UK House Prices Forecast to Cool Towards Year-end

- Written by: Gary Howes

Image © Adobe Images

UK house values are surging in price in a "space race" that sees buyers seeking more indoor and outdoor space in the wake of the pandemic, but economists says the trend is likely to continue until the fourth quarter of the year.

Annual house price growth in the UK rose to 10.9% in May according to Nationwide, giving the highest reading of their House Price Index for nearly seven years.

This is the highest level of increase recorded since August 2014.

“It really is a seller’s market at the moment, and with house prices at their highest level in nearly seven years it is a hostile environment for first time buyers who would have struggled to afford to buy even before the pandemic," says Tracy Crookes, financial planner at Quilter.

The Nationwide house price measure is one of the most trusted in the industry and it revealed a new record average price of £242,832, up £23,930 over the past twelve months.

Prices rose 1.8% month-on-month, slightly softer than the 2.3% rise recorded in April.

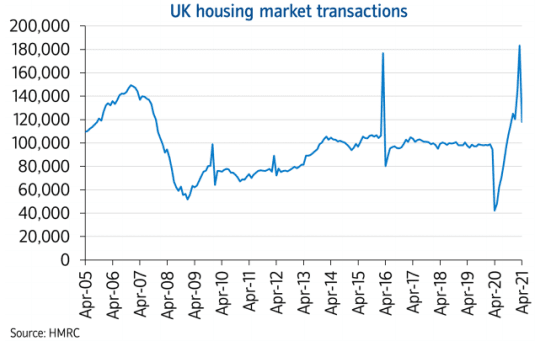

UK housing market transaction activity collapsed in the wake of the first lockdown with transactions falling to a record low of 42,000 in April 2020.

But activity surged towards the end of last year and into 2021, reaching a record high of 183,000 in March.

“It’s unsurprising house price growth is in the double digits after the year we’ve just had, with the market forced to a standstill in March 2020 and then jump-started back to life with various government support measures," says Crookes.

While March’s spike in transactions was driven by the original end date of the stamp duty holiday, a lot of momentum has been maintained according to Nationwide.

68% of those surveyed by Nationwide said their relocation plans were not impacted by the stamp duty holiday, instead shifting housing preferences is continuing to drive activity with people reassessing their needs in the wake of the pandemic.

Of those moving or considering a move, 33% were looking to move to a different area, while nearly 30% were doing so to access a garden or outdoor space more easily.

Concerning the outlook for house prices, Samuel Tombs, UK Economist at Pantheon Macroeconomics says the upward pressure on prices looks set to remain strong over the coming months.

Tombs notes Google Trends data indicate that visits to one of the three main property websites in May were 22% above their average for the time of the year.

"The seasonally adjusted number of registered house-hunters per estate agents’ branch in April was 30% above its 2012-to-19 average, according to the National Association of Estate Agents. Demand was a bit stronger than in March, when house-hunter numbers were 24% above normal, albeit below the peak seen in November," says Tombs.

However, the market could start to cool by the fourth quarter says Tombs.

"We continue to expect house prices to dip in Q4, by which time the SDLT threshold will have returned to £125K. Housing transactions already have come off the boil in the U.S., where, unlike the U.K., the market has not been juiced by tax cuts, indicative of weak post-Covid demand," says Tombs.

"An increase in new housing supply also likely will undermine prices later this year," he adds.

Pantheon Macroeconomics find consumer confidence only has recovered to levels consistent with negligible above-inflation increases in house prices, suggesting that prices are vulnerable to correct when the twin supports from Covid-19 and the SDLT holiday have been removed.

Quilter also expect a few more months of hot activity, before a cooling off towards the winter.

"We expect the strength of the property market to continue for the next few months at least, as a result of the extended stamp duty holiday and income support measures still available from the government. Once the stamp duty holiday begins tapering in June, along with the furlough scheme, we could see some of the momentum in the market begin to unwind," says Crookes.