UK Inflation Outlook: 0% Ahead

- Inflation rate at lowest since 2016

- Decline likely to stabilise say some economists

- But Berenberg economist says fall to 0% likely

- Bank of England to announce fresh stimulus on Thursday

Image © Adobe Images

The UK's rate of inflation has fallen to its lowest level since 2016 thanks largely to the global slump in oil prices, but a recovery in oil and an exit from lockdown should mean that the economy should see prices start to pick up once more.

However, the rebound is likely to be shallow at best as depressed wages are likely to leave an impact on inflation over coming months, allowing the Bank of England to expand its quantitative easing programme which should in turn keep the Pound broadly subdued.

The UK's Consumer Price Index - the most-watched measure of inflation - rose by 0.5% over the course of year to May reports the ONS, after prices flatlined at 0% in the month to May.

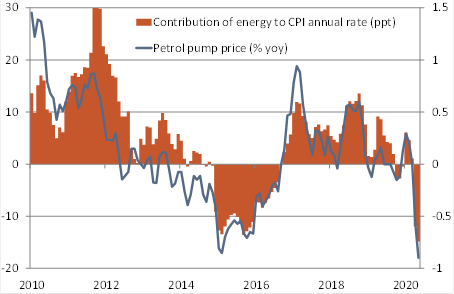

This makes for the weakest rate of annual inflation since 2016, an outcome largely been driven by a sharp drop in oil prices that reached a nadir in April.

The core rate of inflation - which excludes food, energy, alcohol and tobacco prices - slipped to 1.2% confirming just how important the fall in fuel prices has been as a contributor to the decline in inflation.

According to economist Victoria Clarke at Investec, petrol and diesel prices knocked around 0.06% off the 12-month inflation rate in February, around another 0.15% in March, more than 0.30% in April and then knocked off around another 0.15% in May.

Image courtesy of Berenberg Bank

The outlook for inflation still rests with oil, and the recovery seen in crude oil benchmarks over the course of the past month should start to feed through to rising prices on the forecourt once more.

The Bank of England forecast a 0.4% fall in inflation for May and they expect the rate of decline to ease in June.

"Our forecasts also suggest that inflation likely does not head sharply lower from here, notably with oil prices having coming off their lows," says Clarke.

But James Smith, Developed Markets Economist at ING Bank says while oil prices might fade a as a downward drag on inflation, falling wages could trigger falls in core inflation, ensuring the UK looks set to be locked into a multi-month period of low inflation.

"We expect headline UK inflation to stay below 1% this year, and given the slack in the jobs market, we'd expect price pressures to stay fairly muted for some time," says Smith.

The observation comes 24 hours after the release of UK labour market statistics that showed wages are down, with the growth rate of regular average weekly earnings falling from 2.7% in March to 1.7% April.

"The slack in the jobs market suggests we shouldn’t expect a broader rise in inflation. While the government’s furlough schemes have helped avoid the spike in unemployment seen in the US so far, there are growing fears about what will happen as this state support is unwound. With many businesses unlikely to be able to operate at their usual capacity, there will be pressure on profits and therefore staffing costs. That would imply wage pressures are set to remain generally muted," says Smith.

Kallum Pickering, Senior Economist at Berenberg Bank is meanwhile forecasting inflation rates closer to 0% for coming months.

"Although the harsh lockdowns and social distancing policies to control the COVID-19 pandemic impair both demand and supply, the emerging disinflation suggests that the short-fall in spending (demand) is outweighing the drops in production and available resources (supply). We expect inflation to fall towards zero in Q3," says Pickering.

The prospect of low inflation rates for the foreseeable future will likely open the door to further monetary easing at the Bank of England as they strive to create the conditions necessary to limit the economic fallout from the covid-19 crisis.

The Bank has already slashed interest rates to 0.1% and increased its quantitative easing programme to £200BN, but because inflation is clearly no threat policy makers will feel they have the leeway to increase support.

According to Bloomberg consensus, the market anticipates that the Bank will announce an additional £100BN in quantitative easing.

"Eventually, we expect the BoE to go for an additional £200bn. We see almost a 50% chance that the BoE could surprise markets to the upside and announce that this week already. Expect the allocation of further asset purchases to be 95% gilts and 5% corporate bonds – as with the first round," says Pickering.

The increase in quantitate easing will ensure the amount paid on government bonds - known as the yield - will likely remain extremely low. This in turn makes UK government bonds less attractive to international investors who have traditionally invested in UK bonds to take advantage of the yield they pay.

The decline in demand by international investors for UK bonds will in turn deprive Pound Sterling of supportive inflows of capital, which is why low inflation is ultimately an outcome associated with a weaker Pound.

Low inflation, an active Bank of England and persistent Brexit trade negotiation anxieties will all combine to ensure the Pound retains a subdued tone over coming weeks and months.