevated for some time, although one leading economist warns of outright declines ahead.

Nationwide's monthly house price survey for August reported house prices rose 2.1% on the month, taking year-on-year growth to 11%, up from 10.5% in July.

Consensus expected growth to come in at 8.7%.

"We're seeing no let up in the extreme levels of house price growth seen in recent months. These hot market conditions are likely to remain beyond the summer months and well into autumn as we enter what is traditionally one of the busiest times of the year for the UK market," says Marc von Grundherr, Director of Benham and Reeves.

Nationwide's Chief Economist Robert Gardner said the strong outcome for August was surprising because it seemed more likely that the tapering of stamp duty relief in England at the end of June would take some of the heat out of the market.

Gardner says some of the August strength may reflect strong demand from those buying a property priced between £125K and £25K who are looking to take advantage of the stamp duty relief in place until the end of September.

However, some economists we follow are more cautious on the outlook and warn a slowdown in growth can be expected.

Gains in house prices come ahead of the reversal of temporary measures designed by government to help the sector through the Covid pandemic, which economists say will help cool trends in the sector.

"The acceleration of Nationwide’s measure of year-over-year house price growth in August likely reflected buyers rushing to purchase properties ahead of the full reversal of the temporary rise in the Stamp Duty Land Tax threshold back to £125K at the end of September, from £250K now," says Gabriella Dickens, Senior UK Economist at Pantheon Macroeconomics.

"Once this support is withdrawn, we expect house price growth to slow over the remainder of the year," says Dickens.

"As we look towards the end of the year, the outlook is harder to foresee. Activity will almost inevitably soften for a period after the stamp duty holiday expires at the end of September, given the incentive for people to bring forward their purchases to avoid the additional tax," says Gardner.

Pantheon Macroeconomics are monitoring certain near-term market indicators to assess where the market is heading and note early signs of a slowdown.

Dickens cites Google Trends data which shows that searches for the three most popular property websites in the seven days to August 22 were 4.5% above their 2016-to-2019 average, down from 13.5% above in the last full week of July.

Rightmove has meanwhile reported that asking prices rose just 5.6% year-over-year in August, though this was only slightly weaker than July’s 5.7% increase.

Pantheon Macroeconomics says the market impact of the second reduction in the stamp duty threshold likely will be larger than the previous reduction, given that the average UK house price is £266K.

"At the same time, households’ incomes will come under pressure from the withdrawal of the furlough scheme and higher CPI inflation. Accordingly, we expect an outright fall in house prices of around 1.5% in Q4," says Dickens.

HMRC data shows the number of transactions completed ahead of the first Stamp Duty reduction in June soared, before falling sharply in July.

von Grundherr says a slight dip can be expected at the end of the year but says "even the best performing markets are subject to seasonal influences."

Industry experts maintain that house prices are likely to remain elevated owing to the country's ongoing shortage of housing supply in the face of a rapidly expanding population.

"We’re simply not seeing the market decline that many expected," says Colby Short, Founder and CEO of GetAgent.co.uk.

"This is undoubtedly due to the continued imbalance between current demand and the level of stock available to satisfy the appetite of the nation’s homebuyers. While these two factors remain out of kilter, house prices will continue to climb," he adds.