"UK House Price Inflation has Reached Fever Pitch", but High Water Mark Nears

- Written by: Gary Howes

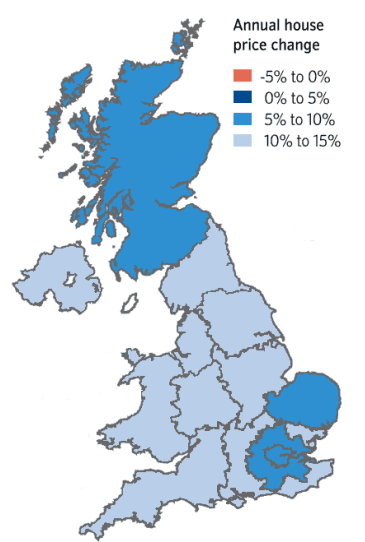

Image courtey of Nationwide

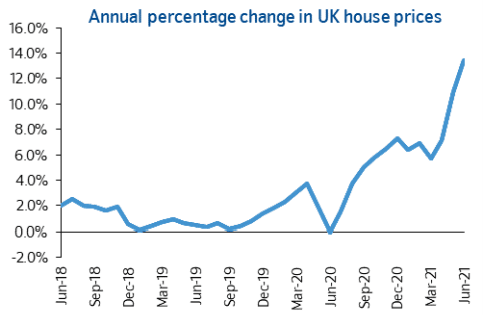

Annual house price growth in the UK rose to 13.4% in June, the highest level since November 2004, but economists says we could be approaching the 'high water' level in the market.

According to the June Nationwide House Price Index - a much-watched barometer of the UK housing market - prices went up 0.7% month-on-month from May to June, after taking account of seasonal factors.

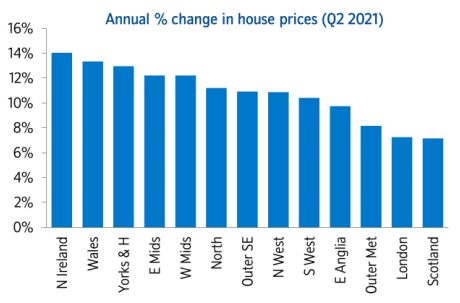

"In parts of the UK house price inflation has reached fever pitch, with estate agents in the most in-demand rural and coastal areas reporting prices ramping up almost by the week," says Jonathan Hopper, CEO of Garrington Property Finders.

Image courtesy of Nationwide

The year-on-year growth rate is flattered somewhat by the comparison to June 2020 when the market was seen to be unusually weak owing to the first lockdown.

But Robert Gardner, Nationwide's Chief Economist says regardless of this 'base effect' the market continues to show significant momentum.

The month-on-month figure therefore offers a guide as to underlying pressures, with June seeing the third consecutive month-on-month rise (0.7%), after taking account of seasonal effects. Prices in June were almost 5% higher than in March.

Image courtesy of Nationwide

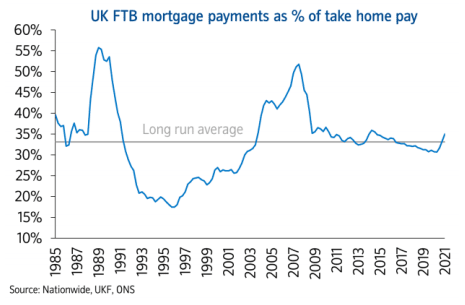

All regions of the country have experienced an acceleration in house price growth with affordable mortgage payments enticing more buyers into the market.

"The typical mortgage payment is not high by historic standards compared to take home pay, largely because mortgage rates remain close to all-time lows," says Gardner.

Indeed, according to Nationwide affordability remains broadly in line with its long run average, as shown in the chart below.

The findings could go some way in easing fears that the UK is witnessing the formation of another major asset bubble, similar to that witnessed in the years preceding the 2008 financial crisis.

Economists nevertheless note that the UK's double-digit house price increases are just part of a synchronised global asset boom that could be a cause for worry.

Oxford Economics have released research showing the current asset price boom in the UK is the largest in 50 years as house prices, stocks and commodities all move higher in tandem.

"With demand so strong and cheap mortgages helping buyers absorb some of the rising costs, market conditions are unlikely to change dramatically in the short-term," says Hopper.

Fuelling cheaper mortgages are the ultra-low interest rates on offer at the Bank of England which ensures the cost of finance right through the financial system is maintained at low levels.

"One of the key themes across developed economies seems to be housing market strength. Ultra-low interest rates and large pots of excess savings accumulated over the course of the pandemic have boosted demand for residential property, and resulted in house prices in many jurisdictions soaring," says Philip Shaw, Economist at Investec.

Indeed, outgoing Bank of England Chief Economist Andy Haldane said recently, "the housing market in the UK is on fire."

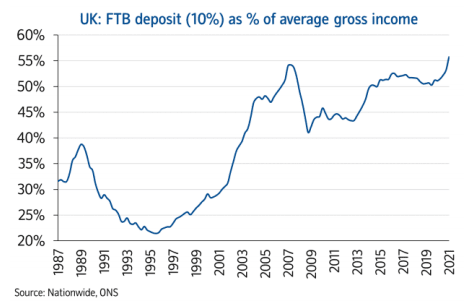

While the cost of finance remains relatively affordable, house prices are nevertheless close to a record high relative to average incomes.

Gardner says this is important because it makes it even harder for prospective first time buyers to raise a deposit.

He uses the example of a 10% deposit now being over 50% of typical first time buyer’s income: a potential buyer earning the average wage and saving 15% of take home pay would now take five years to raise a 10% deposit.

Hopper says buyer demand is so strong that those selling desirable properties can expect multiple high offers and fierce competition from buyers.

But, he adds that the market might be approaching "the high tide mark for the exceptional inflation seen over the past year".

The ending of the Stamp Duty holiday will commence from this Thursday, and Hopper says buyers are likely to become less frantic in their desire to complete purchases as quickly as possible.

Hopper says the fast pace of the market has also been partly responsible for throttling back supply and thus stoking price rises as some would-be sellers hold off on entering the market for fear of their home selling before they find a suitable new home to move to.

“Once supply starts to improve, the market should regain a better sense of equilibrium and price inflation will cool. The current pace of house price rises is clearly unsustainable as wages aren’t growing nearly fast enough to keep up," says Hopper.