Spain's Fading Tourism Boom Could Impact on House Prices Popular with Expats

- Spanish tourism has boomed after competitor destinations suffered from terrorist attacks

- The trend has supported Spanish economic growth over the last three years but is set to slow, says UBS

- House prices in areas popular with tourists could suffer

© Adobe Stock

The period between 2015 and 2017 witnessed a spike in Islamic militant terrorist attacks targeting tourists inside museums, hotels, beaches and nightclubs in Egypt, Tunisia, and Turkey; this saw visitor numbers to the Islamic Meditteranean region decline dramatically.

The Iberian peninsula, and in particular Spain, benefited as tourists displated a 'flight to safety'. Visitor numbers to Spain swelled, seeing double-digit growth as tourists opted for the old favourite in their droves.

The increase in tourism was a welcome relief to a country ravaged by some of the worst fall-out from 'el crisis' and the Spanish economy started to recover.

Increased tourism contributed 0.4% growth to the entire country's GDP growth rate per annum, accounted for over 11.0% of the economy and added a quarter of a million jobs in the period between 2015 and 2018.

Between 2008 and 2013, property prices plummeted by over 30% but between 2014 and 2018 they will have gone up by over 21%, and regions popular with tourists have seen an outsized growth in house prices when compared to the rest of Spain. According to Instituto de Práctica Empresarial (IPE) estimates, there’s still room for further rises and the trend is positive, driven by the economy and a big appetite for Spanish property among foreign investors.

But, trends could be about to turn for these tourist hot-spots.

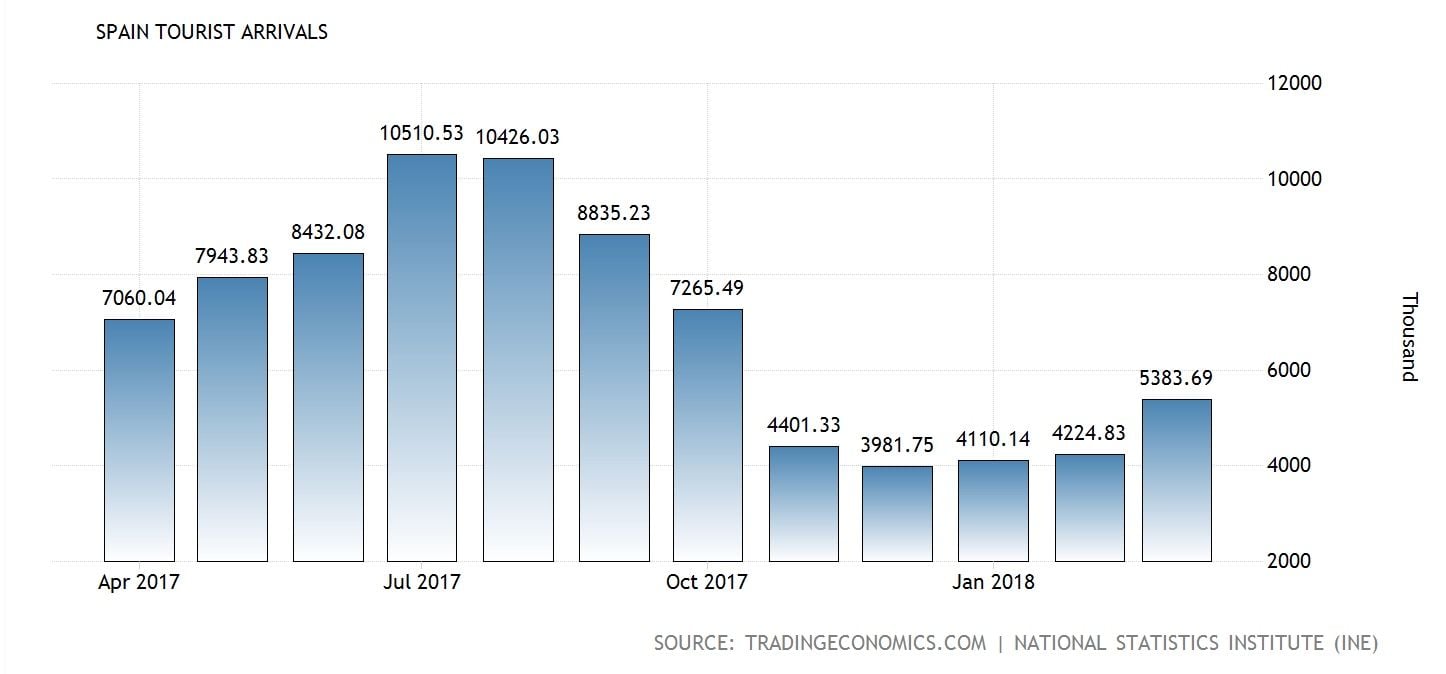

Tourism growth appeared to peak in 2016 when visitor numbers to Spain rose by 10.6% and touched 90 million, but since then the Spanish-revival appears to have flagged.

