Strong UK Employment Data Catches Pessimistic Analysts on the Wrong Foot Again

- Written by: Gary Howes

A strong set of UK employment and earnings data were released on Wednesday the 17th August which has confounded expectations for an increase in unemployment.

Analysts were left scratching their heads following the release of the latest set of UK employment and earnings data wich showed an unexpected improvment in the labour market.

Those seeking out-of-work benefits actually decreased by 8.6K while economists had forecast that those seeking benefits would rise by 9.5K.

The unemployment rate in the UK remains at 4.9%.

“Today’s figures showed that the UK labour market brushed off pre-referendum uncertainty which should provide a solid base for the hit from the vote to leave the EU,” says Scott Bowman.

Employment growth slowed only slightly – with the 172,000 rise in the three months to June down from 176,000 in May.

This meant the employment rate rose to a record high of 74.5% and the unemployment rate remained at a post-crisis low of 4.9%.

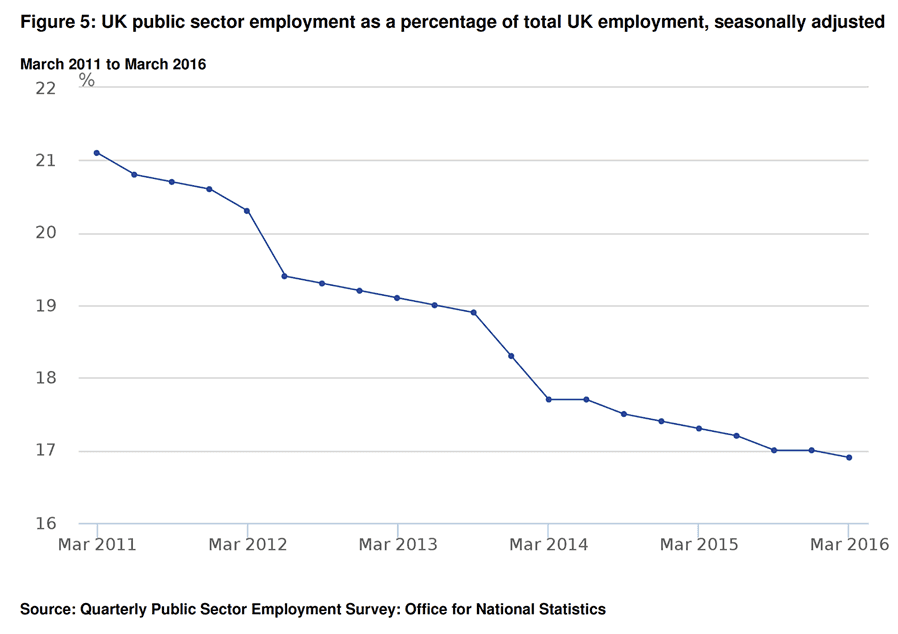

On a political note, the ruling Conservative Party will be delighted to see the waning importance of the government as an employer.

One of the Conservatives' central policy objectives on taking power from the previous Labour government was to challenge the dominance of the state in the UK employment mix.

Back in 2010 the public sector accounted for in excess of 20% of the UK workforce, this is now down to less than 17%.

Importantly, the trend remains decisive:

