PMIs: Deteriorating Job Market Heaps Pressure on the ECB to Cut Faster

- Written by: Gary Howes

Image © Adobe Images

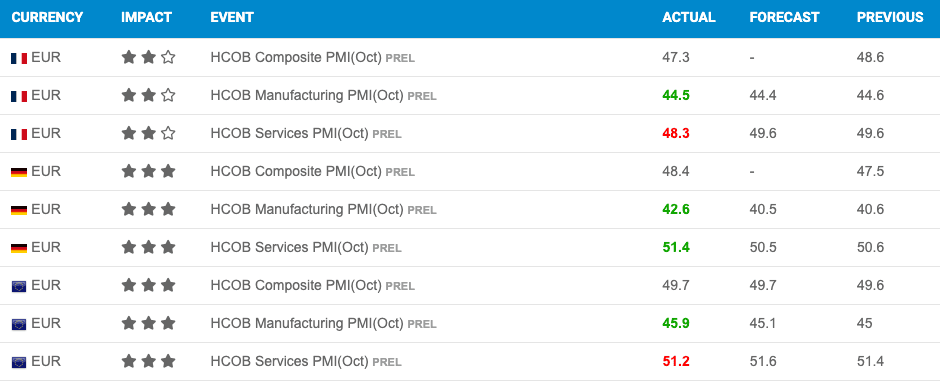

The Eurozone PMI survey for October revealed an ongoing slowdown and a notable deterioration in the bloc's labour market, which could encourage the European Central Bank (ECB) to cut interest rates further than previously expected.

The headline composite PMI read at 49.7 in October as business activity in the Eurozone ticked lower for the second month running.

The survey, conducted by S&P Global, revealed output was scaled back in response to a weakening demand environment, with new orders down for the fifth consecutive month.

Companies responded to lower workloads by reducing employment to the largest degree in almost four years, said S&P, while business confidence dropped to an 11-month low.

The ECB cut interest rates in September and said it would do so again in the coming months. However, it maintains that the pace it cuts is dependent on the data.

The findings of the October PMI survey mean the central bank will almost certainly reduce rates again in December.

The ECB is particularly watchful of the labour market, as this impacts wages, which in turn impacts domestic inflation. A concern of the ECB has been that the still-strong labour market is capable of churning out higher wages and therefore poses an upside risk to inflation.

But, the PMI findings that companies are reducing employment to the largest degree in almost four years will cause ECB policymakers to sit up and take note.

"This is fertile ground for the ECB doves," says Chris Turner, an analyst at ING Bank. He notes a recent comment by ECB member Fabio Panetta that the ECB's base interest rate needs to be cut to neutral (2.00/2.25%) or even lower.

Cutting interest rates can help bolster the Eurozone economy, but it can also weigh on euro exchange rates if the they are coming down faster than elsewhere.