In 2017 growth was still a healthy 8.6% but not as much as it had been in the year before. Since then it has fallen even more although Summer 2018 is yet to arrive.

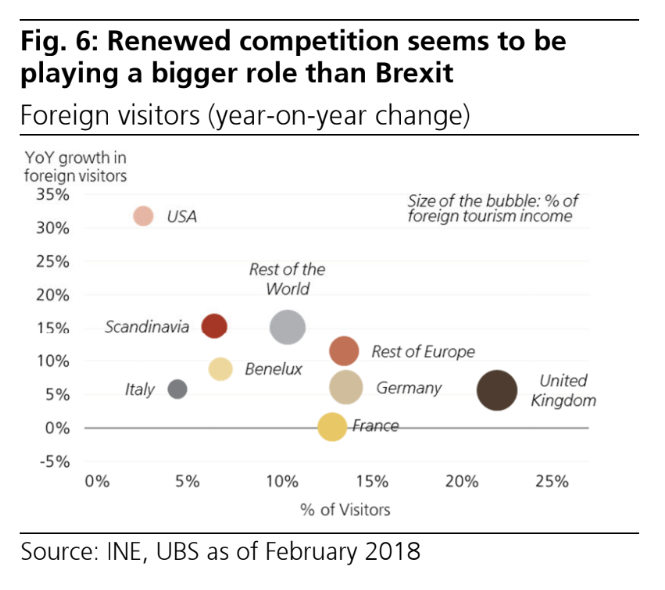

The drop in visitor numbers to Spain appears to be directly related to a recovery in visitors to Egypt, Tunisia, and Turkey which have managed to overcome their reputations as unsafe holiday destinations. There appears to be a direct negative correlation between rising tourism to those destinations and falling tourism to Spain.

The steep increase in demand for capacity in Spain during the years of 'fear' has also led to a rise in prices due to overdemand which has started to have a rebalancing effect in favour of the slightly risky but cheaper one-time favourites.

It is now likely tourism to Spain will start to fade as visitors return to Egypt, Turkey and Tunisia where increased security and cheaper prices start to become more important factors in purchasing decisions, according to a report by Roberto Scholtes Ruiz, chief investment officer for Spain at Swiss-based investment bank UBS.

"The number of foreign visitors to Spain and the nominal income from tourism increased at double-digits rates the last two years," says Ruiz, "but growth rates in the number of visitors and amount of revenue began decelerating last summer as Mediterranean competitors bounced back. Barring renewed woes in these countries, their comeback is expected to continue at the expense of Spain," says Ruiz.

The slowdown could be such that tourism's outsized contribution to growth will diminish to only 0.1% in 2019.

"The contribution of tourism to Spanish GDP expansion will wane almost completely by next year and will partly explain the slowdown of the domestic economy toward trend in the next few years," says Ruiz.

Real growth in GDP terms from tourism could meanwhile fall from a peak of 5.0% in 2016 to 2.7% in 2019.

The reduction in the contribution of tourism to overall growth is likely to impact on GDP growth rates, which UBS forecasts will fall from 3.1% last year to 2.8% this year and 2.3% next.

The Spanish economy may also be hit by non-tourist-specific factors such as the strengthening Euro, rising oil prices, and a less accommodative European Central Bank (ECB).

The largest share of tourists to Spain come from the UK, which accounts for 23% of all tourists to the country, however, a risk factor both in terms of numbers and spend is the weak Pound and Brexit.

"Brexit could have greater negative effects on the Spanish economy if a protracted slowdown dents Britons' purchasing power and translates into a mixture of fewer UK visitors, shorter stays and lower daily spending," says Ruiz.

Impact on House Prices

The Spanish housing market recovered strongly during the tourist boom years, but gains were concentrated in big cities, the tourist coastal area, and the islands, with "a much more muted healing," says Ruiz, "in the rest of the country, where excess supply remains to be absorbed."

The expected slowdown in the near-term, however, will "cool" house prices in prime areas and the "uneven recovery will continue".

Despite the contribution from tourism waning, however, Ruiz still sees growth remaining above "potential" at least as long as global growth continues to trend higher.

Ultimately the rebound in the rest of the Mediterranean also hinges on the ability of Turkey, Egypt, and Tunisia to avert attacks by ISIL, and whilst Tunisia, in particular, has been extremely focused on increasing security at tourist sites, any further atrocities could lead to a reversion back to a preference for Spain and Portugal.

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.