OECD Forecasts Underscore UK's Inflation Problem

- Written by: Gary Howes

Image © Adobe Images

New OECD forecasts show the UK has a problem with sticky inflation, which requires the Bank of England to be vigilant.

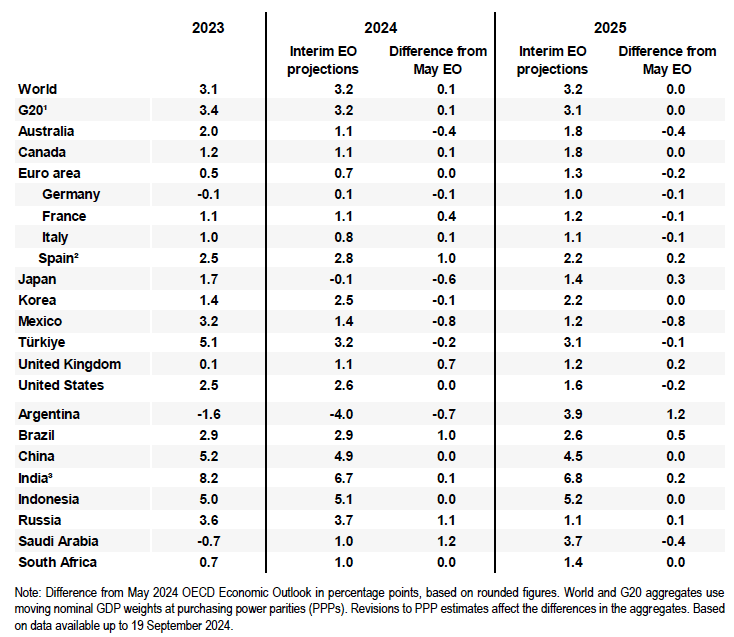

In its latest outlook on the world economy, the Organisation for Economic Cooperation and Development (OECD) said the UK economy was on course to expand by 1.1% this year, an upgrade of 0.7 percentage points from its last forecast in May.

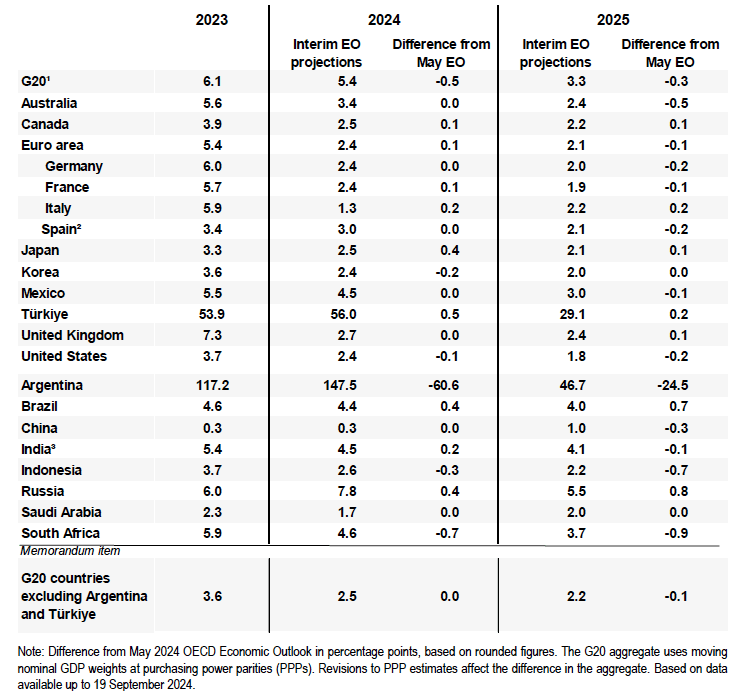

The Paris-based organisation also released forecasts that suggest the Bank of England might have an inflation problem on its hands as new projections showed that headline CPI inflation would be at 2.7% in 2024 and fall to 2.4% in 2025.

The 2025 forecast will be particularly worrying for the Bank of England, as it could potentially have to adopt novel explanations for cutting interest rates in a pro-cyclical environment.

Above: The OECD's inflation forecasts.

The OECD noted that the prices of over half the items in the UK inflation basket were still growing at an annual rate above 3% in July 2024. That was more than in the U.S., where 40% of items were above the same threshold.

The OECD said risks to higher inflation could come from continued labour-cost growth. The new Labour government has promised to further improve pay for workers on top of the 10% minimum wage increase approved by the outgoing Conservatives.

Above: Annual GDP growth forecasts from the OECD show the UK's significant upgrade.

By contrast, the OECD's forecasts showed the Federal Reserve has a runway to cut interest rates further, predicting the USA would experience inflation of 2.4% in 2024 and 1.8% next year.

Germany's inflation rate was seen at 2.4% and 2.0% respectively, while that of France was set at 2.4% and 1.9%.

For Canada, inflation was seen at 2.5% and 2.2%, and the Bank of Japan will welcome forecasts of 2.5% and 2.1%, confirming that Japan has exited the deflationary quagmire.