The Coffee Price Spike and UK Inflation

- Written by: Sam Coventry

Image © Adobe Images

UK coffee prices are set to rise sharply thanks to global supply concerns, what does this mean for UK inflation?

Shreyas Gopal, a Strategist at Deutsche Bank, says the price of coffee beans has risen recently to 25-year highs.

Arabica coffee prices surged this week to a 1997 high above USD 3 per pound, fueled by sustained worries about Brazil’s 2025 output. Trees were damaged by a long drought earlier this year.

"Combined with this month's fall in GBP/USD following the US election, in sterling terms, arabica beans are up nearly 70% in cost since last November," he explains.

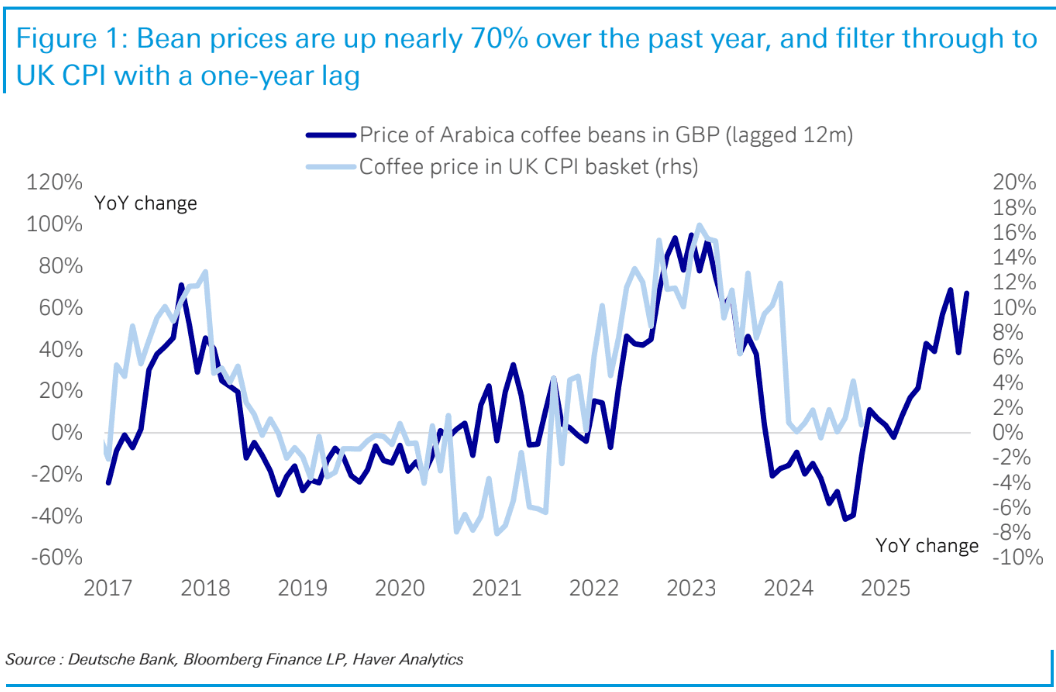

Gopal says there will naturally be a passthrough to the cost of coffee as measured in the UK CPI basket, albeit with approximately a one-year lag, as the chart below shows:

The UK reportedly drinks nearly 100 million cups of coffee per day, but its weight in the overall CPI basket is small, and Gopal thinks the price increase is likely to have little impact on overall inflation trends or expectations.

"That offers a little relief to the Bank of England in the midst of rising pressures elsewhere, as they sit down with their pricier cup of coffee next year," says Gopal.