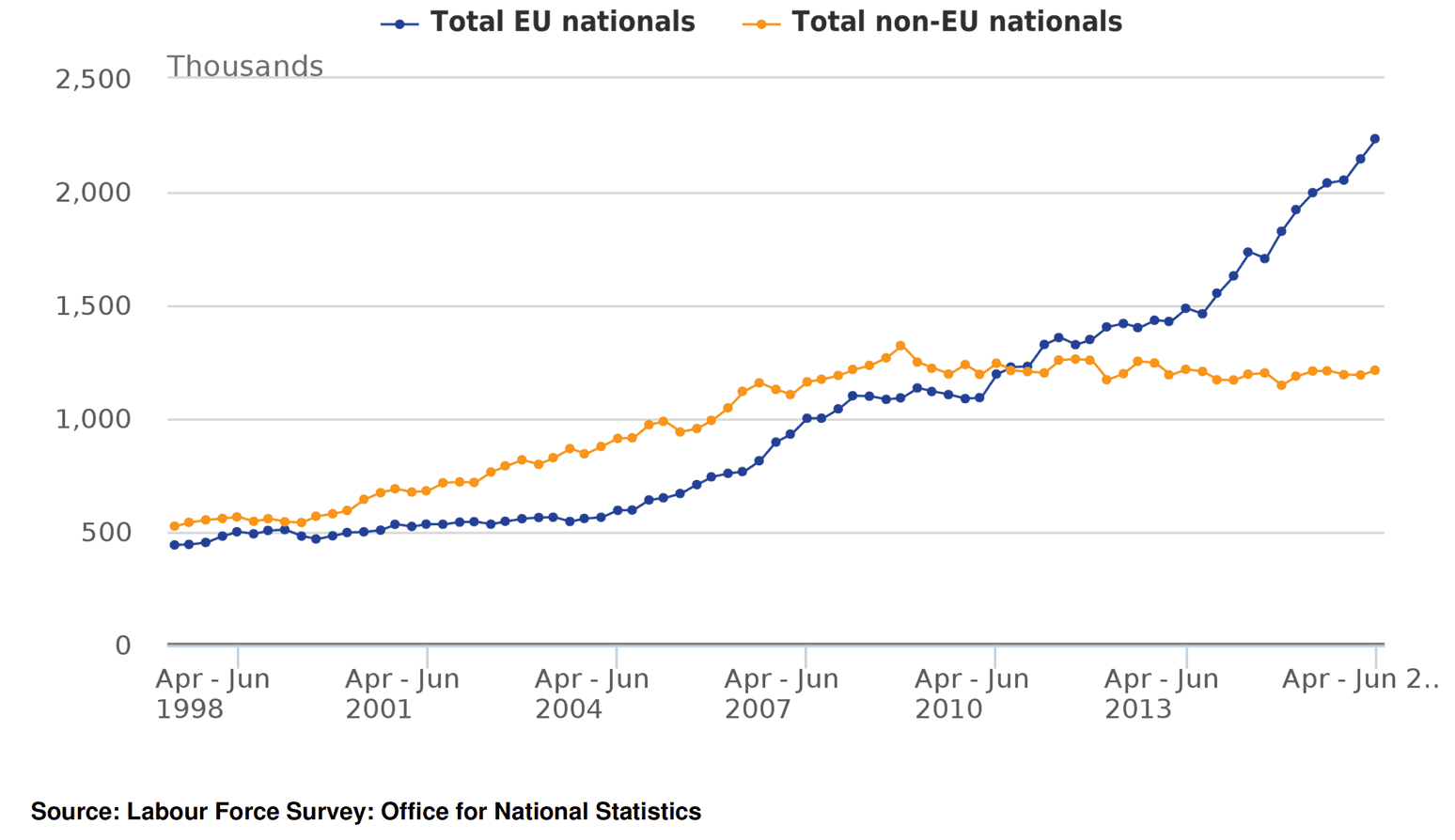

Of interest for Brexit-watchers, the data shows that the number of EU nationals working in the UK continues to rise at a steady pace:

How the above dynamics play out over coming months will be fascinating - can we expect a surge in EU nationals securing employment in anticipation of tighter immigration laws in the future?

Or will the rate of increase flatten in the wake of new migration controls being introduced? Whether this is even achievable in the context of free movement being the key to accessing the European market remains another question altogether.

Earnings Data Poses Questions

Meanwhile, pay rises continue to outstrip inflation with average earnings, with bonuses included, rising by 2.4%, up from a previous 2.3%.

However, Capital Economics’ Bowman would have liked to have seen more:

“Earnings growth is still subdued considering how much the labour market has tightened in recent times."

Nevertheless, the data will be welcomed by the Chancellor of the Exchequer Philip Hammond who will be feeling he won’t need to be quite as drastic in cutting taxes and boosting spending as he may have previously thought.

The Bank of England will meanwhile be wondering if they have overcooked the stimulus egg when they cut rates and boosted quantitative easing on the 4th of August.

If so, then we may not see any further interest rate cuts, something that should aid a Sterling recovery.

Employment Data Forecast to Deteriorate Over Coming Months, But Don't be too Negative

Despite economists having been caught wrong-footed by the July employment report, many continue to warn that a slowdown is likely.

"We would caution that it’s too early to see the impact of the referendum on the labour market since hiring and firing tend to lag economic activity. We continue to expect unemployment to rise and wage growth to ease over the next year," says Daniel Vernazza at UniCredit Research in London.

Capital Economics' Bowman, who typically maintains an upbeat tone on the UK economic outlook, agrees: "The vote to leave the EU should cause some firms to put hiring decisions on hold or cut back headcounts altogether, resulting in the unemployment rate drifting up over the coming quarters."

So we would certainly expect a deterioration in the data over coming months, however, there remains the risk that 'Remainers' - who dominate the financial services sector - will continue to be wrong-footed by their pessimism.