Weaker Pound sees British Expats Rush into Property Purchases Back Home

80% increase in buy-to-let mortgage applications from British expats looking to leverage their foreign earnings using a weaker Pound.

A looming Brexit has not stopped those Britons living abroad from expressing a vote of confidence in the future of their home country through property purchases.

The weaker Pound has allowed those Brits earning foreign currency abroad to look at their home nation as an investment opportunity according to Skipton International who are one of the few mortgage providers to British expats.

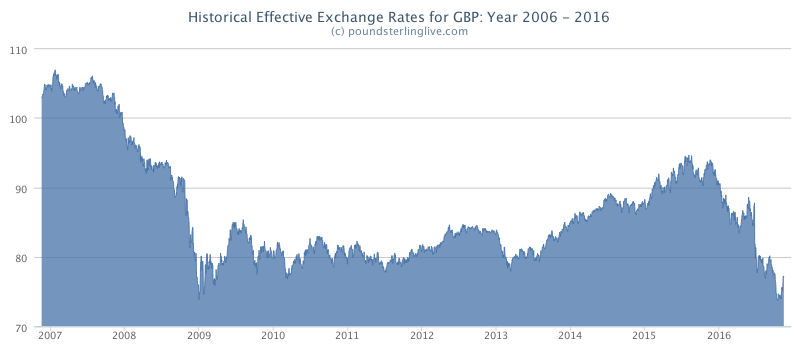

The UK currency has fallen against a host of currencies since the Brexit vote with the trade-weighted Pound near ten-year lows:

Skipton International launched buy-to-let mortgages for expats in 2014 as a response to the difficulties British expat customers faced obtaining a mortgage on UK investment properties.

Since then, Skipton has lent over £100m to British expats around the world and completed over 500 mortgages.

Nigel Pascoe, Director of Lending, Skipton International, said:

“We have seen a massive increase in enquiries from British expats in the months after Brexit, which accelerated notably since the value of the pound dropped substantially. On some days we have seen up to four times the number of queries we were seeing before Brexit.

“Many British expats are viewing the devaluation of Sterling as a good opportunity to buy properties in the UK, bringing back foreign currency savings. UK property is typically a long term investment for British expats; they can service the mortgage through the rental payments, while enjoying capital growth on a property.”

Earlier this year, Skipton opened up their mortgages to self-employed applicants and also expanded their eligible country list, enabling even more British expats to access the mortgages.