Business Survey Shows Inflation Expectations Drop Sharply

- Written by: Gary Howes

Image: Dave Collier, sourced: Flickr, licensing: CC 2.0.

Businesses say their price expectations fell sharply to an 11-month low in June, a development that the Bank of England will welcome.

This is according to the latest edition of the Lloyds Bank Business Barometer, a key survey of UK business sentiment and expectations.

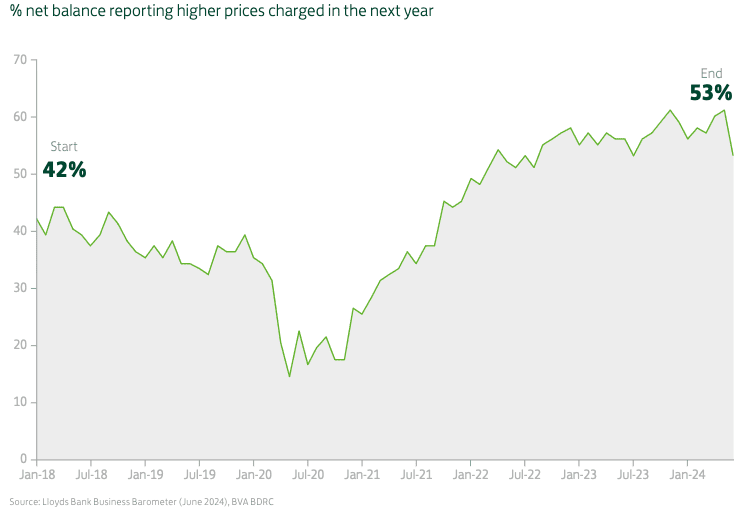

According to the survey, firms’ own price expectations fell sharply to an 11-month low, with the net balance dropping 8 points to 53%.

Above: Own price expectations. Is this an inflexion point?

Business pricing is a key driver of inflation and tends to respond to the cost pressures (mainly inputs and wages) and the demand from consumers and other businesses.

Inflation expectations also matter; if a firm expects inflation to continue rising, it will price its products accordingly.

Analysts at Lloyds Bank say the decline in the UK's official CPI inflation rate to 2.0% will positively impact expectations.

"Fewer businesses indicated that their prices would increase in the next few months, which chimes with last week’s fall in inflation figures," says Hann-Ju Ho, an economist at Lloyds Bank Corporate & Institutional Banking.

The Bank of England indicated in June that more of its interest rate policysetters think it will be appropriate to cut interest rates soon as headline inflation continues to fall. The market now sees a 50/50 chance of an August rate cut.

Should businesses be less inclined to raise prices in the coming months, the Bank's officials might feel emboldened to pursue an August cut.

The Business Barometer reports 57% of respondents (down from 63%) said they plan to increase their prices, while 4% (up from 2%) intend to lower them. The decline in price expectations was broad-based across sectors and regions and may reflect a reaction to the fall in the official headline inflation rate to more normal levels.

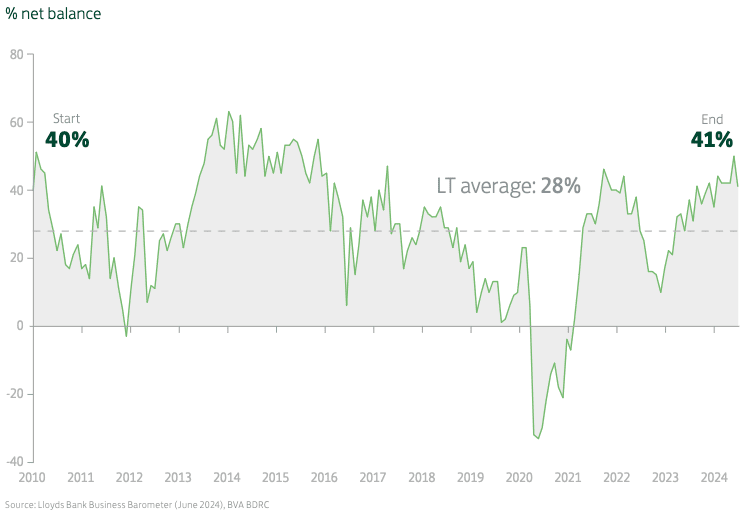

Other headlines from the Barometer include news that business confidence has moderated from last month’s exuberance, "but firms remain relatively upbeat".

Above: Business confidence.

Following last month’s surge to an eight-year high, business confidence in June dropped back to 41%, representing a fall of nine points.

UK business confidence remains above the survey’s long-term average of 28% for the thirteenth month in a row. Therefore, it still points to relatively upbeat sentiment for firms’ trading prospects and their optimism regarding the economy.

Lloyds says businesses report their trading prospects for the next twelve months remain robust, although there are signs of moderation compared to the strong start to the year and last month’s buoyant outturn. 53% (down from 62%) reported stronger output expectations, while 9% (up from 8%) signalled weaker activity.

The labour market is expected to remain healthy, albeit with some further easing in conditions, as 48% of companies, down from 54%, indicated that they plan to increase their workforce in the next 12 months.

This gradual loosening in the labour market is reflected in easing wage pressures. Expectations for average wage growth in the next 12 months dipped this month, although they remain elevated relative to pre-Covid responses. The share of businesses anticipating pay growth in the 4-5% range fell to a one-year low and the share expecting pay growth of more than 5% eased to a 3-month low

Easing wage pressures means companies will be under less pressure to raise prices, which will ease domestically generated inflation further.