Pound-Franc Pushes New 21-month High, Screens as Overbought

- Written by: Gary Howes

Image © Adobe Images

The Pound to Franc exchange rate has rallied to a new 21-month high after UK inflation figures cast doubt on Bank of England interest rate cuts and now screens as overbought. But, fundamental developments mean weakness should be shortlived going forward.

The Swiss National Bank has meanwhile already cut interest rates and could be close to lowering interest rates again, creating a significant central bank policy divergence between Switzerland and the UK that can boost the Pound relative to the Franc.

The odds of a Bank of England interest rate cut in June have now fallen to negligible levels, while an August rate cut is no longer fully priced. This after UK CPI inflation rose 2.3% y/y in April. However, measures of underlying core inflation beat expectations handsomely and have actually started accelerating on a 3-month annualised basis.

Compare GBP to CHF Exchange Rates

Find out how much you could save on your pound to Swiss franc transfer

Potential saving vs high street banks:

CHF 2,825.00

Free • No obligation • Takes 2 minutes

"Sterling is climbing across the board after data showed UK inflation neared the Bank of England’s 2% target but failed to slow as much as expected, sending the probability of a June rate cut from 50% to 15%," says George Vessey, Lead FX Strategist at Convera.

The pushback in market expectations has supported UK bond yields and boosted the attractiveness of Sterling financial assets to foreign investors, creating demand for the Pound. "We now expect the BoE to deliver the first cut of 25bp in August (June previously). Given the later start to the cutting cycle," says Kirstine Kundby-Nielsen, Danske Bank.

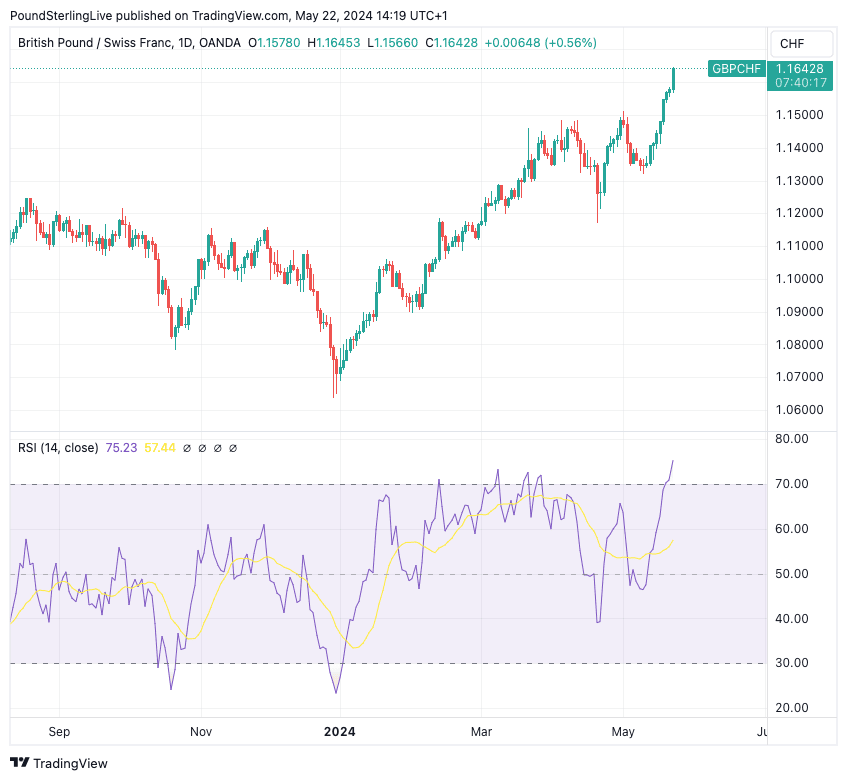

Pound-Franc rose to 1.1636 following the data and looks to cement a fifth successive monthly advance.

Above: GBP/CHF now screens as overbought on the short-term timeframe. Track GBP/CHF with your own custom rate alerts. Set Up Here

Economists at JP Morgan say the persistence-weighted 'supercore' measure of inflation rose 0.7% in April while the 3m/3m annualised pace shot up from 5.4% to 6.0% based on their seasonal adjustment (the 3m, saar rate is 6.6%).

"We stick with our August call but believe the risks have clearly tilted back towards a later cut, and the talking point now will be whether the BoE can ease at all this year," says Allan Monks, Chief U.K. Economist at JP Morgan.

The Swiss Franc embarked on what looks to be a sustained period of decline after the Swiss National Bank became the first G10 central bank to commence an interest rate cutting cycle with its March 21 rate cut.

Analysts say further CHF weakness is now likely as the SNB becomes an outlier.

Dr. Karsten Junius, Chief Economist at J. Safra Sarasin, says the will next lower its policy rate for the second time in June.

"In our view, the SNB can afford to normalise its policy stance i.e., lower its policy rate to the neutral rate, given that the output gap is likely closed or even negative and inflation sits in the middle of is target range," says Junius.

A word of caution for those watching GBP/CHF is that it is now looking notably overbought on the short-term timeframes.

The daily RSI has moved to 75.17, which puts it well above the 70 level that signals overbought. The RSI typically reverts back below 70 when such developments occur, meaning a period of consolidation, or a retracement, is nearing.

But for now, weakness will be viewed as temporary as the fundamental picture favours more GBP/CHF upside.