U.S. Inflation Debate: Jury in Deliberation on Whether It’s Peaked

- Written by: James Skinner

“Compensation costs for private industry workers increased 3.1 percent over the year. In June 2020, the increase was 2.7 percent.”

Image © Adobe Images

The Federal Reserve’s favoured measure of inflation appeared to suggest on Friday that American price pressures may have begun to peak in June, potentially vindicating its patient stance on monetary policy, although economists disagree as to whether this is the case.

Personal Consumption Expenditures (PCE) price indices underwhelmed market expectations when declining for the month of June on Friday, following six months of strong increases which have so-far seen the annualised price gains more than double in 2021.

Those annual rates appeared to peak when the main PCE price index published by the Bureau of Economic Analysis increased by a steady 4%, unchanged from the 4% seen in May.

“Core PCE inflation likely has not yet peaked - we think a near-4% print is likely by November - but most of the increase in recent months has been in Covid-sensitive components and won’t persist,” says Ian Shepherdson, chief economist at Pantheon Macroeconomics.

The more important core PCE index did, however, creep higher still albeit with its slowest increase of the year so far when rising from 3.4% to 3.5%.

Source: Pantheon Macroeconomics.

Core PCE prices garner more attention from economists because they overlook energy prices, which are often volatile as a result of international factors as much as the domestic, while also being blind to changes in regulated price items like alcohol and tobacco.

“The current inflation spike can only become a spiral if wage inflation accelerates excessively relative to productivity growth, and the jury will be out on this question for some time,” Pantheon’s Shepherdson writes in a note on Friday.

June’s data is potentially important for the interest rate and broader monetary policy outlook because more so than with other measures PCE price indices, it impacts on how the Federal Open Market Committee at the Fed perceives and understands the overall U.S. inflation picture.

The Fed has looked through recent increases in the PCE indices as well as the consumer price index inflation rates, which have risen even further this year, citing for its steady hand the concentration of price pressures within sectors most adversely impacted by the pandemic.

“As the economy continues to reopen and spending rebounds, we are seeing upward pressure on prices, particularly because supply bottlenecks in some sectors have limited how quickly production can respond in the near term,” Fed Chairman Jerome Powell said in a press conference on Wednesday.

{wbamp-hide start}

GBP/USD Forecasts Q2 2023Period: Q2 2023 Onwards |

“These bottleneck effects have been larger than anticipated, but as these transitory supply effects abate, inflation is expected to drop back toward our longer-run goal,” Powell added.

It’s inflation which central banks are attempting to manage in the context of a predefined target whenever they tinker with interest rates or change other monetary policies, although price pressures are themselves sensitive to changes in economic growth as well as many other factors.

However, economists say that what matters most to the medium and long-term inflation outlook is growth in wages and salaries for workers, which also underwhelmed market expectations on Friday.

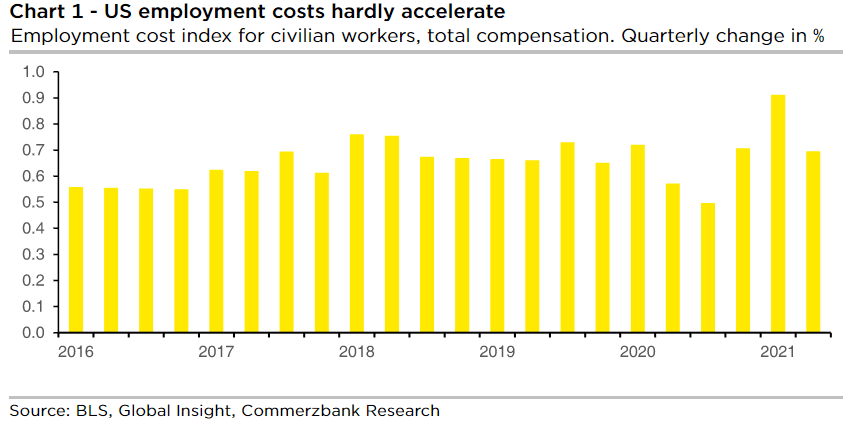

“The data are thus still consistent with the Fed's assumption that no second-round effects in the form of increased wage growth are yet evident across the board,” says Dr Christoph Balz, a senior economist at Commerzbank.

Source: Commerzbank.

“This should confirm the central bank's forecast that inflation rates will return to normal and fall back toward the 2% target in the medium term. The Fed can thus wait for further data and does not have to accelerate the exit from its expansionary monetary policy,” Dr Balz writes in a note Friday.

Bureau of Economic Analysis data also showed separately to the PCE figures that employment costs for all civilian workers rose by 0.7% during the three-months to the end of June, less than the 0.9% anticipated by consensus, and that wage and salary costs rose by 0.9%.

Annualised increases were a little over 3% after having risen by much less than other measures of inflation, and at a point when the U.S. job market remains a long way from the conditions the Fed says are necessary for its 2%-average inflation target to be met in a sustainable way.

“The Fed wants the labor market to return to its pre-Covid position as quickly as possible, and premature rate hikes would be a good way to ensure that doesn’t happen,” Pantheon’s Shepherdson says.

Last month’s nonfarm payrolls report from the Bureau of Labor Statistics showed there were 2.9 million more individuals officially classed as “long-term” unemployed than in February 2020, and some 2 million Americans who’d been unemployed for less than five weeks in total.

Overall, there were 6.2 million who said they were unable to work because their employer had either closed or lost business as a result of the pandemic.

So while readers may have heard much about mounting prospects of higher borrowing costs and interest returns of late, as far as the data shows; these remain as far off as they are subject to the question of whether the above referenced inflation rates have really peaked or not.