Bank of England's Bailey Pans Strong Wage Data

- Written by: Gary Howes

Above: File image of Andrew Bailey. Edited from original @ Association of British Insurers, reproduced under Creative Commons Licensing.

Bank of England Governor Andrew Bailey downplayed new wage data in an apparent attempt to keep alive expectations for another interest rate cut.

Speaking in Brussels, Bailey said he remained confident that inflation would continue to decline in 2025 despite official data showing wages surged at the fastest pace in eight months.

"Pay growth went up, but actually not quite as much as we were expecting," Bailey said.

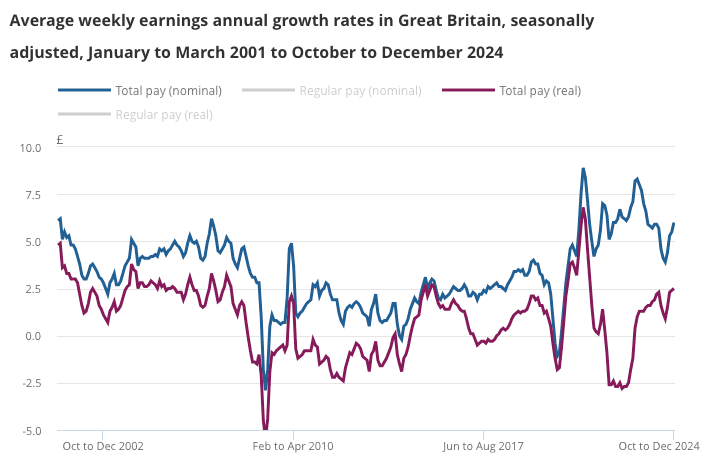

UK regular pay rose 5.9% year-on-year in December, meeting expectations but representing the fastest increase since April 2024. Overall pay, which includes bonuses, rose 6.0%, which was ahead of expectations for 5.9% and the fastest increase since November 2023.

Economists say strong wage growth feeds inflation, particularly in a stagnant economy, as it implies demand is running ahead of supply.

"The Bank of England's job is not done and there is still some way to go in eradicating inflationary persistence. 6% wage growth in a period of negative productivity growth is self-evidently inflationary," says Kyle Chapman, FX Markets Analyst at Ballinger Group.

However, Bailey was keen to point the finger at other data to justify his central bank's policy of cutting interest rates as inflation rises again.

"One of the best anchors we have is the survey that our agents around the country do every year, and they think settlements this year are going to come down," he said. "So I don’t think we saw anything this morning that fundamentally changes that."

According to the Bank of England's Agents' Summary of Business Conditions for the fourth quarter of 2024, firms anticipate average pay settlements in 2025 to be between 3% and 4%.

This projection is slightly higher than the 2% to 4% range reported in the previous November Monetary Policy Report but remains below the 5.5% average settlement observed in 2024.

By discounting the official data and opting to focus on pay forecasts, Bailey is choosing data to support the official Bank of England guidance that it is ready to deliver more interest rate cuts in the coming year.

Taken at face value, the comments would suggest that a March rate cut is very much a live possibility.

Bailey also signalled that the UK's weak economic growth would act as a natural brake on inflation.

Policymakers have warned that inflation could temporarily rise close to 4% in the second half of the year, raising fears of stagflation.

Bailey declined to indicate when the BoE might begin cutting interest rates, saying only that monetary policy adjustments would be "gradual and careful."

"There are two-sided risks," he added, underscoring the BoE’s cautious approach.